Storage Injection Comes in Below Expectations, Boosting August Natural Gas Futures

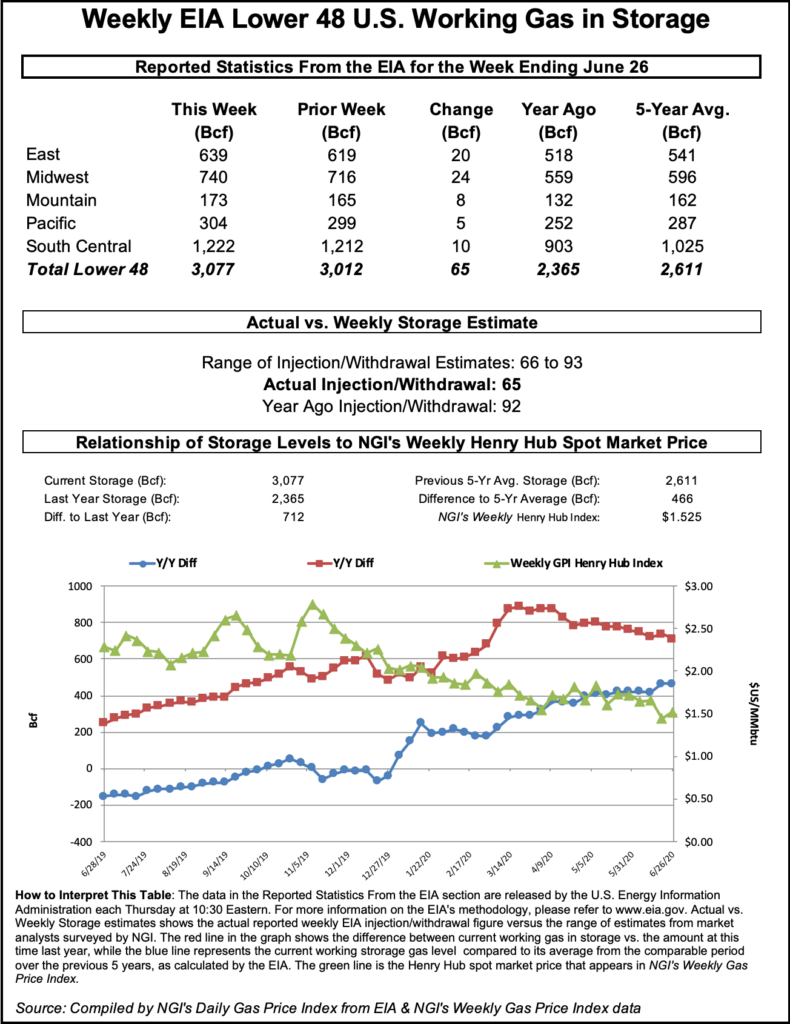

The U.S. Energy Information Administration (EIA) reported an injection of 65 Bcf for the week ending June 26, a print that fell below analysts’ average expectations and sent natural gas futures higher.

Prior to the EIA report, the August contract was up 2.2 cents at $1.693/MMBtu, and the prompt month advanced further to around $1.718 when the data was released. By 11 a.m. ET, the August contract was up 4.3 cents from Wednesday’s close to $1.714.

The latest build was far below the prior week’s injection of 120 Bcf but was in line with the average of previous years.

The 65 Bcf injection compares with the 92 Bcf increase in storage recorded in the same week a year earlier and the five-year average build of 65 Bcf for that week.

Analysts said the latest injection suggests that supply and demand, skewed in recent months by the coronavirus pandemic, could be improving with summer heat driving cooling demand and low prices spurring power demand.

Power is “certainly coming on strong,” Gelber & Associates analyst Daniel Myers said on The Desk’s online energy platform Enelyst. “I see some balancing with last week.”

Before the report was released, a Bloomberg poll found injection estimates ranging from 68 Bcf to 85 Bcf, with a median of 78 Bcf. A Wall Street Journal survey produced estimates spanning 66 Bcf to 85 Bcf and an average of 79 Bcf, while a Reuters poll showed estimates from 69 Bcf to 93 Bcf, with a median of 78 bcf. NGI estimated a 71 Bcf build.

The latest build lifted inventories to 3,077 Bcf, above the year-earlier level of 2,365 Bcf and above the five-year average of 2,611 Bcf.

By region, the Midwest led with a build of 24 Bcf, followed by the East, with a 20 Bcf injection, according to EIA. The South Central build of 10 Bcf included a 14 Bcf injection into nonsalt facilities and a negative 4 Bcf read in salts. The Mountain region’s inventory grew by 8 Bcf, and the Pacific’s increased by 5 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |