Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access

SM Energy Raises Production Guidance as Completions Improve

Denver-based SM Energy Co. raised its production guidance for 2014 in spite of an anticipated hiccup in the company’s Eagle Ford Shale operations during the third quarter. The company also will be spending more than planned earlier.

“Recent enhancements in our completion techniques are improving the value and quantity of drilling inventory across our portfolio, which has been further bolstered by our recent acquisition activity in oil-weighted areas of our Rocky Mountain region,” said CEO Tony Best.

Production guidance for 2014 has increased by about 3%. The new guidance incorporates downtime expected in the operated Eagle Ford asset during the third quarter due to temporary well shut-ins during offset completion work.

The company increased its annual 2015 production growth target to 20%, up from 15%. Additionally, SM Energy expects about 15% annual production growth for 2016.

BMO Capital Markets analysts said the news from SM Energy was mixed as third quarter guidance was below expectations due to the temporary Eagle Ford well shut-ins. However, the 2015 and 2016 outlook is slightly better than they were expecting.

“…[W]e view the SM story as more about inventory and net asset value growth versus production as Eagle Ford Area 3 can drive significant volume growth,” BMO said. “We view enhanced completions in low-return Eagle Ford areas as the biggest potential [net asset value] driver, and we are less bullish on new ventures.”

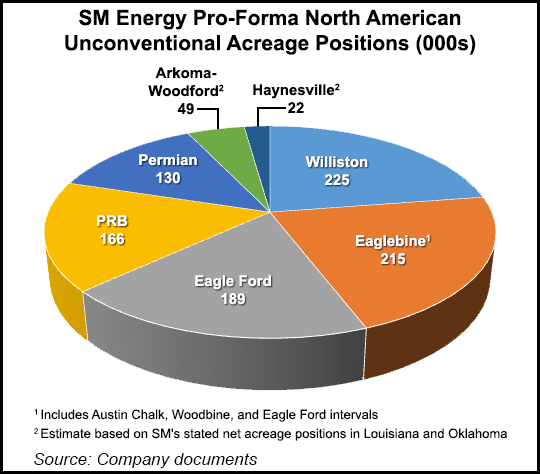

SM Energy updated its 2014 capital expenditure budget with the majority of the increase attributable to $430 million of un-budgeted acquisitions in the Powder River and Williston basins and additional activity related to those acquisitions in the second half of 2014.

An increase in Eagle Ford investment reflects higher levels of activity in the nonoperated Eagle Ford program than were assumed in the original budget. In the Bakken/Three Forks program, the increase relates to drilling and completion activity in the fourth quarter associated with a previously announced pending acquisition in its Gooseneck area in North Dakota, which is expected to close during the third quarter (see Shale Daily, July 31). In the Powder River Basin, SM Energy is increasing capital to reflect accelerated activity in the second half of the year due to strong results from its Frontier program. An increase in the new ventures segment and non-drilling spending are mainly due to construction of a gathering system in its East Texas program.

The aggregate capital program for each of 2015 and 2016 is expected to be similar to the revised 2014 program, excluding the impact of 2014 acquisitions and nonoperated Eagle Ford carried capital, the company said.

“We believe the combination of strong, fully funded production growth, higher liquids percentage and a diversified asset portfolio will result in share outperformance versus its peers,” Wells Fargo Securities analysts said in a note on SM Energy Monday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |