E&P | Earnings | International | NGI All News Access | NGI The Weekly Gas Market Report

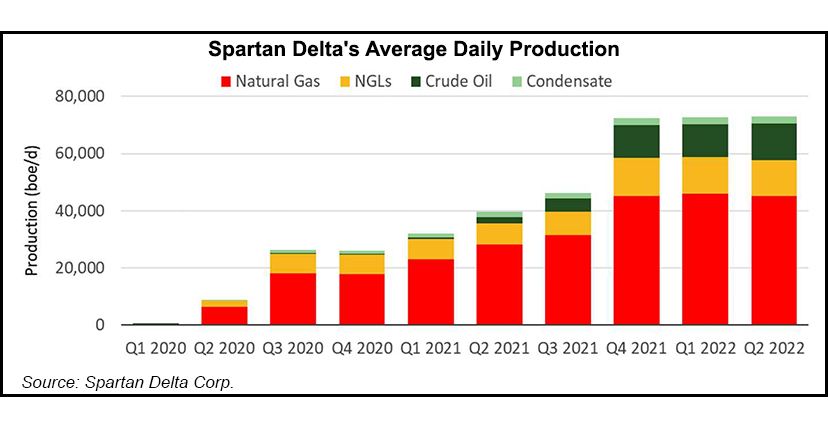

Spartan’s Oil, Natural Gas Surge in Western Canada Spurred by Takeovers, High Prices

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |