Natural Gas Prices | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

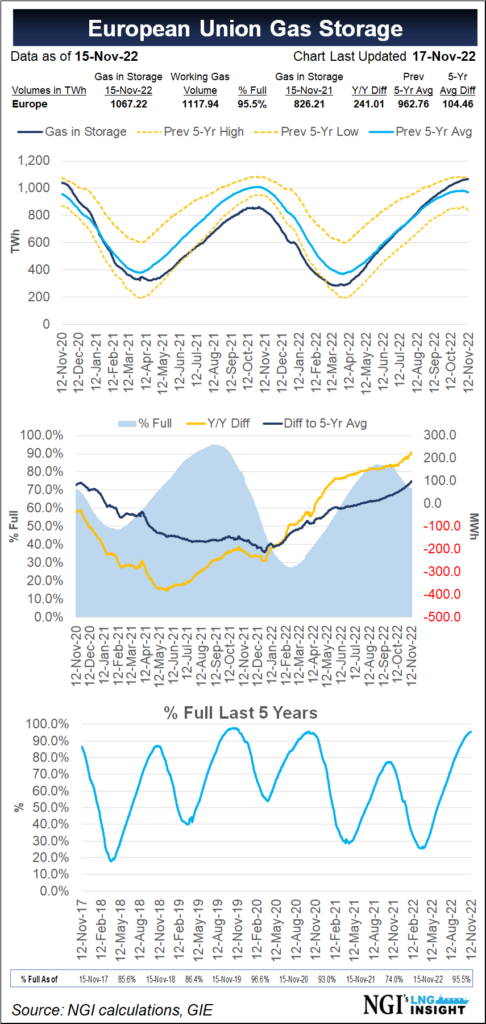

Storage, LNG Calm European Natural Gas Prices as Countries Look for Further Demand Cuts

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |