Six NatGas Rigs Return to U.S. Action

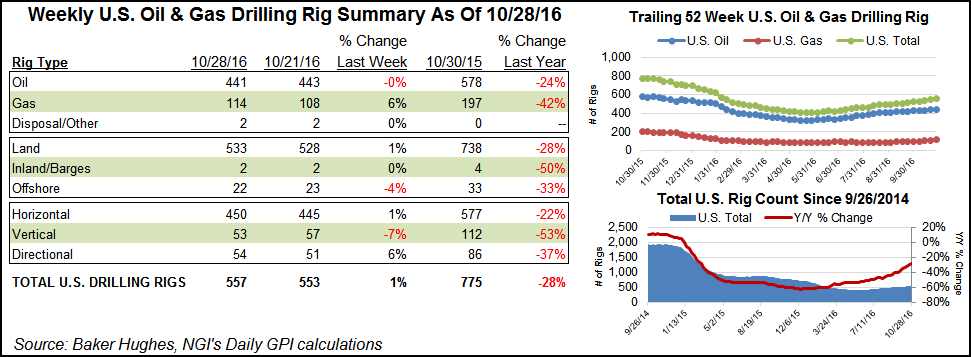

Overall, five U.S. land-based rigs were put back in play during the week ending Friday, bringing the tally to 533 running. One rig left the offshore, making for a net U.S. gain of four to rest at 557 running.

Two U.S. oil rigs left, but six natural gas rigs came back. The return of five horizontals and three directionals was offset by the departure of four vertical rigs.

Canada added five gas rigs, four oil and one “miscellaneous” unit to bring its overall tally to 153 running.

The Williston Basin led the pack of gaining U.S. plays with the addition of five rigs. That’s in North Dakota, which also saw its rig tally rise by five. Texas added two rigs, no thanks to the Permian Basin or Eagle Ford, both of which were flat with the previous week, as was the Barnett Shale. The Haynesville Shale added three rigs to end the week at 20 running, continuing a comeback theme for the legacy gas play.

Some operators in the Haynesville are enjoying lower breakeven costs, thanks to well productivity and cost efficiency improvements, according to BTU Analytics LLC, and that’s showing up in a slowly rising Haynesville rig count. One year ago, the Haynesville had 25 rigs running, and it’s slowly creeping back toward that number.

That’s a far cry from the Haynesville hey day in 2010 when more than 180 rigs were plying the play, according to BTU Analytics analyst Kathryn Downey Miller, who devoted a note to the Haynesville on Friday.

Higher proppant loads are one thing improving the Haynesville outlook, she said. But “even if 3,000 lbs of proppant per lateral foot doesn’t become the norm, lower breakeven costs for many of the basin’s largest operators in combination with a constructive outlook for the gas market over the next few years provides a meaningful opportunity that we expect select producers to jump on,” Miller wrote. “And faster drilling times along with average basin IP [initial production] rates 75% higher than 2012 mean that if rig additions seen in the past few weeks continue, it won’t be long before Haynesville Shale production is growing once again.”

Meanwhile, according to the Railroad Commission of Texas (RRC), Lone Star State production for August was 75.03 million bbl of crude oil and 606.93 Bcf of total gas from oil and gas wells. These preliminary figures are based on production volumes reported by operators and will be updated as late and corrected production reports are received. Production reported for the same period last year was 74.68 million bbl of crude oil on a preliminary basis, updated to a current figure of 90.45 million bbl; and 624.11 Bcf of total gas on a preliminary basis, updated to a current figure of 746.33 Bcf.

In the last 12 months, total Texas reported production was 1.004 billion bbl of crude oil and 8.2 Tcf of total gas. Crude oil production reported by the RRC is limited to oil produced from oil leases and does not include condensate.

Texas production in August came from 183,052 oil wells and 92,155 gas wells.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |