Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Sino-U.S. Trade War Widens, But Crude, LNG Not Included

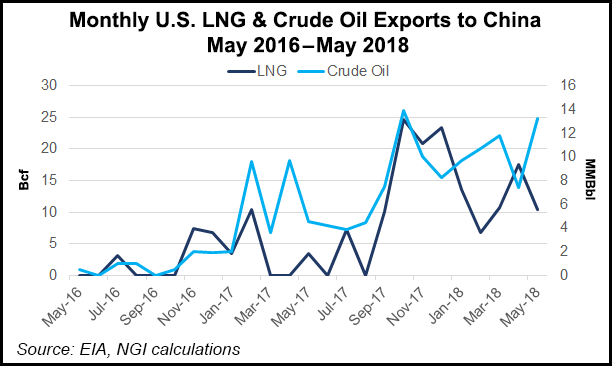

The Sino-U.S. trade war continued to widen this week as China was preparing to impose a 25% tariff on $16 billion worth of domestic imports but not on crude oil or liquefied natural gas (LNG). The announcement came one day after the Trump administration unveiled a similar tariff on a range of Chinese goods.

U.S. Trade Representative (USTR) Robert Lighthizer’s office on Tuesday released a list of 279 Chinese products that would be subject to a 25% tariff beginning on Aug. 23. USTR had originally proposed in June levying the tariff on 284 products, including “gas supply or production meters,” which could impact oil and gas producers. The meters were on the final list.

“The Trump administration continues to urge China to stop its unfair practices, open its market, and engage in true market competition,” Lighthizer said. “We have been very clear about the specific changes China should undertake. Regrettably, instead of changing its harmful behavior, China has illegally retaliated against U.S. workers, farmers, ranchers and businesses.”

Beijing retaliated the next day. “Overriding domestic law over international law is a very unreasonable practice,” China’s Commerce Ministry said in a translated statement. “In order to safeguard its legitimate rights and interests and the multilateral trading system, the Chinese side had to make the necessary counter-measures and decided to impose a 25% tariff [on $16 billion worth of U.S. imports] and implement it in parallel with the U.S.”

China’s list of 333 American-made goods subject to the retaliatory tariff includes a variety of energy products including liquefied petroleum gas, oil shale, propane, butane, diesel and fuel oils, but it excluded crude oil. Also noticeably absent was LNG, which appeared on a list the Commerce Ministry released last week in response to the Trump administration’s threat to slap a 25% tariff on $200 billion worth of Chinese goods.

In a note to clients Wednesday, analysts with ClearView Energy Partners LLC said China’s omission of crude may reflect issues with the country’s energy security.

“Simply put, crude may have been a bluff — and LNG could be, too — and energy scarcity may have led China to retreat from its threat posture,” ClearView said. “We would not rule out the prospect that China could be rationalizing its crude import policies to defend ongoing purchases of Iranian oil ahead of the Nov. 4 snap-back of U.S. sanctions.

“In short, China may be seeking to substantiate its argument that its energy security concerns demand imports of all crude — from the U.S. as well as Iran — despite the escalating U.S.-China trade conflict.”

Since May 1, the United States has imposed a 25% tariff on steel and a 10% tariff on aluminum imported from China. The trade war widened in mid-June after the White House enacted a 25% tariff on a host of other Chinese goods, including parts for offshore oil and natural gas drilling and production platforms. After Beijing vowed to retaliate in July against a 10% tariff on $200 billion worth of Chinese goods, the White House increased the tariff to 25% at the beginning of this month.

The trade dispute has also upended plans for Chinese state-owned companies to invest in billions in shale-related projects in West Virginia and the Alaska LNG Project.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |