Infrastructure | NGI The Weekly Gas Market Report

Six NatGas Rigs Return to U.S.; Canada Adds Three

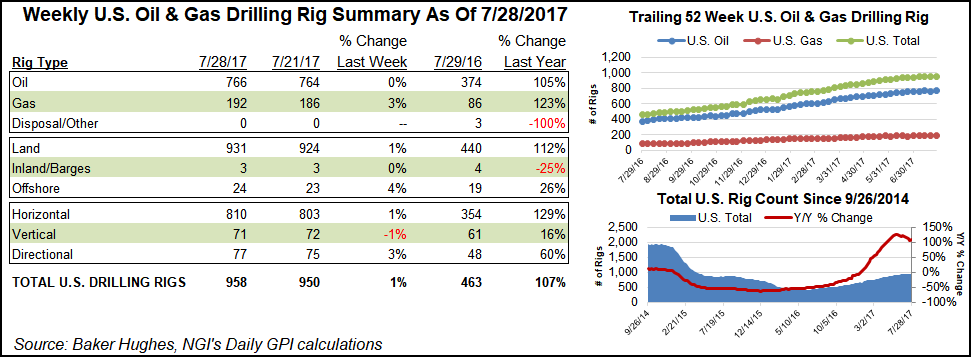

U.S. drillers bounced back with six natural gas-directed rigs returning during the week ended July 28, according to Baker Hughes Inc. (BHI). The United States added eight rigs total for the week, countering recent indications that North American drilling activity is plateauing overall.

The United States saw seven land rigs and one offshore rig return, according to BHI. The onshore gains more than offset the four land rigs that packed up the week before. The total U.S. rig count now stands at 958, up from 463 a year ago.

Meanwhile, Canada gained 14 rigs (11 oil-directed, three gas-directed) to end the week at 220, up from 119 rigs a year ago.

In total, North America gained 22 rigs for the week for a combined tally of 1,178, up from 582 in the year-ago period.

Among plays, the Permian Basin (in West Texas and parts of southeastern New Mexico) led the charge, adding five rigs to end at 379 (up from 172 a year ago). The Permian’s weekly gains appear concentrated in the New Mexico portion of the play, as the state added four rigs for the week while Texas finished down a rig overall, according to BHI.

Activity also increased in the Midcontinent, where Oklahoma’s Cana Woodford added four rigs to finish at 63 (up from 29 a year ago).

The rig gains by play reflect the uptick in gas-directed drilling. The Appalachian Basin’s Marcellus (46) and Utica (29) shales each added a rig for the week, and even the Barnett Shale in Texas got in on the act, adding a rig to end at 7, according to BHI. The Haynesville Shale held onto its recent gains to hold flat at 45 rigs, triple its year-ago tally of 15.

This week, natural gas futures got a jolt after the Energy Information Administration reported a miserly 17 Bcf inventory build, and analysts predict erosion of the year-on-five-year storage surplus to continue this summer.

Meanwhile, a number of major oilfield services companies have reported 2Q2017 earnings recently, describing a North American drilling landscape that has — despite this week’s gains — showed signs of slowing down overall. Halliburton Co. Chairman Dave Lesar told analysts that exploration and production companies have been “tapping the brakes.”

“Today, rig count growth is showing signs of plateauing, and customers are tapping the brakes,” he said. “This demonstrates that individual companies are making rational decisions in the best interests of their shareholders. This tapping of the brakes is happening all over the place in North America.”

Recent BHI rig count data has reflected this, according to Patrick Rau, NGI‘s director of Strategy & Research. Broken down into four-week periods, the recent pace of growth in the U.S. rig count represents a fraction of the gains seen in previous four-week periods, Rau noted.

“Don’t expect much in terms of rig additions in the third quarter either, unless commodity prices take off again,” Rau said. “Patterson-UTI noted it averaged 158 U.S. rigs in June, expects 159 for July and 160 for all of the third quarter.”

Rau also pointed to Helmerich & Payne‘s projections that it could potentially exit the third quarter at or below the 190 rigs running at the start of the quarter.

“Current spot market rates are in the low $20,000 per day range for leading-edge rigs, but both Patterson-UTI and Helmerich & Payne indicated day rates would need to move into the mid-$20,000s to justify new build activity. However, demand for super-spec rigs continues to grow, and both companies are actively upgrading lesser rigs to meet this demand,” Rau said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |