NGI Data | Markets | Natural Gas Prices | NGI All News Access

Sluggish Physical Market Outdone by Surging Screen; July Adds 9 Cents

Physical gas for Friday delivery changed little in Thursday’s trading as most traders and marketers elected to get their deals done prior to the release of storage data by the Energy Information Administration (EIA).

Widespread market gains of a few pennies throughout most production zones, however, were offset by declines in the Northeast, Mid-Atlantic and Marcellus. Overall, the market shed a penny to $2.51. Futures bulls, however, were waiting in the wings with both barrels loaded, and once EIA reported a mildly bullish storage build of 75 Bcf, futures started on a 9-cent trek higher, which saw prices end at the top end of the day’s range, a short-term bullish indicator. At the close, the soon-to-expire July contract had risen 9.1 cents to $2.850 and August was up 8.4 cents to $2.866. August crude oil slipped 57 cents to $59.70/bbl.

Eastern traders sent physical prices lower as weather forecasts called for a sharp drop in temperatures in major eastern markets. Forecaster Wunderground.com predicted the high Thursday in New York City of 91 degrees would plummet to just 75 Friday and ease further to 70 by Saturday. The normal high in New York is 82. Philadelphia’s expected high Thursday of 84 was seen sliding to 80 Friday before dropping further Saturday to 71. The seasonal high in Philadelphia is 83.

Gas bound for New York City on Transco Zone 6 fell 19 cents to $2.35, and gas on Tetco M-3 shed 10 cents to $1.24.

Marcellus points also weakened as construction delays on the Transco Leidy project caused full production on the expanded pipeline to be pushed back to July 2. Next-day deliveries on Millennium fell 14 cents to $1.15, and packages on Transco Leidy fell 8 cents to $1.13. Gas on Tennessee Zone 4 Marcellus came in a dime lower at $1.02, and packages on Dominion South changed hands 14 cents lower at $1.13.

Industry consultant Genscape said, “A key component of Transco’s construction on its Southeast Project will not be completed until today, and flows through the affected segment are not expected to fully recover to pre-construction levels until next Thursday.” The project is huge and will expand system capacity as much as 525,000 Dth/d from points in Pennsylvania as far south as pooling points in Alabama.

In addition “Transco proposed to construct and operate a total of approximately 30 miles of new 42-inch diameter pipeline loops in four sections of the northern part of the line in Pennsylvania.”

Other market centers reported gains. Gas at the Chicago Citygate rose 4 cents to $2.79, and deliveries to the Henry Hub were seen at $2.79 as well, up 2 cents. Trading at the NGPL Mid-Continent Pool was active and gas there rose 4 cents to $2.66. Gas at the SoCal Citygate was quoted a nickel higher at $3.17.

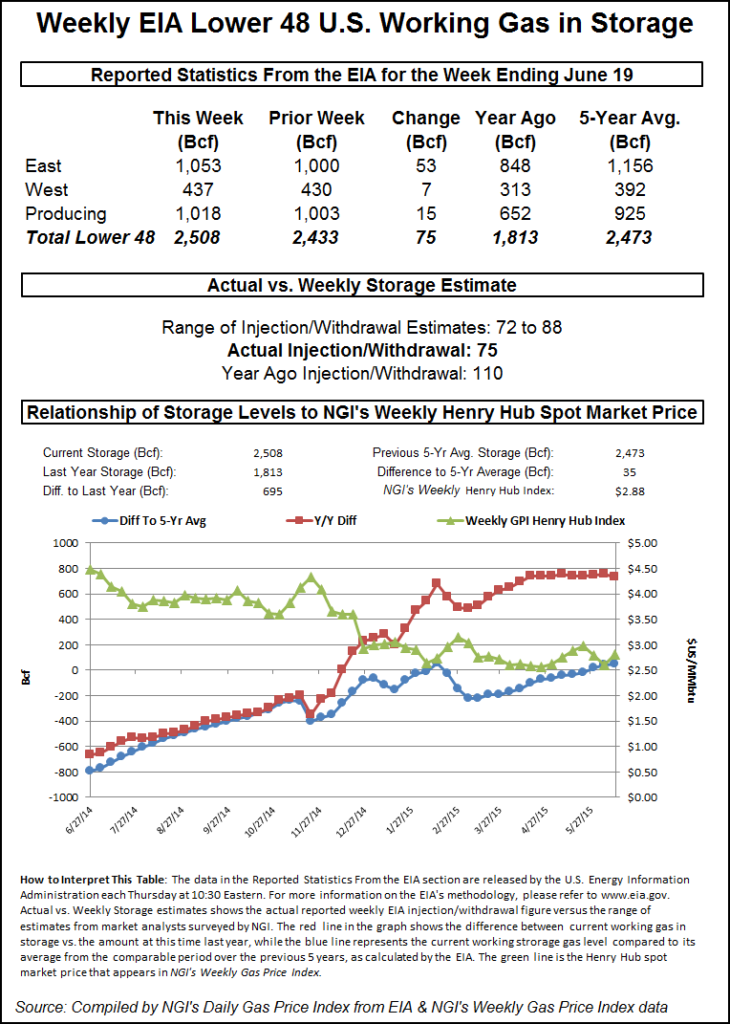

Ahead of the 10:30 a.m. EDT release of storage figures by EIA traders were expecting that some clarity might be shed on production, coal-to-gas switching, power loads, and surging exports to Mexico. If their estimates were correct, this week would be different from previous weeks. Last year 110 Bcf was injected, and the five-year pace stands at 87 Bcf. This week’s numbers were expected to be lower.

Analysts’ estimates were coming in well shy of the five-year average. IAF Advisors was looking for a 76 Bcf injection, and Citi Futures Perspective checked in with a stout 83 Bcf build. A Reuters survey of 25 traders and analysts revealed an average 77 Bcf with a range of 72 Bcf to 88 Bcf.

Once the number hit trading screens at 10:30 a.m. July futures rose to a high of $2.829 and by 10:45 a.m. July was trading at $2.784, up 2.5 cents from Wednesday’s settlement.

“Guys were looking for a 76 Bcf to 78 Bcf build, and prices burst higher but are now settling in,” said a New York floor trader once the report was released. He noted that Thursday was also options expiration and for those who had sold $2.75 July calls, they were now sporting a loss of 3.4 cents.

Tim Evans of Citi Futures Perspective said, “The 75 Bcf in net injections was below the median expectation and tends to reinforce the idea of a modest tightening in the background supply-demand balance. Anecdotally, maintenance work may be limiting supply while power sector demand is on the rise with the closure of some coal-fired power plants.”

Inventories now stand at 2,508 Bcf and are 695 Bcf greater than last year and 35 Bcf more than the five-year average. In the East Region 53 Bcf was injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 15 Bcf.

John Sodergreen, editor of the Energy Metro Desk weekly survey queried “Is production really dipping? Not even close. Recall that we’ve been burning a bit more gas lately due to coal plant shutdowns, and oh yes, last week was the warmest week of the year.”

If last week were the warmest of the year, this week looks to be even warmer, at least according to National Weather Service (NWS) cooling degree day (CDD) stats in key energy markets. NWS predicts greater cooling requirements from New England to the Midwest. For the week ended June 20 actual CDDs for New England were 10, or five below normal. The Mid-Atlantic endured 41 CDD, or 12 above its seasonal norm, and the greater Midwest saw 42 CDD, or six above normal.

For the week ended June 27 NWS sees a higher tally. New England comes in at 41, or 19 CDD above normal, and the Mid-Atlantic should see 49 CDD, or 12 above normal. The greater Midwest from Ohio to Wisconsin is forecast to bake under 63 CDD, or 21 above normal.

Short-term traders missed the boat market wise as they saw the market holding steady since options expired Thursday. “My guess is the market will linger around this $2.75 area with the options just below it,” said a New York floor trader. “Next week I look for a test to $2.65.”

He added that market expectations of a storage build of around 80 Bcf were built into the market, but the market has often been reacting in a counter-intuitive fashion. “The number comes out bearish and the market rallies a dime. It comes out bullish and we’re off 5 cents. It’s kind of strange.” Not today, though.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |