Strong Late Season Withdrawals, but Only Modest Natural Gas Futures Gains

With government storage data offering few surprises and midday weather data sending mixed signals, a natural gas futures market that has seemed reluctant to make any sudden moves crept higher Thursday.

In the spot market, prices continued to grind lower in the Midwest and East as the impact of this week’s cold pattern fades; the NGI Spot Gas National Avg. dropped 23.5 cents to $2.970/MMBtu.

The April Nymex futures contract settled slightly higher on the day, up 2.5 cents to $2.866 after trading both sides of even, as high as $2.871 and as low as $2.812. The May contract settled at $2.872, up 2.2 cents.

NatGasWeather viewed the midday Global Forecast System (GFS) operational run as “much milder trending” Thursday.

“But when the more important GFS ensemble data came out and it remained to the colder side, prices seemingly reversed course,” the forecaster said. “…What remains of great interest is both the GFS and European models continue to show strong late winter cold blasts becoming widespread across the northern, central and eastern U.S. March 16-20, where lows will again drop into the negative teens to 20s for strong national demand.”

The data has dropped a few heating degree days from the outlook for the period but continues to project above-average demand, NatGasWeather said, calling it a “modestly bullish setup” given the current inventory deficit to the five-year average could widen to more than 600 Bcf.

Over the next few days “we expect the weather data will flip-flop between minor milder and colder trends” in the outlook for temperatures beyond March 15, “but the most recent data continues to show it will be cold enough for deficits to increase further,” especially given smaller average withdrawals for the time of year as the end of the heating season approaches.

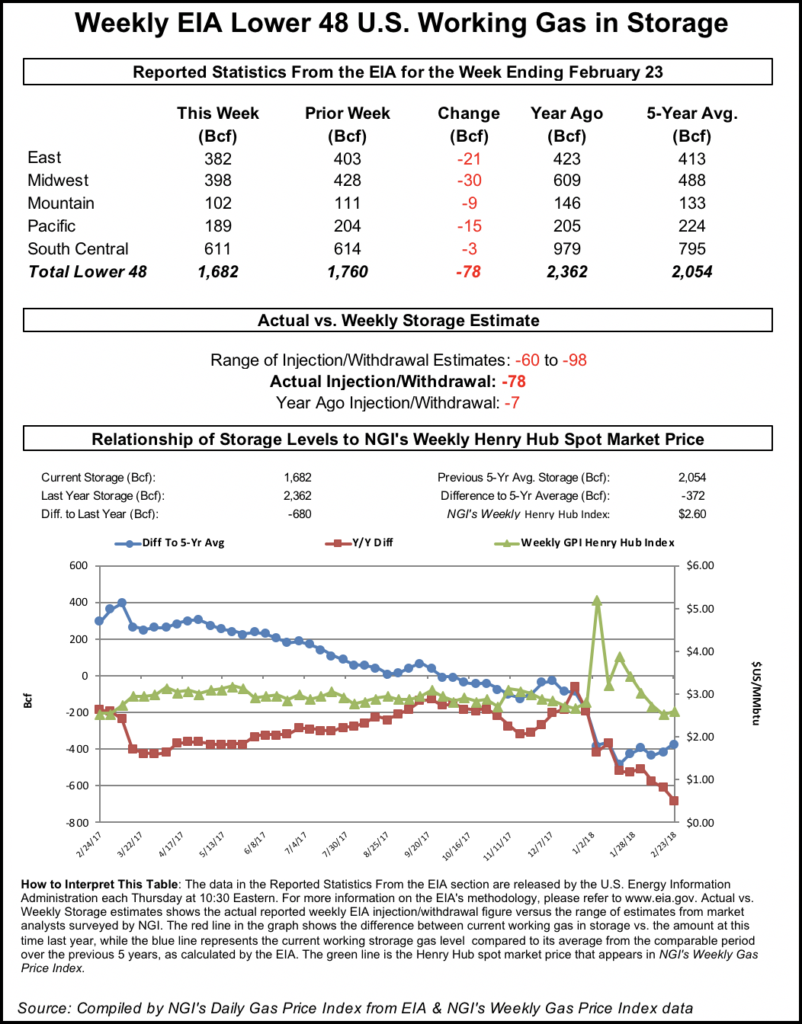

The Energy Information Administration’s (EIA) weekly storage report failed to make much of an impact price-wise, with a larger-than-average 149 Bcf withdrawal from stocks that came close to market expectations. The 149 Bcf pull for the week ended March 1 compares with a 60 Bcf withdrawal for the year-ago period and a five-year average pull of 109 Bcf.

Shortly after the report’s 10:30 a.m. ET release Thursday, the April Nymex contract went as high as $2.860 before dropping down into the $2.835-2.845 area, around 1-3 cents lower than the pre-report trade. By 11 a.m. ET, April was trading at $2.842, roughly even with Wednesday’s settlement.

Prior to EIA’s latest storage report, major surveys had pointed to a number in the 141-145 Bcf range, with estimates as high as 155 Bcf and as low as 123 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled at a withdrawal of 150 Bcf. NGI’s storage model predicted a 136 Bcf withdrawal.

Bespoke Weather Services, which had called for a 143 Bcf pull, said the 149 Bcf figure “simply indicates that we assumed last week’s looseness was a bit more structural as opposed to holiday-driven, as clearly last week’s number was loose due to significant holiday demand destruction.

“…Given recent market action it seemed traders were afraid of a more bullish miss. We see this instead as neutral overall, and would expect rapid loosening over the coming few weeks to limit upside for prices even though storage levels should approach 1,060 Bcf by March 22 and could briefly dip below 1,040 Bcf overall.”

Total Lower 48 working gas in underground storage stood at 1,390 Bcf as of March 1, down 243 Bcf (15%) year/year and 464 Bcf (25%) below the five-year average, according to EIA.

By region, the Midwest posted a 47 Bcf week/week withdrawal, while 43 Bcf was withdrawn in the East. In the South Central, EIA reported a 41 Bcf pull, including 19 Bcf withdrawn from salt stocks and 22 Bcf taken from nonsalt. The Pacific saw a 10 Bcf pull, with 6 Bcf withdrawn in the Mountain region, according to EIA.

Shortly after EIA data crossed trading screens, the discussion on energy social media platform Enelyst showed market observers looking ahead to a larger withdrawal from next week’s report, with estimates generally topping 200 Bcf.

A large withdrawal next week, driven by colder-than-normal weather to start March, would bring stocks that much closer to a 1 Tcf end-of-season carryout. ICE EIA end of draw index futures settled Wednesday at 1,045 Bcf, down 15 Bcf from the previous settle.

Genscape Inc. estimates show the demand impact from this week’s cold blast peaked on Monday, when temperatures were cold enough to prompt a single-day storage withdrawal of around 41 Bcf.

“This is the fourth highest single-day estimated withdrawal of this heating season,” analyst Margaret Jones said. “The end of January cold snap brought record cold to the Midwest and a three-day run of estimated withdrawals in excess of 42 Bcf/d — with withdrawals peaking on Jan. 30 at over 50 Bcf/d.

“Monday’s high withdrawal combines single day net demand of 131 Bcf, with net supply around 90 Bcf.”

That supply figure includes around 2.0 Bcf/d of production freeze-offs that Genscape observed on Monday, up from a little above 1.1 Bcf/d on Saturday and about 0.6 Bcf/d last Friday (March 1).

“In addition to the Rockies, affected areas included the Midcontinent, Permian Basin and the Northeast,” Genscape analyst Nicole McMurrer said. “…Freeze-off estimates quickly dropped back down” later in the week amid warming temperatures. “With the cold front passing, the Midcontinent and Texas regions are seeing a quick rebound in production estimates.”

Midwest, East Grind Lower

Forecasts for a gradual warm-up into the weekend and next week continued to pressure physical prices lower in the Midwest and East Thursday.

NatGasWeather’s forecast Thursday showed “frigid cold weather losing its grip across the southern and eastern U.S. the next few days, with temperatures becoming quite mild over the East this weekend.” This includes temperatures climbing into the 40s to 60s “over the Northeast and Mid-Atlantic and 70s and 80s across the Southeast.

“A cold shot will race across the northern U.S. early next week for a minor swing back to stronger demand, while also having trended a little colder in recent days,” the forecaster said. However, “this will quickly be followed by a nice mild break returning across the Great Lakes and East late next week for a swing to lighter than normal national demand as highs warm into the 50s to 80s.”

In the Northeast, Algonquin Citygate tumbled $2.755 to $4.230, while in the Southeast, Transco Zone 5 dropped 19.0 cents to $2.900. In the Midwest and Midcontinent, Joliet was off 12.0 cents to $2.840, while Northern Natural Ventura shed 24.0 cents to $2.775.

Price action in the West was mixed Thursday. A number of Rockies and California locations fell on the day, though two recently volatile hubs posted large gains.

In the Rockies, Northwest Sumas, where prices soared to astronomical levels last week, climbed 65.5 cents to average $6.875 Thursday.

According to a schedule posted this week, Westcoast Energy Inc. said it would be limiting southbound volumes out of British Columbia through the pipeline’s Station 4B to 1.67 million GJ/d for Friday, Sunday and Monday. A tool run scheduled for Saturday will limit flows to 1.18 million GJ that day, according to the pipeline.

Southbound volumes through Station 4B have been restricted in the aftermath of an explosion on the Enbridge Inc.-owned Westcoast system in October, contributing to significant, record-setting volatility as the constraints on Canadian imports have coincided with robust gas demand in the region this winter.

Genscape estimates called for demand in the Pacific Northwest to fall to just above 2 Bcf/d Friday and into the weekend, down from a recent seven-day average of 2.69 Bcf/d.

In California, meanwhile, SoCal Citygate picked up 74.0 cents to average $5.865, a significant premium to both Henry Hub and other locations in the region. Utility Southern California Gas (SoCalGas), restricted in its pipeline imports, continues to lean on the Aliso Canyon storage facility this winter to maintain reliability, even with its restricted regulatory status as a last-resort option.

SoCalGas posted notice this week that it withdrew volumes from the heavily scrutinized storage facility on Monday, Tuesday and Wednesday, including a 230 MMcf/d pull on Tuesday.

SoCalGas was calling for system demand to climb to about 3.2 Bcf for Friday before easing back to just under 3 Bcf/d over the weekend. Pipeline receipts are expected to be capped at around 2.7 Bcf/d during that period, according to the utility’s website.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |