Markets | LNG | NGI All News Access

Shifts in Weather, LNG Outlooks Sap Momentum for Natural Gas Futures; Spot Prices Surge

An early rally Monday on expectations for increasing heat across much of the Lower 48, including temperatures in excess of 100 over swaths of the West Coast, fizzled in afternoon trading after a new mid-range weather outlook disappointed. The latest American model still showed near-term heat but cooler-than-previously-expected forecasts for early July that could reduce cooling degree days (CDD).

The July Nymex contract settled at $1.664 /MMBtu, down a half-cent day/day. August fell 1.0 cent to $1.738.

Bolstered by current heat waves, NGI’s Spot Gas National Avg. advanced 16.0 cents to $1.620.

Triple-digit temperatures are expected to cook much of California this week, with 90s permeating Oregon and Washington, according to the National Weather Service (NWS). Intense summer heat already settled in across much of the Southwest, Texas and the southern Plains. The NWS noted that high pressure is mounting in the western half of the country, enabling temperatures to climb and remain elevated, a development that is fueling power demand.

But NatGasWeather pointed to a cooler midday run of the Global Forecast System (GFS) to explain the afternoon reversal in gas prices. The July contract was trading several cents higher earlier in the day.

“The latest data is trending cooler, losing a rather hefty 13 CDDs compared to its run prior to the market reopen,” NatGasWeather said. “The GFS still forecasts a rather hot pattern June 28-July 4, just not as impressive this round due to weather systems finding flaws in the upper ridge, especially over the Northeast.” The onus is on hot patterns always proving it, “so any lost demand could disappoint” markets.

A bump in demand for liquefied natural gas (LNG) injected a second dose of bullish sentiment to start the trading day but concerns about a sustainable U.S. export recovery remain entrenched.

Genscape Inc. estimated that, for the evening cycle for Monday’s gas, LNG feed gas demand rebounded day/day by 550 MMcf/d, bolstered by strong demand from Sabine Pass facilities.

“Since June 15, feed gas demand from interstate pipelines has averaged 3.61 Bcf/d — nearly 600 MMcf/d less than today’s current value of 4.21 Bcf/d,” Genscape said.

But LNG volumes remain weak compared to pre-pandemic levels due to European and Asian demand for U.S. exports proving stubbornly light amid slow economic recoveries from coronavirus-caused recessions. Bespoke Weather Services on Monday noted “rumors of more hefty LNG cargo cancellations down the road” and said this also factored into the lost momentum in afternoon trading.

Cheniere Energy Inc. customers are expected to cancel up to 23 cargoes in August, Bloomberg reported Monday. Shipbroker Poten & Partners previously predicted that 130 U.S. cargoes could be cancelled between May and October.

Genscape noted that structural declines in gas production during the ongoing pandemic could further align supply/demand over coming months, with average forecasted production throughout this injection season declining 2.6 Bcf/d year/year. Meanwhile, the latest U.S. Energy Information Administration (EIA) storage report showed an injection of 93 Bcf for the week ending June 12, which increased inventories to 2,807 Bcf, above the five-year average of 2,386 Bcf.

“Even in the presence of elevated storage relative to the prior five-year average, these production declines have created significant implications for this upcoming withdrawal season,” Genscape said, adding that its most recent forecast shows production for this winter averaging “nearly 6.5 Bcf/d lower than last, resulting in significant supply/demand imbalances that will result in increased withdrawals from storage. As a result, winter prices have found increased support.”

The firm, however, cautioned that its supply/demand outlook could change substantially if producers ramp up output in the second half of 2020, noting an anticipation of shut-in associated gas coming back online this summer should more oil drillers start lifting crude output in response to increased domestic gasoline demand – and recovering oil prices — as states allow businesses to reopen and travel rebounds.

Raymond James & Associates Inc. analysts said in a report Monday that, of the 4.28 billion people who had been under a government-ordered lockdown to slow the spread of the virus in the spring, more than 99% are now in some stage of economic reopening, with the majority fully reopened.

But the pace of economic activity accompanying the reopening remains difficult to gauge, analysts said, in large part because the virus continues to spread rapidly. California, for example, reported more than 4,500 new cases on Sunday alone, its highest daily increase since March. Several other heavily populated states, from Florida to Texas, are also reporting high levels of new cases, trends that could discourage activity and have a dampening effect on commercial and industrial power demand.

“While an estimated 5.2 Bcf/d of lost demand has recovered since the domestic demand destruction peak in mid-April, it is possible that the ‘quick’ portion of the recovery may have already occurred and the ‘slow’ portion lies ahead,” EBW said. “Estimates of lower industrial demand alone comprise half of the demand loss and may remain offline for 12-18 months or longer. Further, rising infections in populous states — including Texas, Florida, and California — may lead to extended atypical behavior and a slower recovery.”

Spot Prices Pop

Spot gas prices rose across the country Monday, boosted by the near-term heat.

For the coming week, Maxar’s Weather Desk observed hotter patterns for the East and Midwest, including above-normal temperatures in the Upper Midwest near the end of June. These patterns are in addition to strong heat in the West and expectations for continued lofty but near-normal temperatures in Texas.

On average, cash price advances were the greatest in California, the Southwest, Appalachia, the Northeast and the Rocky Mountains.

In the West, SoCal Citygate surged 54.0 cents day/day to average $2.120, and Kern Delivery spiked 32.5 cents to $1.830.

Elsewhere, Algonquin Citygate jumped 24.5 cents to $1.840, while Dominion North gained 14.0 cents to $1.495. El Paso Permian advanced 17.5 cents to $1.470, and Opal climbed 19.0 cents to $1.590.

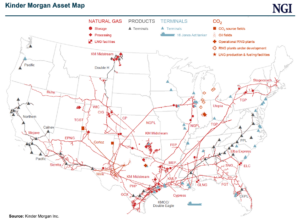

In pipeline news, Egan Hub Storage announced a June 30 completion target for maintenance work that impacts Kinder Morgan MR 45122. During the outage, Egan said it could not accept withdrawals for delivery to Kinder Morgan.

Additionally, Columbia Gas Transmission said it would perform planned pigging maintenance on Line SM-80 Loop in West Virginia. This could limit up to 351 MMcf/d of gas flowing onto Columbia Gulf Transmission on gas days Tuesday and Thursday, but Genscape expects little impact.

“We have seen deliveries at levels below the restricted capacity level over the past week and a half, so cuts to scheduled quantities may not actualize,” the firm said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |