Markets | NGI All News Access | NGI Data

Shorts Still Comfortable After Supportive Storage Report

Natural gas futures gained ground Thursday after the release of government storage figures showing inventory drawdowns to have been somewhat greater than what the market was expecting.

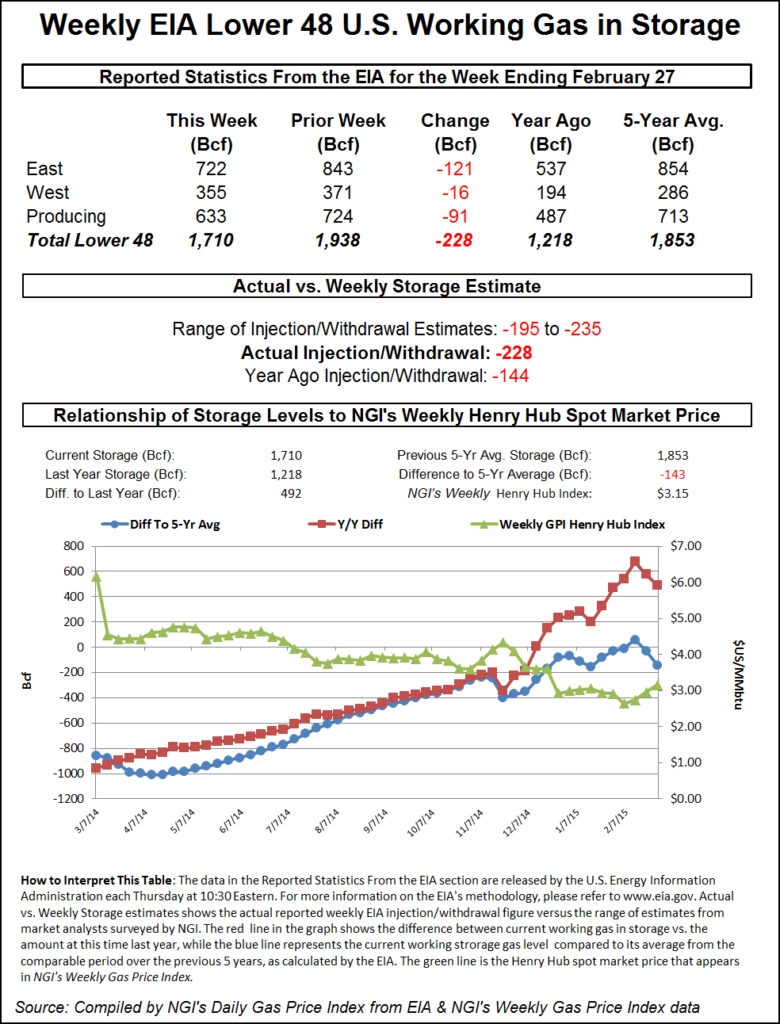

For the week ended Feb. 27, the Energy Information Administration (EIA) reported a decrease of 228 Bcf in its 10:30 a.m. EST release. April futures rose to a high of $2.813 after the number was released, and by 10:45 a.m. April was trading at $2.797, up 2.8 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease in the low 220 Bcf area. A Reuters survey of 23 traders and analysts showed an average 222 Bcf with a range of 195 Bcf to 235 Bcf. Analysts at IAF Advisors hit the nail on the head with an estimated 228 Bcf pull, and Bentek Energy’s flow model predicted a 224 Bcf withdrawal.

“Traders were looking for anywhere from 222 Bcf to 227 Bcf, and the market floated higher after the data was released,” said a New York floor trader. “It doesn’t feel like any bullishness. It gave a little incentive for short-term buying, but I don’t think there is any incentive do anything until you get to the $3 to $3.01 area. Shorts are comfortable here.”

Tim Evans of Citi Futures Perspective said, “The net withdrawal was more than last week’s 219 Bcf decline and far above the 115 Bcf five-year average for the date. Although price reaction has been muted so far, we consider this a constructive report.”

Inventories now stand at 1,710 Bcf and are 492 Bcf greater than last year and 143 Bcf below the five-year average. In the East Region 121 Bcf was withdrawn and the West Region saw inventories decrease by 16 Bcf. Stocks in the Producing Region declined by 91 Bcf.

The Producing Region salt cavern storage figure fell by 45 Bcf from the previous week to 136 Bcf, while the non-salt cavern figure dropped 46 Bcf to 496 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |