Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Some Basis Markets Boosted Last Week by Bidweek Volatility, Summer Fundamentals

Bidweek volatility, a bearish storage picture and expectations of low hydro supplies sparked a handful of movers and shakers in an otherwise dull natural gas forwards basis market last week.

Most market hubs saw modest weakness at the front of the curve, but two Northeast points posted declines of more than 20 cents from March 23 to March 26.

At Texas Eastern Transmission zone M3, April basis plunged 23.2 cents to reach minus $1.049/MMBtu, according to NGI’s Forward Look. May basis, however, was up a modest 1.8 cents to minus $1.053/MMBtu, and the balance of summer (May-October) slid 1.4 cents to minus 99.5 cents/MMBtu.

Dominion South point April basis was down 21.3 cents from Monday to Thursday to reach minus $1.159/MMBtu, while May was down 1.3 cents to minus $1.18/MMBtu. The balance of summer, meanwhile, was essentially flat at minus $1.172/MMBtu.

A Northeast trader tied the dramatic losses at the two market hubs to the typical volatility one sees during bidweek.

“Dominion was wild. The index will piss someone off. Count on it,” the trader said. “Monday and Tuesday will be all about setting the index.”

The weakness at Dominion comes as storage facilities there reported their smallest withdrawal of 2015 last week. Dominion withdrew 7 Bcf bring inventories to 69 Bcf, a 33 Bcf surplus to 2014 levels and 23 Bcf below the five-year average, according to Bentek Energy.

Meanwhile, weather forecasts are not offering much support either aside from the occasional cold blast affecting portions of the Northeast.

According to forecasters with NatGasWeather, there will be numerous weather systems bringing rain, snow, and thunderstorms to the U.S. during the coming two weeks, but extreme temperatures associated with the Arctic cold pool over Canada should fail to push into the U.S., apart from bouts of moderately cooler-than-normal temperatures.

“As we have been mentioning, the weather data for the second week of April is unconvincing in keeping cooler temperatures spilling into the northern U.S., which will gradually trend weather sentiment from neutral to bearish unless cooler weather patterns gain traction very soon,” NatGasWeather said.

As such, Dominion basis is expected to continue weakening as demand tapers off and production is expected to continue growing in the near term, according to Genscape’s Rick Margolin.

“Dominion should remain weak until reversals/expansions come in, primarily in November, but maybe earlier with REX East to West,” Margolin said.

Spectra’s Uniontown to Gas City and Ohio Pipeline Energy projects, Tennessee Gas Pipeline’s Broad Run Flexibility, NiSource’s East Side Expansion and Transco’s Leidy Southeast are all expected to go into service in the November-December timeframe.

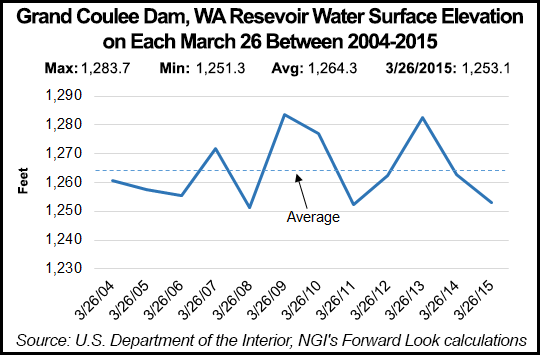

In the West, Northwest Pipeline-Sumas continues to strengthen as the dismal hydro supply picture becomes clearer.

Sumas April basis jumped 8 cents between Monday and Thursday to reach minus 49.6 cents/MMBtu, and May edged up 3.1 cents to minus 55.1 cents/MMBtu. The balance of summer was up just 1.6 cents to minus 48 cents/MMBtu.

Current water levels at Oregon’s Dalles Dam are among the lowest in more than 50 years, and Genscape is projecting the low output from hydro generating plants in the region will generate 0.12 Bcf/d of incremental gas burn through July.

Some 6.1 GW of wind and solar power added this summer are also expected to help meet the higher demand brought on by the low hydro supplies.

Meanwhile, California gas storage inventories remain robust as mild winter temperatures, increased use of renewables and a strong hydro season in the Pacific Northwest helped dampen the need to rely on storage.

According to Genscape, Southern California Gas working gas inventories are projected to end the winter at 89.5 Bcf, and Pacific Gas & Electric will end with around 131.3 Bcf in storage.

This will put each system up 266% and 251%, respectively, from last year’s record low end-of-winter inventories. It would also leave SoCal with 25% more gas than the five-year end-of-winter average and PG&E 37% above the five-year average.

Despite the bearish storage picture, forward prices at the two California points hardly budged this week, shifting no more than 2 cents across the curve.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |