Markets | NGI All News Access | NGI Data

Stifling Heat Drives Gains in Weekly Natural Gas Prices

Triple-digit temperatures suffocated cities from the West Coast to Texas, lifting demand to record levels and driving up natural gas prices during the Aug. 12-16 week. Driven by the highest prices of the summer so far in the Permian Basin, the NGI Spot Gas Weekly Avg. climbed 9.5 cents to $1.985.

In Texas, the state’s electric grid operator had to implement the first level of its energy emergency alert system twice during the week, but not before setting a new record for power usage. Power loads in the Electric Reliability Council of Texas (ERCOT) reached an all-time high of 74,576 MW on Monday, Aug. 12, as real-feel temperatures neared 120 degrees in Dallas.

ERCOT operated under normal conditions throughout the day, but it had alerted market participants of a projected reserve capacity shortage from 2-6 p.m. The thin operating cushion led to a dramatic spike in real-time power prices, which soared to around $6,500/megawatt hour (MWh).

On Tuesday, ERCOT again warned of low reserves, which fell close to 2,000 MW, and power prices spiked to the $9,000/MWh market cap. A similar situation unfolded even on Thursday, despite lower temperatures in the state.

Thursday’s drop in operating reserves occurred when ERCOT unexpectedly lost more than 5,000 MW of generation. The grid operator had been using every tool in the shed to cope with the extended period of high demand, including older, inefficient generation units.

The extreme heat was a boon for Permian Basin gas prices. Waha weekly prices jumped $1.165 to average $1.255, although gas traded as high as $1.72.

Other areas of Texas also posted gains for the week, although those were limited to less than a dime.

Scorching temperatures also baked parts of California, but gains there also paled in comparison to those in West Texas. The most volatile pricing hub, SoCal Citygate, rose 11.5 cents to $2.935, with smaller increases seen elsewhere in the state.

Rockies locations rode the momentum, with Kingsgate surging 18 cents on the week to $1.84 amid pipeline maintenance in Canada that restricted supplies.

Most of the other increases seen around the country were limited to less than a dime, although the pipeline work crushed NOVA/AECO C, which plunged 61.5 cents to Cdn 82.5 cents/GJ. average.

The searing temperatures not only fueled weekly prices, but also Nymex futures as early signs pointed to continued heat and above-average demand for the remainder of the month and potentially into September. The September contract rose 9.5 cents during the Aug. 12-16 period to $2.20. October climbed 9 cents to $2.207.

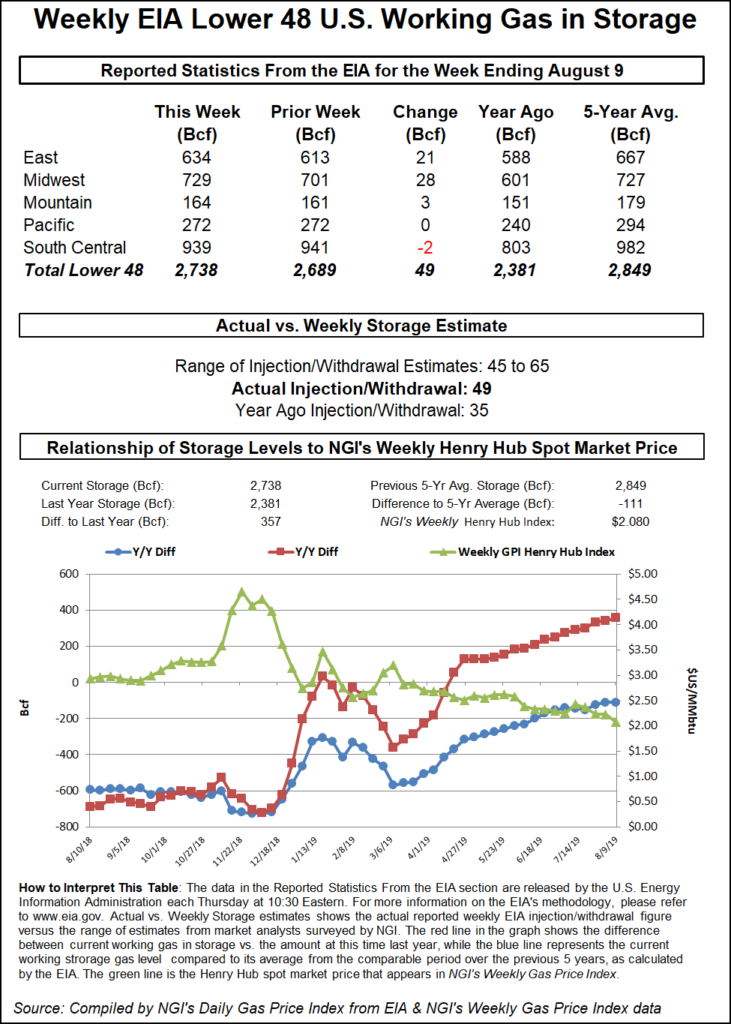

Nymex futures chugged along most of the week, with small day/day shifts but plenty of intraday volatility. That changed on Thursday, however, when the Energy Information Administration (EIA) reported a surprisingly low storage injection for the week ending Aug. 9.

The EIA reported a 49 Bcf injection that was about 10 Bcf below what analysts had called for, with traders driving up the September Nymex contract by as much as 12.4 cents before going on to settle at $2.232, up 8.9 cents on the day.

The reported build was one of the tightest, or more appropriately “least bearish”, of the summer injection season, according to Mobius Risk Group. The 49 Bcf compared to last week’s 55 Bcf injection, the five-year average of 49 Bcf and last year’s 35 Bcf injection, according to EIA data.

Considering the reference week had one less cooling degree day (CDD) than the prior week, six more than the five-year average for the comparable week and six less than the same week last year, “there is undeniably some market tightening due to lower prices. However, it will likely take confirmation in subsequent weekly storage reports before the market considers the ramifications beyond the month or bal-year,” Mobius said.

There are some supportive stats in bulls’ favor. The last half of August is forecast to be 44 CDDs warmer than normal and 18 CDDs warmer than the same period last year, according to Mobius. Likely injections, if these weather forecasts are accurate, for the second half of August will average less than 65 Bcf/week.

“This would lead to a marginal 15 Bcf increase in the cumulative storage surplus,” the Houston-based firm said.

However, production remains near all-time highs and is set to grow further once scheduled pipeline maintenance draws to a close. Meanwhile, new oil and gas pipelines starting service in the Permian are likely to open the floodgates on supply right when temperatures are starting to ease for the fall season.

Plains All American’s Cactus II just started service, and Kinder Morgan Inc.’s Gulf Coast Express (GCX) has begun flowing gas as part of its commissioning process. The 2 Bcf/d gas pipeline is expected to start full operations in late September.

Analysts at EBW Analytics Group said in a recent note that they expect GCX to “unleash bottlenecked Permian output” once it comes online.

“A combination of capturing currently flared gas and rising Permian oil — and associated gas — production with new oil pipelines may quickly increase supplies headed to the Gulf Coast by over 1.0 Bcf/d, further increasing downward pressure on natural gas prices,” EBW said.

In fact, it isn’t until the second half of 2020 that Tudor, Pickering, Holt & Associates (TPH) see the gas market balancing, as incremental demand adds of around 3.5 Bcf/d are forecast to outpace 1.9 Bcf/d of supply additions in 2020.

Spot gas prices were mixed Friday as weather conditions were expected to get progressively warmer in the coming days over the northern United States. The South was forecast to remain hot too, with retail providers in Texas continuing to call for power conservation on Friday.

Temperatures were expected to ease a bit for the coming week, with daytime highs stalling in the 90s, rather than 100s, according to forecasts. The dip in projected gas demand, combined with scheduled pipeline maintenance in neighboring regions, delivered a blow to Permian prices, which had in recent days reached their highest levels of the summer so far.

Waha spot gas plunged 37 cents to $1.175, with nearly as stout losses seen throughout the rest of the region. By comparison, pricing hubs across the rest of Texas were generally up a few cents on the day.

Natural Gas Pipeline Company of America (NGPL) said Amarillo line maintenance beginning Tuesday and lasting through Saturday is expected to cut more than 700 MMcf/d through Compressor Station 107 in Mills County, IA. Similar maintenance events in prior months have temporarily depressed NGPL’s Permian takeaway capabilities while forcing the pipeline’s Midcontinent region to curb receipts as NGPL Midcontinent cash spot prices plummet to compete with Permian molecules and spot pricing, according to Genscape Inc.

“This inter-basin competition between constrained Permian outflow and NGPL-captive molecules is inflamed by a lack of eastbound takeaway capacity through the pipe’s TEXOK tariff zone,” Genscape natural gas analyst Matthew McDowell said. “Segment 15 typically flows full towards the Gulf Coast mainline and has not had substantial available primary firm capacity since January 2019.”

A prior 30-day analysis (excluding the most recent force majeure impacting flows from July 29-Aug. 1) showed that Station 107 Mills in western Iowa flowed an average of 1,412 MMcf/d, according to Genscape. “During prior forces majeure, spot prices at NGPL Midcon have dropped and rallied over $1 around these events and have dipped into negative territory briefly,” McDowell said.

On Friday, NGPL Midcontinent spot gas tumbled 10.5 cents to $1.695, while several other points in the region shifted only a few cents.

Another exception in the Midcontinent, however, was ANR SW, which fell 11 cents to $1.72 as the pipeline said planned maintenance on its Michigan Leg South could create constrained conditions and lead to flow cuts of up to 170 MMcf/d. Over the past 14 days, flows through St. John Eastbound have averaged 735 MMcf/d and maxed at 1,034 MMcf/d, according to Genscape.

Prices across the Midwest barely budged on Friday. The same was true across much of Louisiana and the Southeast.

In Appalachia, Texas Eastern M-3, Delivery rose 4.5 cents to $1.915, a day after Texas Eastern Pipeline (Tetco) issued an update regarding repairs following the explosion earlier this month. In compliance with the Corrective Action Order issued by the Pipeline and Hazardous Materials Safety Administration (PHMSA), Tetco is implementing its work plan to replace segments of Lines 10 and 25 in the vicinity of the incident site, and it is assessing Line 15 between Uniontown and Kosciusko.

Based on the current schedule, Tetco expects to complete the necessary repairs and related activities to return Line 25 back to service from Aug. 24-26, returning the line to a capacity of about 780 MMcf/d, according to Genscape.

Tetco also expects that necessary Line 10 construction will be completed by early September. Before returning Line 10 and 25 to service, Tetco “will address all of the site-specific concerns identified by PHMSA and will be undertaking rigorous inspections on Line 10 and 25 in compliance with the CAO.”

The pipeline also stated that these lines would not be returned to service until all regulatory requirements stipulated in the order were satisfied and “it is safe to do so.”

Meanwhile, after several reschedules, several points on the Columbia Gas Transmission (TCO) system in Pennsylvania and West Virginia will be affected because of unrelated maintenance on Tetco, mainly restricting all receipts and deliveries between the two pipes at the Waynesburg interstate interconnect, effectively cutting up to 273 MMcf/d of deliveries from TCO onto Tetco from Sunday to Saturday, Aug. 18-24, according to Genscape.

Finally, Transcontinental Gas Pipe Line (Transco) said maintenance underway on Leidy Line A near Station 515 in Luzerne County, PA, is expected to be complete by Tuesday, four days earlier than scheduled. The event has impacted roughly 600 MMcf/d of Transco’s Pennsylvania production, but overall Northeast production has not been affected because of reroutes to Tennessee Gas Pipeline and Millennium Pipeline, Genscape said.

Indeed, Transco-Leidy Line was flat on Friday at $1.845.

In the Northeast, big gains were seen across New England, where Algonquin Citygate jumped 21 cents to $2.345. Transco points were up less than a dime.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |