Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Southwestern Pays Chesapeake $5.375B for Marcellus/Utica Dry Gas Package

Chesapeake Energy Corp. on Thursday agreed to sell a wide swath of its dry natural gas-heavy assets in southern Pennsylvania and northern West Virginia to Southwestern Energy Co. for $5.375 billion, a sale that has been anticipated for months.

Under terms of the agreement, Southwestern would receive 413,000 net acres and 1,500 wells, 435 of which are in the Marcellus and Utica formations, along with property and facilities. Average production in September was 336 MMcfe/d, 55% weighted to natural gas, 36% to natural gas liquids and 9% to oil. Proved reserves at the end of 2013 was 221 million boe.

The acquired assets include 256 operated and producing Marcellus and Utica horizontal wells, and 179 nonoperated or nonproducing Marcellus and Utica horizontal wells. The average working interest of the operated properties is 67.5%. The transaction is subject to consent of the principal co-owner of this acreage, which also has a 30-day preferential right to purchase. Statoil ASA became Chesapeake’s top drilling partner in the Marcellus in 2008 (see Daily GPI, Nov. 12, 2008). Chesapeake also has other joint ventures in parts of the basin.

Southwestern CEO Steve Mueller talked about the transaction during a conference call with analysts. The purchase, he said, “fits who we are and what we do best.”

The Houston operator never has been too acquisitive, preferring instead to secure positions in selective basins, such as the gas-rich Fayetteville Shale, where it always has been the biggest leaseholder and where it has managed to earn positive returns even in weak commodity environments.

“We have a proven record of earnings, driven by natural gas over several years,” Mueller told analysts. “Year over year, our returns beat liquids-centrlc companies…We exceed economic hurdles and continue to provide transparent, top-tier returns.” After taking a hit on hedging, net income in 2Q2014 rose year/year to $207 million (59 cents/share) from $190 million (54 cents) (see Shale Daily, Aug. 4). Average realized gas prices were $3.77/Mcf from $3.87 in 2Q2013.

“Many out there in the industry…are missing some of the signals” on gas prices, Mueller said. “We see evidence of new demand growth in ’14…All the fundamentals point to a $4.00 Nymex price environment. A strong company can make great returns in that environment and win. Our company’s performance has shown that. Even in a low cost environment, we’ve show that this acquisition strengthens that position.

“We’ve stress-tested [the acquisition] and at a $3.50 price, we still have strong returns…”

While many of Southwestern’s peers have strayed from the natural gas pasture to grab more lucrative oil and liquids fields, Southwestern continues to place most of its bets on gas. “This is not about the past, it’s about the future,” Mueller said of the transaction.

Southwestern isn’t going blind into Appalachia, he said. The company already has drilled about 300 gas wells in the Marcellus, building on its 4,000-plus gas well success in the Fayetteville, he noted. Chesapeake’s also done a lot of the leg work, giving Southwestern the opportunity to true up the leasehold and ensure it gets everything it’s paid for.

Chesapeake has done little with the leasehold it’s selling; most of the company’s development today is centered on wet gas leases in Ohio. However, its Marcellus dry gas output still rose 2% between May and September, Mueller told analysts.

Most of the acreage that Southwestern is buying already is held by production or has lease commitments through 2018 that average less than 20,000 acres per year. Average net revenue on the leases is about 86%.

As part of the transaction, Southwestern would assume a portion of Chesapeake’s firm transportation and processing capacity commitments. Based on capacity and expected future commitments, preliminary plans are to begin with four to six rigs in 2015 and increase to 11 rigs by 2017.

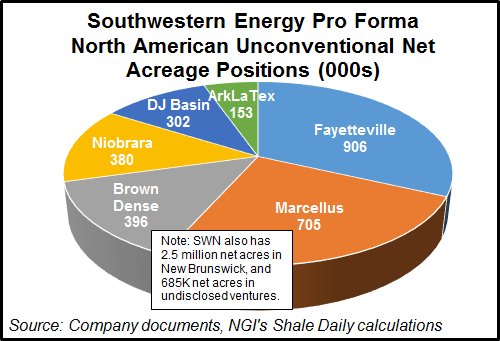

Southwestern estimates that it could drill in Appalachia for a “minimum” of 20 years and maintain an 11-rig pace, said Mueller. By the end of 2017, the reserve mix for the company is estimated to be one-third each for the Fayetteville, northeast Marcellus and the newly acquired West Virginia and Pennsylvania properties, as compared to the roughly two-thirds for the Fayetteville and one-third northeast Marcellus today.

The purchase may affect Southwestern’s capital expenditures in 2015, but it’s a bit early to say, the CEO told analysts. The plan currently is for cash flow to fund most of the drilling projects in the onshore.

“Our patience and disciplined approach to investing every dollar we spend has led to this outstanding opportunity,” Mueller said. “We remain committed to providing long-term value to our shareholders and believe that part of that value is maintaining our investment grade profile.”

Southwestern plans to finance the transaction in part with debt. It also is “considering dispositions of certain nonstrategic assets,” but no details were provided.

It’s the second big deal in Appalachia with Chesapeake in 18 months. Southwestern in April 2013 agreed to pay $93 million for a string of leaseholds in Pennsylvania that together equaled about 162,000 net acres (see Shale Daily, April 30, 2013). That transaction almost doubled Southwestern’s leasehold to more than 337,000 net acres across the play.

For Chesapeake, the sale “marks a major step in Chesapeake’s transformation and a dramatic improvement in our financial strength as we seek to maximize value for our shareholders,” said CEO Doug Lawler. “Earlier this year, we committed to unlocking the significant value inherent in this asset, recognizing the disconnect of its perceived value within our portfolio.”

Lawler, since he took over in 2013, has said on several occasions that there were no sacred cows in Chesapeake’s portfolio. Like other parts of the portfolio, some of the Appalachian assets, particularly the dry gas assets, have been on the market for some time. Lawler said in June the dry gas assets likely would be sold for the right price (see Shale Daily,June 19). In July, management also warned that its gas pricing differentials in parts of the Marcellus during the second quarter and into July had weakened relative to the Henry Hub benchmark and were “significantly wider than forecast” (see Daily GPI, July 29).

“It’s important to note that this transaction has no impact on our expected growth profile or on our views around maintaining a disciplined capital program,” Lawler said. Chesapeake still expects its full-year production guidance for 2015 to be 7-10% growth from 2014 levels adjusted for asset sales, he said.

The sale, expected to be completed by the end of the year, drew lots of positives for Chesapeake.

Standard & Poor’s Ratings Services (S&P) revised the rating outlook on Chesapeake to positive from stable. It also affirmed its “BB+” corporate credit rating. The recovery rating on the debt remains “3,” which indicated an expectation for a “meaningful (50-70%) recovery in the event of a default.”

Completing the sale “should provide Chesapeake with sufficient wherewithal to reduce financial leverage to a greater extent than assumed in our base case scenario, but management has not clarified the specific use of proceeds, and we perceive there to be uncertainty on this point,” said S&P credit analyst Scott Sprinzen, who has scrutinized the company since it was led by former CEO Aubrey McClendon, and cited progress since Lawler’s arrival (see Shale Daily, July 29, 2013; May 16, 2012).

If Chesapeake were to take “actions” that resulted in an incremental reduction of debt and “debt-like liabilities of more than $5 billion,” so that its debt totaled less than $11 billion, then its debt-to-earnings ratio would be “sustainably below two times over the next two years,” Sprinzen said. “This could result in an upgrade and the revision of our financial risk profile assessment to significant from aggressive.

“On the other hand, the rating could be jeopardized if, contrary to our expectations, there were some combination of a failure to complete pending asset sales, operating setbacks, or a growth strategy and financial policy that were more aggressive than we now anticipate.”

Wells Fargo analysts estimated the transaction to be worth $1.00-2.00/share accretive to Chesapeake’s net asset value. Assuming $40,000/flowing boe, the remaining acreage in Appalachia held by Oklahoma City operator was estimated to be valued at $7,600/acre.

Chesapeake “was not directing much capital toward these properties, and thus we do not expect any change to the fiscal year 2015 capital program,” said the Wells Fargo team. “Further, the properties were not contributing to the company’s production growth…Regarding use of proceeds, we’d expect some will go toward paying down debt, but at this time management is keeping quiet on other potential uses.

“We’d note that having some dry powder in this weak commodity/equity environment could create some interesting opportunities.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |