Regulatory | Infrastructure | NGI All News Access

Sierra Club Targets More Federal Approvals for MVP in Quest to Stymie Project

The Sierra Club has put the U.S. Fish and Wildlife Service (FWS) on notice, imploring the agency to vacate key authorizations for the Mountain Valley Pipeline (MVP) that it claims are insufficient and could result in illegal impacts on certain species, raising the specter of yet another challenge against the embattled pipeline.

In a letter to the FWS, the Sierra Club said an extensive list of questions and a data request the agency recently sent to the Federal Energy Regulatory Commission, which is working to ensure MVP complies with the Endangered Species Act (ESA), is suspect. The Sierra Club also blasted the request by FWS, saying it makes clear that the agency’s 2017 biological opinion and incidental take statement (ITS) for MVP “are based on incomplete information and flawed analyses.”

The group also said the biological opinion and ITS must be vacated given the U.S. Court of Appeals for the Fourth Circuit’s decision last year to vacate the same authorizations for the similarly routed Atlantic Coast Pipeline (ACP). In that case, the Sierra Club and other environmental groups argued that the ITS failed to set clear limits for affected species.

The FWS later reissued ACP’s ITS, but the court stayed it pending another appeal from the Sierra Club. Work has been on hold since.

Under the ESA, an ITS is required for activities that could impact or result in the taking of threatened wildlife. Sierra Club raised concerns in its letter about MVP’s impacts on the Indiana bat and the Northern long-eared bat. The organization also wrote that FWS must further analyze MVP’s impacts on a species of mussel, the yellow lance, and the Roanoke logperch as well.

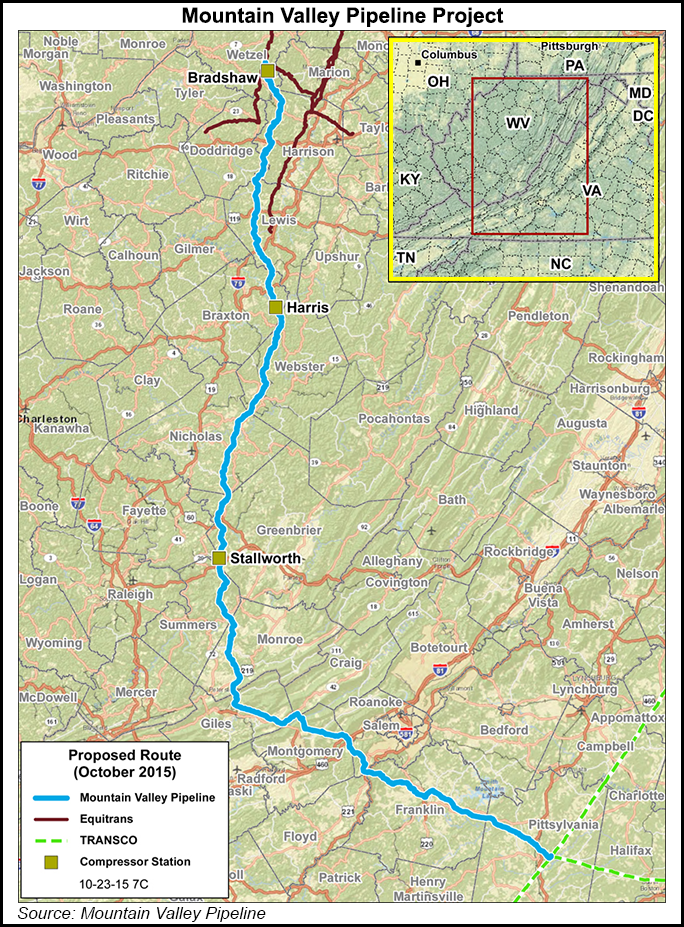

ACP has faced repeated delays and still has to work through other permit issues. The same is true for MVP, and work on the project has mostly stopped as a result. Equitrans Midstream Corp., MVP’s lead sponsor, recently cautioned that the pipeline isn’t likely to enter service by the end of the year as it had hoped, given all the regulatory challenges it faces.

MVP would move 2 Bcf/d of Appalachian natural gas to markets in the Southeast, while ACP would move 1.5 Bcf/d in the same direction.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |