Markets | LNG | NGI All News Access

September Natural Gas Futures Slump After Storage Report, Cooler Weather Forecasts

September natural gas futures sunk on Thursday after a higher-than-expected storage build and forecasts for moderating heat amplified demand and containment concerns as fall approaches.

In its first trading day on the books as the prompt month, the September Nymex contract shed 10.1 cents day/day and settled at $1.829/MMBtu. October fell 8.8 cents to $1.991.

NGI’s Spot Gas National Avg. declined 6.0 cents to $1.730.

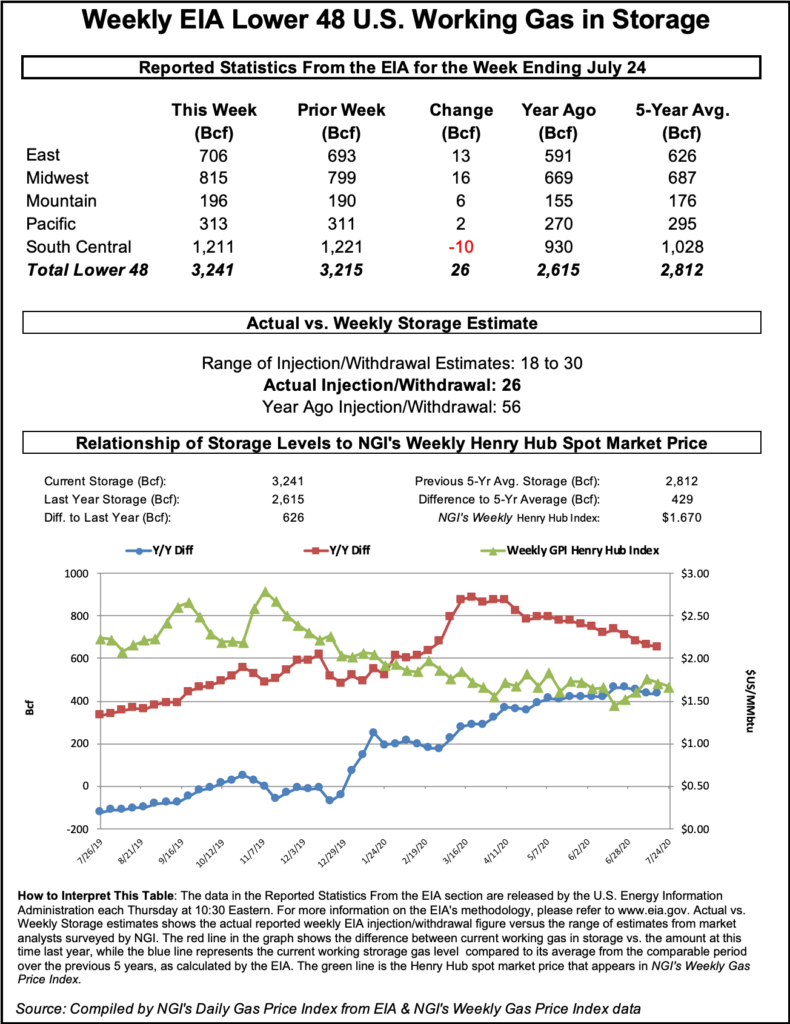

The U.S. Energy Information Administration (EIA) reported an injection of 26 Bcf into storage for the week ending July 24, a print that came in higher than the average of major polls. A Bloomberg survey showed a median prediction of 23 Bcf, while a Wall Street Journal poll found an average of 25 Bcf. NGI predicted a build of 24 Bcf.

Summer heat and robust cooling demand have helped address imbalances imposed by the coronavirus and the economic recession that the pandemic has caused. The latest injection marked the fifth-consecutive week of sub-100 Bcf builds. EIA reported an injection of 37 Bcf for the week ending July 17 and a build of 45 Bcf for the week prior to that.

Improvement, however, has proven weather-reliant, with key demand drivers beyond summer heat remaining weak relative to pre-pandemic levels. Liquefied natural gas (LNG) exports are well below year-earlier levels, and new outbreaks of the virus call into question the timing of a comeback. The pandemic stalled economic activity in important U.S. LNG export destinations across Asia and Europe and, by extension, demand for imported gas.

Increased spread of the coronavirus in recent weeks has raised concerns about a second economic slump domestically and abroad — after signs of recovery in May and into June — because new rounds of business restrictions may be necessary to slow spread of the virus. Business closures would hamper commercial and industrial energy demand.

The storage report coincided with the federal government’s read on second quarter U.S. gross domestic product (GDP). The Commerce Department said the economy contracted at a record rate last quarter, with GDP falling at a 32.9% annual rate. Additionally, weekly jobless claims increased for a second consecutive week, the government said Thursday, indicating that economic recovery in the current quarter is on fragile ground as the virus persists.

Criterion Research LLC’s James Bevan said on The Desk’s online energy platform Enelyst that Lower 48 gas production has held steady at 86.6-86.7 Bcf/d this week, suggesting that production levels may remain modest.

“The prevailing theory across the upstream sector is that most oil-focused companies are pulling back on spending and switching to maintenance capital plans” for the second half of 2020, “which will result in a gradual decline in production across oily basins in the South Central and Rockies. The decline is already materializing in the South Central, with volumes trending downwards for much of July.”

However, against the economic backdrop, the onus is on prolonged and intense summer heat driving air conditioner use through August to further align supply/demand imbalances and ward off containment challenges in the fall.

The build for the July 24 week lifted inventories to 3,241 Bcf. That exceeded the year-earlier level of 2,615 Bcf and the five-year average of 2,812 Bcf.

Forecasts looking into next month, however, have trended cooler.

NatGasWeather said the overnight data extended cooler trends, with both the Global Forecast System and European models shedding expected cooling degree days (CDD).

“Both show stronger weather systems and cool shots into the northern and east-central U.S. next week,” the forecaster said. “In fact, cooler trends for next week have now dropped national daily CDD below normal, losing more than 30 Bcf in demand since late last week. Clearly, weather trends have been increasingly bearish.”

Lighter cooling demand could result “in a larger-than-normal build” for the EIA storage report next week, NatGasWeather said. That would put supplies “on path for reaching 4 Tcf by the end of the refill season.”

Cash Drops

Spot prices fell across much of the Lower 48 on Thursday amid forecasts for cooler temperatures.

Substantial decliners included El Paso Permian, down 33.0 cents day/day to average $1.100, and Waha, off 21.5 cents to $1.100.

Energy Transfer LP said late Wednesday a fire erupted at the massive Mont Belvieu natural gas liquids (NGL) complex east of Houston, damaging the company’s Lone Star NGL facility after a contractor struck an underground pipeline. The company said the fire was contained and there were no injuries. However, the blast was expected to push back on Permian supplies.

Texas Eastern M-3, Delivery was off 31.5 cents to $1.545.

In the Northeast, Algonquin Citygate was down 21.0 cents to $1.525, and Tenn Zone 6 200L dropped 45.5 cents to $1.705. Prices have been volatile in the region with lofty temperatures early in the week and an expected shift by next week.

While heat is projected to remain intense over much of the western and southern sections of the United States, moderate temperatures are settling in across the Midwest, and these conditions are expected to push into the Northeast in coming days, bringing moderate highs in the 80s.

At the same time, a severe storm season in the Atlantic is underway.

Traders on Thursday were tracking Tropical Storm Isaias — the ninth named storm of 2020 — which is projected to approach Florida by the weekend, according to the National Hurricane Center. The storm “is expected to bring cooler temperatures to the Southeast region over the coming week,” Genscape Inc. said, pushing CDDs over the 14-day outlook well below normal.

Deeper into August, more widespread heat is anticipated.

“We do still envision above normal heat toward the middle of August, but nothing extreme, as the focus of above normal temperatures looks to be more north versus south,” Bespoke Weather Services said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |