E&P | NGI All News Access | NGI The Weekly Gas Market Report

Superior Energy Gains in 2Q as More Horsepower Activated, Sand Issues Resolved

Superior Energy Services Inc. saw no slowdown in U.S. land activity during the second quarter, with more hydraulic horsepower (hhp) activated and proppant sand volumes climbing by 25% sequentially.

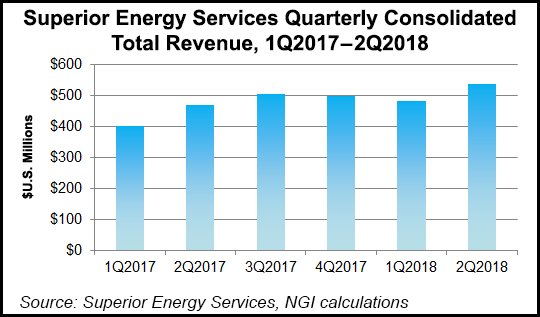

Net losses from continuing operations totaled $25.4 million (minus 16 cents/share) on revenue of $535.5 million for 2Q2018, compared with a year-ago net loss of $62 million (minus 41 cents).

“Our results continued to improve during the second quarter, driven by increases in U.S. land utilization,” said CEO David Dunlap. “Sand supply chain issues, which impeded completions-oriented utilization during the first quarter were resolved. We also activated additional hydraulic horsepower, bringing the active size of our pressure pumping fleet to 750,000 hhp. Higher levels of utilization and active horsepower resulted in an approximate 25% increase of sand volumes pumped sequentially.”

Gulf of Mexico (GOM) activity remained “relatively unchanged” from April through June as stronger drill pipe demand was offset by less workover activity. In addition, some of the company’s expected completion tools work was moved to the third quarter, Dunlap said. Overseas, however, there were improved results, driven by “much stronger” hydraulic workover activity and increased drill pipe demand.

“Our strategy of allocating capital toward pressure pumping and our cornerstone global franchises during the downturn has us on solid footing as we work to improve returns, increase our cash balances and reduce debt levels as the cycle progresses,” the CEO said.

U.S. land revenue climbed 18% from a year ago and was 13% higher sequentially at $375.4 million. GOM revenue stumbled 14% from 2Q2017 and was off 5% sequentially at $72.2 million. The gains overseas were visible, though, as revenue increased 18% sequentially and 29% year/year (y/y) to $87.9 million.

In the drilling products and services segment, revenue jumped 37% from a year ago and was 10% higher from 1Q2018 at $94 million. Versus 1Q2018, revenue in U.S. land rose 7% to $43.4 million, while the GOM segment increased 11% to $23.3 million and international operations increased 17% to $27.3 million.

Superior’s onshore completion and workover services segment reported an 11% gain in revenue from a year ago and an 18% increase sequentially to $276.2 million.

Overall, the production services segment’s revenue climbed 15% y/y and 1% from the first quarter to $102 million.

However, U.S. land revenue in the production services business fell 9% sequentially to $47.9 million as a result of decreased pressure control activity. In addition, GOM revenue for the unit plunged 22% sequentially to $13.6 million primarily because of lower hydraulic workover and snubbing, and lower electric line activity. However, international revenue increased 31% sequentially to $40.5 million.

In the technical solutions segment, Superior’s revenue in 2Q2018 was flat y/y and down 2% to $63.3 million. U.S. land revenue increased 16% sequentially to $7.9 million. GOM revenue, meanwhile, fell 6% from the first quarter to $35.3 million from the shift of completion tool activity to the third quarter. International revenue decreased 2% on lower levels of well control activity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |