NGI Archives | NGI All News Access

Shale Gas, Oil ‘Globally Abundant,’ EIA Says

Estimated global shale gas and shale oil resources represent 32% of the world’s natural gas and 10% of the world’s crude oil technically recoverable resources, according to an assessment released Monday by the U.S. Energy Information Administration (EIA).

The 7,299 Tcf of technically recoverable shale gas calculated by EIA is a 10% increase over its previous estimate made in 2011 (see Shale Daily, April 7, 2011). The assessment also indicated 345 billion bbl of technically recoverable world shale oil resources. EIA’s 2011 report did not include estimates for shale oil. Technically recoverable resources are those that can be produced using current technology without reference to economic profitability.

“Although the shale resource estimates presented in this report will likely change over time as additional information becomes available, it is evident that shale resources that were until recently not included in technically recoverable resources constitute a substantial share of overall global technically recoverable oil and natural gas resources,” the agency said in the 730-page report.

“The shale oil resources assessed in this report, combined with EIA’s prior estimate of U.S. tight oil resources that are predominantly in shales, add approximately 11% to the 3,012 billion bbl of proved and unproved technically recoverable nonshale oil resources identified in recent assessments. The shale gas resources assessed in this report, combined with EIA’s prior estimate of U.S. shale gas resources, add approximately 47% to the 15,583 Tcf of proved and unproven nonshale technically recoverable natural gas resources.”

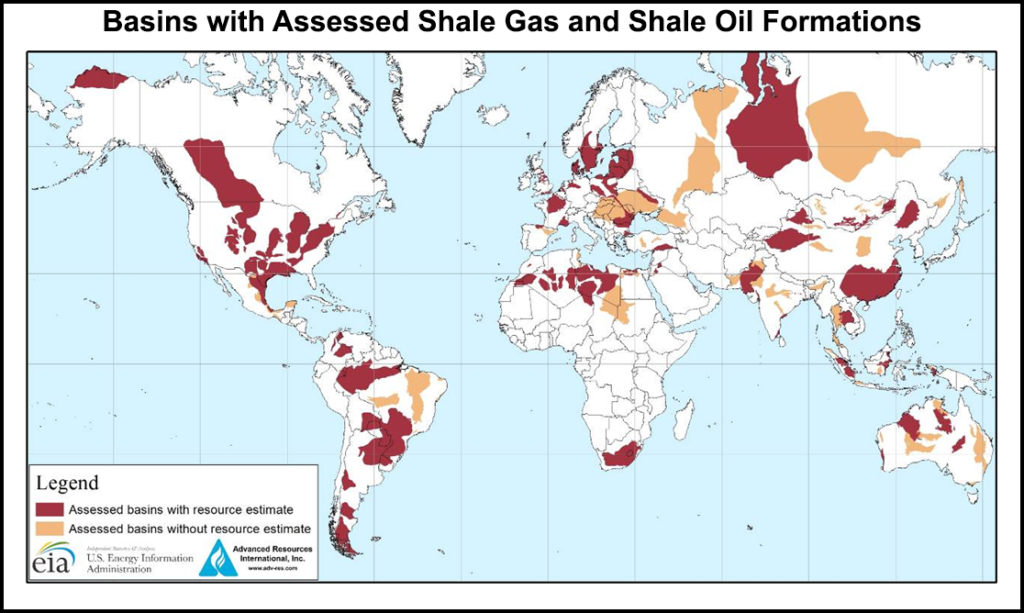

The assessment estimated shale gas and shale oil resources in the United States and in 137 shale formations in 41 other countries. In 2011 EIA assessed 48 shale basins in 32 foreign countries. According to EIA, more than half of the non-U.S. shale gas resources are concentrated in five countries — China, Argentina, Algeria, Canada, and Mexico — and more than half of the identified shale oil resources outside the United States are concentrated in four countries — Russia, China, Argentina and Libya. The United States ranks fourth after Algeria for shale gas resources and second after Russia for shale oil resources.

While the report considered more shale formations than were assessed in the 2011 version, it still did not assess many prospective shale formations, such as those underlying the large oilfields in the Middle East and the Caspian region, EIA said. Currently, only the United States and Canada are producing shale gas and shale oil in commercial quantities.

“As shale oil and shale gas production has grown in the United States to become 30% of oil and 40% of natural gas total production, interest in the oil and natural gas resource potential of shale formations outside the United States has grown,” said EIA Administrator Adam Sieminski. The latest “report indicates a significant potential for international shale oil and shale gas, though the extent to which technically recoverable shale resources will prove to be economically recoverable is not yet clear.”

The research found risked technically recoverable shale gas resources on six continents:

Shale oil and shale gas resource estimates “are highly uncertain and will remain so until the shale basins are extensively tested with production wells,” EIA said.

“Several nations have begun to evaluate and test the production potential of shale formations located in their countries. Poland, for example, has leased prospective shale acreage and drilled 43 test wells as of April 2013. Argentina, Australia, China, England, Mexico, Russia, Saudi Arabia and Turkey have begun exploration or expressed interest in their shale formations,” according to EIA.

Worldwide production of shale oil has the potential to reach 14 million b/d by 2035, about 12% of the world’s total oil supply, prompting a 25-40% decline in oil prices, according to a report issued recently by PwC (see Shale Daily, Feb. 15).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |