E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Struggling Clayton Williams Pins Hopes on Delaware Basin

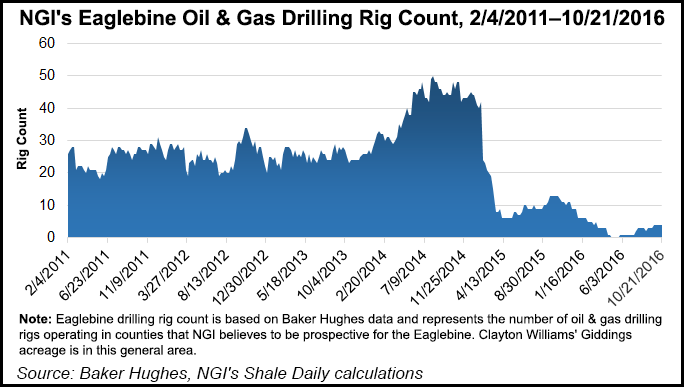

Clayton Williams Energy Inc. has agreed to sell “substantially all” of its assets in the Giddings Area in East Central Texas for $400 million to an undisclosed buyer as it continues a “transformation” embarked upon earlier this year. The deal will make the company a Permian Basin pure-play.

Closing is expected in December, subject to conditions and adjustments, and proceeds are to be used to fund development in the Delaware Basin as well as repay a portion of outstanding debt. The sale will strengthen the balance sheet and transition Midland, TX-based Clayton Williams into a pure-play Permian Basin company, it said. The company has about 70,000 net acres in the southern Delaware.

Wunderlich Securities Inc. analysts wrote Tuesday that they are glad to see Clayton Williams selling up in its Legacy Giddings Field to focus on the Permian, “…especially in light of how much costs have come down in the Delaware Basin and drilling in the area has largely derisked [the company’s] acreage. Notionally, this sale is very accretive to our NAV [net asset value] estimate as we did not assign much value to the Giddings acreage.”

Properties being sold produced an average of about 3,900 boe/d (80% oil) for the quarter ended Sept. 30 and accounted for about 9.7 million boe of proved reserves.

Drilling has been picking up in the Delaware lately (see Shale Daily, Aug. 19), and deals in the Permian sub-basin have been adding up (see Shale Daily, Oct. 14).

Clayton Williams has struggled amid the oil patch meltdown. The company bought time earlier this year with a debt refinancing (see Shale Daily, March 11). A review of strategic options had already begun the preceding fall (see Shale Daily, Oct. 15, 2015).

The company also said that effective at the end of October, Patrick G. Cooke will join the company as senior vice president and COO. For the past four years, Cooke has served in various management capacities with Noble Energy, his most recent position being Texas business unit manager where he had direct management responsibilities over Noble’s Delaware Basin assets.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |