‘Several Hurdles’ Ahead For U.S. Natural Gas Firms in Mexico

Although much remains unclear about the energy policies of Mexico’s next government, “several hurdles will likely appear for U.S. based natural gas entities” looking to expand their footprint in the neighboring country, according to a new report.

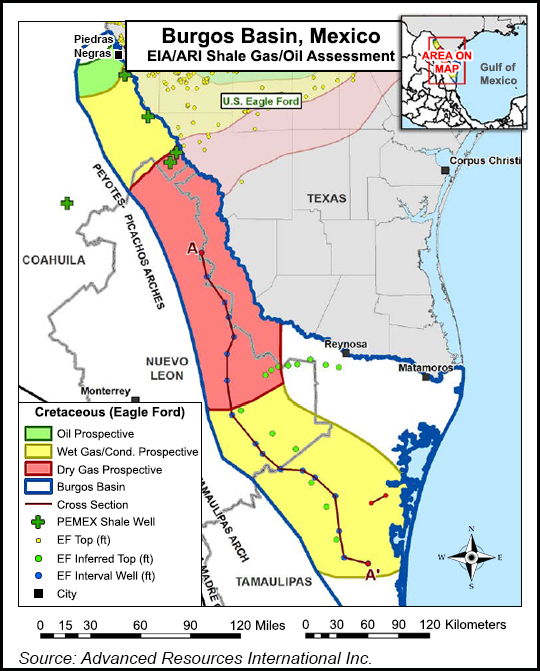

In the upstream segment, a recent pledge to ban fracking by Mexico’s next president, Andrés Manuel López Obrador (AMLO) of the leftist Morena party, has cast doubt over plans to develop the shale-rich Burgos basin in Northeast Mexico, Morningstar Research analyst Matthew Hong said in a note published Wednesday.

“Further development of this basin requires considerable investment with the U.S. an obvious source of money and know-how,” wrote Hong, who is Morningstar’s director of research for power and gas. “However, despite the opportunity, López Obrador has already vowed to end fracking in a news conference at the end of July, leaving Mexico reliant on conventional gas plays to boost production.”

Underinvestment by heavily-indebted national oil company Petróleos Mexicanos (Pemex) has caused production of oil and associated gas from conventional reservoirs to plummet over the last decade.

The 2013 reform was meant to reverse this trend through a series of bid rounds for operating stakes in both new licenses and existing acreage currently operated by Pemex. However, López Obrador and his energy advisors have said they will instead seek to boost crude output to 2.5 million b/d from the current 1.9 million b/d by increasing Pemex’s exploration and production budget, a change in tack that has been met with skepticism by analysts and credit rating agencies.

Two onshore bid rounds, one for conventional acreage and the other for shale, along with a farmout tender for stakes in Pemex licenses, have been postponed to February 2019 from September 2018.

“My sense is that [bid rounds] will be stopped for quite some time,” Eurasia Group’s Carlos Petersen, Latin America country risk expert, told NGI’s Mexico Gas Price Index recently.

“Even from the moderate advisors of López Obrador, I’ve heard that they are fine with Pemex collaborating with the private sector for deepwater projects, but they see that Pemex has the capacity to continue developing the shallow water and onshore reserves.”

However, Petersen said, given Pemex’s financial constraints, “I don’t know where the investment will come from.”

Midstream Outlook Unclear

While natural gas imports from the US appear likely to continue ramping up irrespective of López Obrador’s policies, the question of what percentage will come from liquified natural gas (LNG) versus pipelines remains open.

Hong highlighted that imports to Mexico via pipeline have grown to 4.8 Bcf/d from 3.3 Bcf/d in September 2015 amid a massive post-reform buildout of Mexico’s domestic pipeline network, and that Mexico was also the largest purchaser of US LNG exports in 2017.

US-sourced LNG shipments to Mexico are likely to keep growing, Hong said, especially if delays continue to plague pipeline projects in Mexico.

“For example,” Hong said, “several of TransCanada’s Mexico projects resulted in later in-service dates than originally projected. As operational constraints are resolved on the Mexican distribution system, LNG imports from the U.S. will likely be replaced by cross-border pipeline imports, but this is likely to take several years.”

Hong continued, “At the moment, Mexico receives around 13% of its natural gas imports from LNG, and any expansion in U.S. export capacity could further deepen the relationship between the two countries over the short term.”

During the presidential campaign, and in the days since the election, energy policy discussions have centered around the future of bid rounds, López Obrador’s negative view of the energy reform, and his plans to invest heavily in refining capacity in order to ensure fuel self-sufficiency for Mexico.

Comments from López Obrador’s transition team on the recently liberalized natural gas market, and on the backlog of associated pipeline projects, have been conspicuously absent from the debate.

“Although significant development is still needed through much of the country, recent reforms in the gas sector have centered around providing open access to pipelines through auctions and the creation of a market-based domestic natural gas index,” the Morningstar note said. “Nevertheless, López Obrador’s preference for a strong state presence in the energy sector may mean delays in the liberalization seen over the past four years.”

The report added that López Obrador’s stated goal to increase hydroelectric generation in the power sector could reduce natural gas demand, “although the impact on imports remains unclear.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |