Smaller-Than-Expected Natural Gas Storage Build Underwhelms Futures Traders

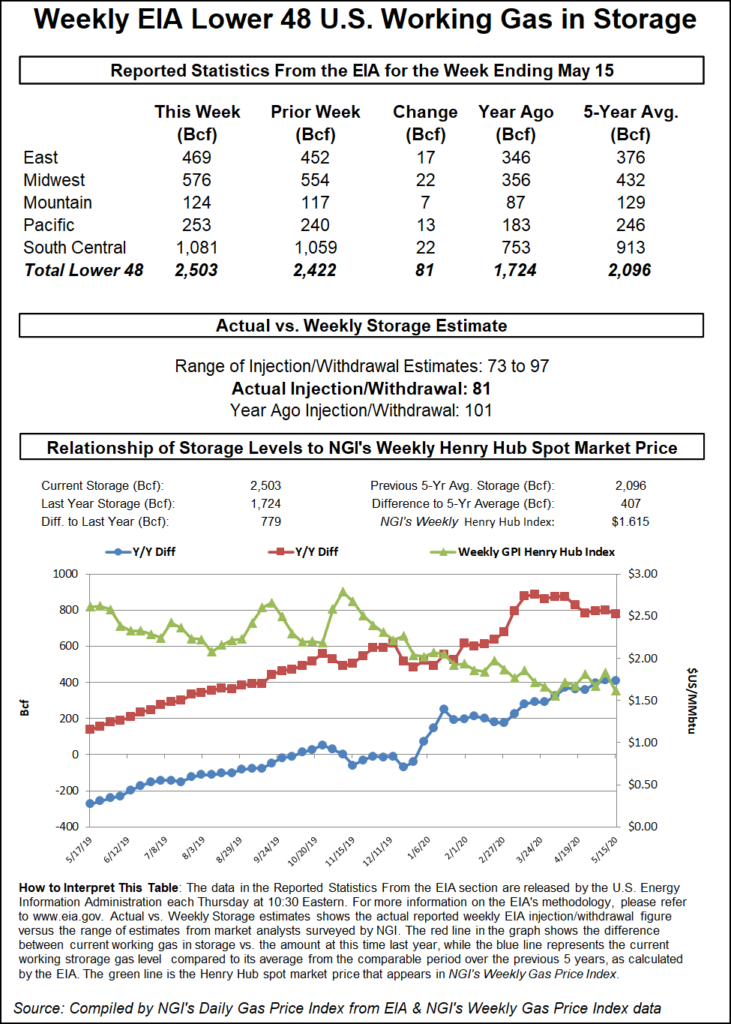

The U.S. Energy Information Administration (EIA) reported a smaller-than-expected 81 Bcf injection into natural gas storage inventories for the week ending May 15.

The storage build fell within the wider range of expectations, but natural gas traders took the news as a reason to bump up prices, at least initially.

In the minutes leading up to the EIA report, the June Nymex gas futures contract was trading at $1.734, off 3.7 cents day/day. When the print crossed trading desks, the prompt month trimmed the losses by 1.0 cent. However, by 11 a.m. ET, the June contract had moved lower, trading 3.9 cents below Wednesday’s close at $1.732.

Bespoke Weather Services, which had projected an 85 Bcf injection, said it wasn’t reading much into the latest EIA figures despite the miss, as it was a “very heavy” heating degree day week and marked the end of any possible influence of heating demand.

“It does represent a little balance improvement, but far more important will be the trend in the next few EIA numbers, as this week’s data has shown some demand coming back,” Bespoke said. “Low global prices keep concern alive for further liquefied natural gas slowdowns, however.”

Ahead of the EIA report, a Wall Street Journal poll of 11 market participants produced a range of storage estimates from 77 Bcf to 90 Bcf, with an average build of 84 Bcf. A Bloomberg survey of six analysts ranged from 76 Bcf to 91 Bcf, with a median estimate of an 84 Bcf injection. Reuters polled 17 analysts, whose estimates ranged from 73 Bcf to 97 Bcf, with a median injection of 83 Bcf. NGI projected an 86 Bcf build.

Broken down by region, the Midwest added 22 Bcf into storage, as did the South Central, which included an 18 Bcf build in nonsalt facilities and a 5 Bcf build in salts, according to EIA.

Market observers on The Desk’s online energy platform Enelyst viewed the South Central build as lighter than expected, but some noted that temperatures across Texas are rapidly increasing.

“Texas heat matters,” said one participant.

Elsewhere across the Lower 48, East inventories rose by 17 Bcf, Pacific stocks increased by 13 Bcf and Mountain stocks added 7 Bcf.

Total working gas in storage as of May 15 stood at 2,503 Bcf, 779 Bcf higher than year-ago levels and 407 Bcf above the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |