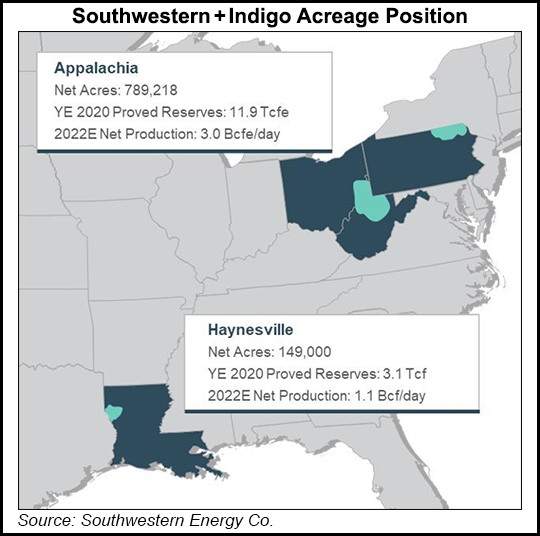

Southwestern Energy Co. is moving beyond the Appalachian Basin to expand its natural gas opportunities with a $2.7 billion takeover of Haynesville Shale pure-play Indigo Natural Resources LLC.

The Houston independent, a Lower 48 pioneer in unconventional drilling techniques, said the merger would boost production to 4 Bcfe/d, 85% weighted to natural gas. Indigo, which now produces 1 Bcf/d net, has core dry gas assets across the stacked Haynesville and Bossier zones in North Louisiana.

Combining the gassy leaseholds in Appalachia and the Haynesville is a “perfect recipe for success,” Southwestern CEO Bill Way said during a conference call with investors.

“We know the Appalachian Basin,” he said. “We know Haynesville…quite well…We know quality, we know strategic...