NGI The Weekly Gas Market Report | E&P | NGI All News Access

Supermajors Strategically Betting on Lower 48 Oil, Natural Gas Prospects

An essential piece of nearly every Big Oil (and natural gas) major in the world today is the Lower 48, which is offering unprecedented scale, strong returns and as important, investment flexibility, according to Wood Mackenzie Ltd.

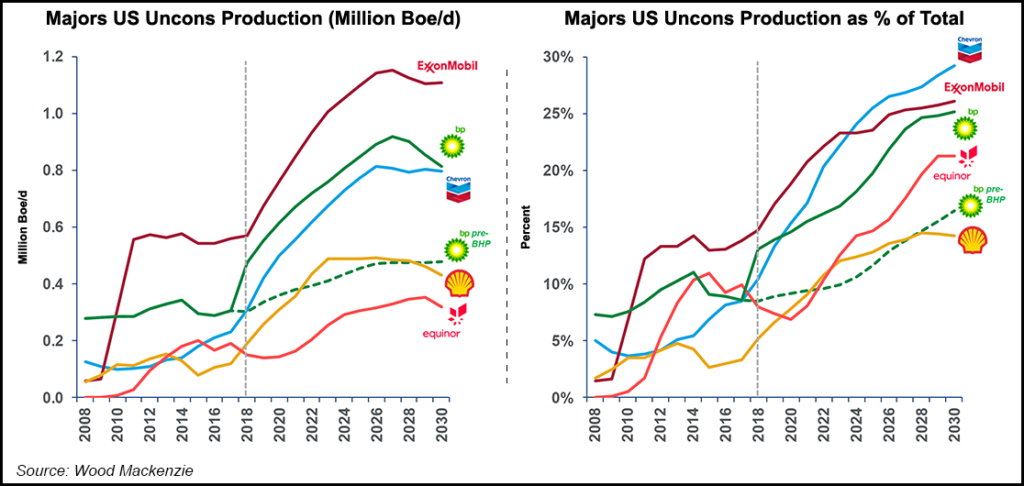

In a new report, “The Majors in U.S. Unconventionals,” researchers outlined comparative positions by international oil companies (IOC) in the Lower 48 and reviewed returns achieved to date in the tight and shale formations. The report does a deep dive on the material exposure to U.S. unconventionals by BP plc, Chevron Corp., Equinor SA, ExxonMobil Corp. and Royal Dutch Shell plc. Total SA and Eni SpA were excluded from the analysis.

”U.S. unconventionals have enormous potential, and the majors have taken note,” said research analyst Roy Martin, who is part of the firm’s corporate upstream team.

Wood Mackenzie estimated that between them, BP, Chevron, Equinor, ExxonMobil and Shell have 45 Tcf of undrilled resource in the Lower 48, “60% of which works below $3.00/Mcf,” and they have 18 billion bbl of undrilled tight oil resource that is profitable below $65/bbl.

BP’s$10.5 billion deal in July to buy nearly all of BHP’s U.S. onshore assets has given nearly all of the supermajors “a footprint in the Permian Basin,” allowing them “to deliver an unprecedented phase of production growth that will see output reach new highs over the next decade.”

U.S. unconventional development has become “crucial” to the supermajors, both for value and volume, Martin said. “Without these volumes, the majors’ collective production would enter long-term decline from 2020.”

Lower 48 volumes are underpinning future value. By the mid 2020s, Wood Mackenzie is forecasting that U.S. unconventionals should be generating $15-20 billion of annual cash flow for the IOC group and account for around 20% of total upstream value.

“U.S. unconventionals will drive the majors’ output to new highs,” Martin said. “Their investment in the resource theme is set to nearly double over the next five years, underpinned by tight oil.”

Only France’s Total and Italy’s Eni “still lack material exposure” to the Lower 48.

However, Total and Eni have substantial U.S. stakes, many linked to unconventional oil and gas.

Total holds unconventional reserves in the Barnett Shale, and it is big player in the Gulf of Mexico(GOM), Gulf Coast petrochemical projectsand in U.S. liquefied natural gas(LNG). Eni also works in the GOM, has operations in Alaskaand holds capacityin domestic LNG projects.

Still, the action is in U.S. onshore oil and gas reserves, Martin said.

“We think the advantages of scale in U.S. unconventionals will continue to manifest themselves as the industry shifts close to a ”big company’ business — almost resembling conventional oil developments.”

According to Wood Mackenzie, ExxonMobil ranks No. 1 in U.S. unconventionals in terms of scale with the most acreage, biggest resource and highest peak production.

“No major has comparable diversity across the Permian, Bakken, Eagle Ford, Haynesville and Marcellus plays,” Martin said.

ExxonMobil has more than one million acres alone in the Permian Basin. During 2Q2018, tight oil growthin the Permian and Bakken Shale, its top two onshore plays, reached more than 250,000 boe/d, an increase of 30% year/year.

Meanwhile, BP’s transaction with BHP “is transformational,” Martin said, “establishing scale in tight oil in one fell swoop, and setting it on course to overtake ExxonMobil as the leading shale gas producer.”

Chevron may have the “most valuable” portfolio, dominated by its “unrivaled Permian position,” the research indicated.The San Ramon, CA-based supermajor was running 19 rigsin the Permian at the end of June, with eight development areas in the Delaware and Midland sub-basins, and it was participating in about 30 joint ventures across the basin.

“Underpinned by its low-royalty Permian position, Chevron possesses the most attractive internal rates of return on new U.S. conventional projects among the majors,” Martin said. “Its future investment in the resource theme of $54 billion is second only to ExxonMobil.”

Wood Mackenzie estimated that U.S. unconventionals could account for up to 30% of Chevron’s total output eventually.

Differentiated drilling strategies by the supermajors in the Lower 48 also is notable.

In the Permian, for example, Shell “shows a preference for larger completions in its Delaware core, while ExxonMobil remains the most committed to drilling laterals longer than two miles across its entire Permian position,” Martin said.

“When benchmarked against the leading Independents, the majors appear to be adopting a longer-term approach to completions, sacrificing high initial production rates in favor of shallower declines, and ultimately, higher recovery rates,” Martin said.

“We expect the majors to continue to expand their footprint in tight oil, and the Permian in particular, over the coming decade. Any increase in the majors’ share of Permian output will have knock-on ramifications for global supply.”

There are other factors, however, driving the supermajors’ strategies in unconventionals, Martin noted, including competition for capital, portfolio mix, balance sheet strength, cost advantages and shifting investor sentiment, which “will have a much greater impact.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |