Markets | NGI All News Access | NGI Data

Strong New England Quotes Lift Physical NatGas to Double-Digit Gains; April Adds Couple Pennies

Physical gas traded Wednesday for delivery on Thursday gained ground as weather forecasts called for falling temperatures into the weekend in key eastern markets and next-day power prices rose.

All points followed by NGI recorded gains, and excluding the volatile Northeast, most points gained about a nickel to a dime. The NGI National Spot Gas Average gained 13 cents to $2.52.

Futures traded within a narrow 8.5-cent range, but strength toward the end of the session added a modest degree of optimism.

At the close, April had risen 2.5 cents $2.799, and May had gained 3.9 cents to $2.909. April crude oil fell 18 cents to $53.83/bbl.

Eastern points posted solid gains as temperatures were forecast to slide into the weekend. AccuWeather.com forecast that Wednesday’s high in Boston of 62 degrees would fall to 47 Thursday and reach 28 by Saturday, 14 degrees below normal. Philadelphia’s high of 73 Wednesday was seen plunging to 49 Thursday and sliding to 39 by Saturday, 9 degrees below average.

Gas at the Algonquin Citygate surged $1.08 to $3.24, and deliveries to Iroquois, Waddington rose 44 cents to $2.99. Deliveries to Tenn Zone 6 200L added $1.02 to $3.19.

Packages on Texas Eastern M-3, Delivery gained a stout 24 cents to $2.33, and gas headed for New York City on Transco Zone 6 rose 31 cents to $2.36.

Next-day power prices were also supportive. Intercontinental Exchange reported on-peak power at the ISO New England’s Massachusetts Hub added $5.09 to $26.19/MWh, and on-peak Thursday power at the PJM West delivery point rose a healthy $3.04 to $28.66/MWh.

Major market centers posted gains as well. Deliveries to the Chicago Citygate added 8 cents to $2.68, and gas at the Henry Hub jumped 9 cents to $2.60. Deliveries to Transwestern San Juan rose 6 cents to $2.40, and gas priced at the SoCal Border Avg. gained 5 cents to $2.52.

Futures traders factored in the upcoming cold spurt and took note of what might be a nascent technical recovery.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

According to forecasters, more seasonal temperatures are on the horizon.

“Demand will be volatile to kick off the new month,” Genscape Inc. said Wednesday morning in a note to clients.Wednesday “should be the final day for eastern markets to enjoy the substantially warmer-than-normal temps of the past few days.”

Beginning Thursday, the warm front’s departure was expected to push heating degree days (HDD) “back toward seasonal norms, with the possibility of colder-than-normal temps by Friday. Following that, though, next week will once again see a rapid reversion to warmer-than-normal temps into the middle of March. Western markets from the Pacific Northwest to Desert Southwest will experience seasonally normal temps.

“Accordingly, we have California/Nevada-region demand falling rather sharply from today’s 7.2 Bcf/d to a low of 5.5 Bcf/d by Monday…This spring is setting up to be a potentially record-breaking year for hydro generation with snowpack levels at record highs and generation already occurring from heavy rains. Rockies, Texas, Midcon and Midwest will start off the month at normal temps, then gradually warm into next,” Genscape analysts added.

“The natural gas futures staged an upward technical correction in price on Tuesday after the nearby April futures survived a near retest of the $2.641 low in the April contract reached last week,” said Citi Futures Perspective analyst Tim Evans in closing comments to clients.

That technical correction may be the first step on the road higher. Other technicians versed in Elliott Wave and retracement see the market squarely in the bull’s court. The bearish case, said United ICAP’s Brian Larose, is that “a five-wave decline from the $3.494 high is still in progress. A wave ‘four’ correction is currently unfolding.

“Bullish case, an ABC pattern down from the $3.994 high has completed. A bottom is forming. Peg $2.825-2.856-2.869-2.875 as ideal resistance. Peg $2.931-2.947 as the must hold to keep the down trend alive. Bulls know what they need to do. Will be watching to see if they can get it done.”

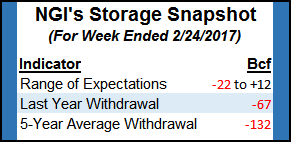

Both the bullish and bearish case will get a test Thursday morning when the Energy Information Administration issues its weekly storage figures. Last year 67 Bcf was withdrawn, and the five-year pace stands at 132 Bcf. This week’s estimates don’t even come close.

Kyle Cooper of IAF Advisors estimated a 2 Bcf build, and ICAP Energy is expecting a withdrawal of 4 Bcf. A Reuters survey of 24 industry traders and analysts revealed an average 4 Bcf withdrawal with a range of +12 Bcf to -22 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |