Regulatory | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Special Permit for LNG by Rail Foreshadows Boon for U.S. Small-Scale Liquefaction

Federal regulators have approved a special permit allowing a New Fortress Energy LLC affiliate to carry liquefied natural gas (LNG) by rail from the shale fields of Northeast Pennsylvania to the shores of the Delaware River in New Jersey.

The New Fortress permit was the only special permit pending to move the super-chilled fuel by rail in the United States and marks a bellwether for what could be rapid growth in the small-scale space as the industry searches for ways around pipeline constraints.

Rail transport would also allow sellers to move more fuel as far larger LNG export terminal development is facing pressure amid a global gas glut and a more competitive market.

Hazardous materials regulations don’t currently authorize the transport of LNG by rail across the United States. Instead, a waiver may be granted through the kind of permit that New Fortress affiliate Energy Transport Solutions LLC received this month.

The Federal Railroad Administration has in the past granted special permits to Florida East Coast Railway to move the fuel by ISO, i.e. International Organization for Standardization, containers, which can be trucked to trains for transport. Federal regulators have also approved a pilot program to move LNG by rail in Alaska. International railroads already move LNG or have tested propulsion systems.

A rulemaking has been underway since last year at the U.S. Department of Transportation (DOT) to develop a framework to transport LNG by rail across the country, and earlier this year, President Trump issued an executive order to speed up the process. DOT issued a notice of proposed rulemaking in October that is out for public comment until Dec. 23.

“I think it will be important to add more flexibility to the market, especially in some of these areas that are more pipeline constrained,” said the Center for LNG’s Katharine Ehly, senior policy adviser.

She pointed to the Northeast, where pipelines have become difficult to build because of grassroots opposition, or in the Permian Basin, where associated gas volumes have continued to increase, straining infrastructure.

New Fortress, which is focused on introducing LNG to stranded markets, called its permit a “significant milestone” for efforts “to bring cleaner and more affordable energy to markets that are reliant on oil-based fuel.”

Under the special permit, railcars are authorized to move LNG from two small-scale liquefaction facilities New Fortress is developing in Wyalusing, PA, to affiliate Delaware River Partners LLC’s proposed Gibbstown Energy Center in New Jersey, where a liquefied petroleum gas (LPG) and LNG logistics terminal is under development. The railcars could only move on that specific route.

The permit indicated that Energy Transport Solutions would start with single car shipments, progress to multi-car shipments and ultimately unit trains, with 20 or more cars. The unit trains can carry about 3 million gallons of LNG, or about the equivalent of what 300 trucks could carry. Plans have also been outlined to move LNG into the Gibbstown facility via truck.

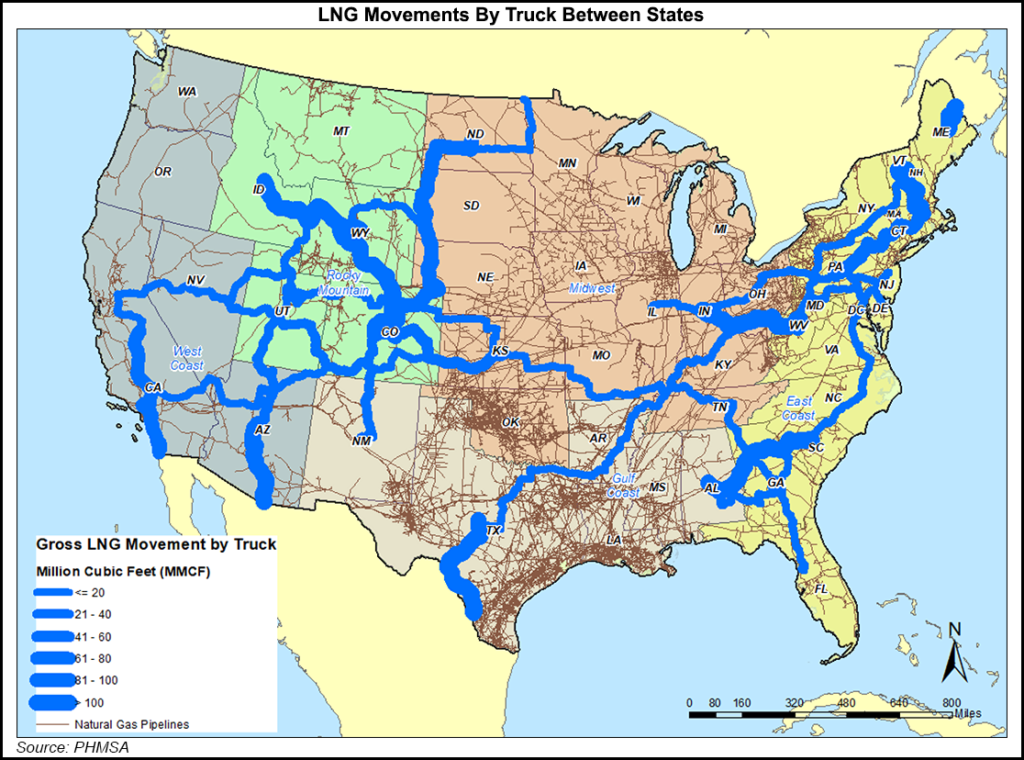

Ehly told NGI that the special permit is a reflection of growth in the small-scale LNG space and the abundance of gas produced across the country. While trains would pale in comparison to the volumes being carried by massive vessels from the six U.S. LNG export terminals now in operation, they could offer a much needed takeaway option in many parts of the country.

If the rulemaking is finalized, LNG by rail volumes could spike in the way that crude shipments by rail have from prolific fields including the Bakken Shale.

Beyond social opposition to fossil fuel infrastructure in the Northeast, associated gas is being flared off at record rates in the Permian because there’s so much of it. Producers have even paid customers to take gas off their hands.

Instead of building massive pipelines in the Permian, or moving ahead with some second wave export terminals on the Gulf Coast that could face a challenging market, small-scale LNG could be another business opportunity for stakeholders. That depends on location, like along the U.S.-Mexico border, where LNG exports via truck have spiked dramatically over the last three years to nearly 30 MMcf/d from 5 MMcf/d, according to the Energy Information Administration.

U.S. railroads moved about 113,978 bbl of oil last year, while another 76,599 bbl of propane traveled on trains, according to the EIA.

Pipeline and Hazardous Materials Safety Administration spokesman Darius Kirkwood couldn’t offer a timeline for when the LNG by rail rulemaking could be finalized. After the public comment period, a final rule would be prepared and sent to the Office of Management and Budget for review.

Both the special permit and proposed rulemaking authorize the movement of LNG in DOT 113 tank cars, or those capable of moving cryogenic liquids. Condensates and crude oil already travel by train, but in LNG’s case, the cars would have to be capable of loading natural gas chilled at minus 260 degrees F.

New Fortress has released few details about the project in New Jersey, but in its request for a waterway suitability assessment from the U.S. Coast Guard filed in 2017, the company highlighted plans for an LNG export capacity of 1.5 million metric tons/year and LPG export capacity of 9.6 million b/year. The terminal is still awaiting various regulatory approvals.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |