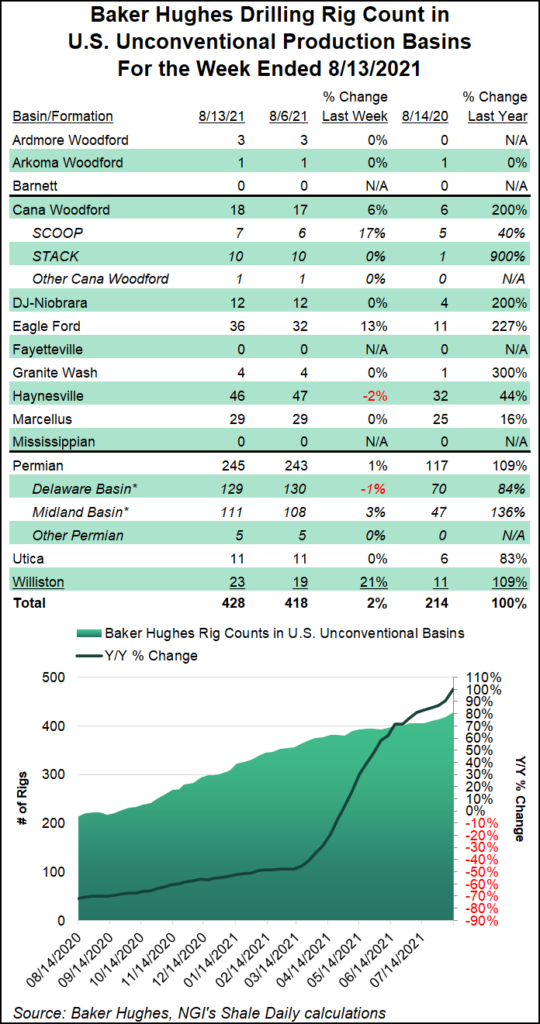

The Eagle Ford Shale and Williston Basin led a surge in U.S. onshore drilling activity during the week ended Friday as the domestic rig count rose nine units to an even 500, according to the latest figures from Baker Hughes Co. (BKR).

Ten oil-directed rigs were added in the United States for the week, offsetting a one-rig decline in natural gas-directed drilling. The combined 500 active U.S. rigs as of Friday is more than double the year-ago tally of 244, according to the BKR data, which is based in part on data from Enverus.

Eight land rigs were added domestically during the period, along with one in inland waters. The Gulf of Mexico dropped one rig from its total, falling to 13. Seven horizontal units and two vertical units were added, while the total number of active...