September Bidweek Sees Firm California, Basis Flip-Flops

NGI‘s National Spot Gas Average for September bidweek advanced a seemingly nominal 4 cents to $3.49 from the previous month, but even though the Midwest got the lion’s share of market focus during August as it endured a brutal heat wave, California for the most part scored the nation’s highest bidweek price, with the PG&E Citygate coming in at $3.88, up 12 cents.

At the low end of the scale, maintenance-riddled and capacity-constrained points in the Marcellus Shale in the Northeast were held close to or under $2.00. Tennessee Zone 4 Marcellus was down a penny at $1.96, and Transco-Leidy Line slipped 2 cents to $2.01. Traditional basis relationships into major market centers turned negative.

Regionally, the Rocky Mountains and Midcontinent were the softest. The Rockies fell 6 cents to $3.31, while the Midcontinent slipped 4 cents to $3.41.

California advanced 3 cents to $3.65 and the Northeast gained 4 cents to $3.26. East Texas and the Midwest both posted gains, with East Texas up 4 cents to $3.47, and the Midwest adding 8 cents to $3.78. South Texas rose 10 cents to $3.51, and South Louisiana rose by 10 cents to $3.52.

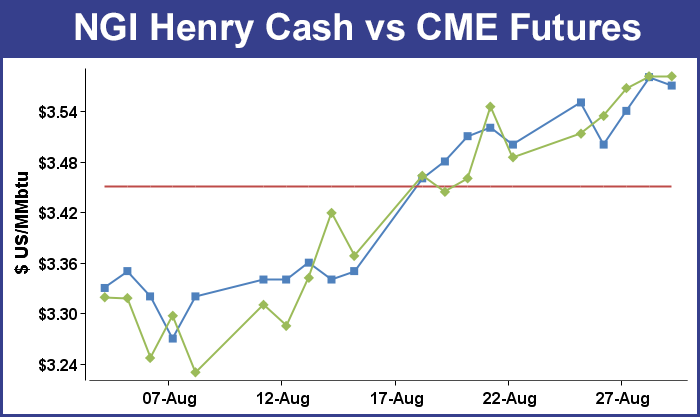

September 2013 bidweek’s $3.49 national average came in slightly above August bidweek’s $3.45, but it topped September 2012 bidweek’s $2.61 average by 88 cents.

The September futures contract expired last Wednesday at $3.567, up 10.8 cents from August’s expiration at $3.459. For the five trading days ending Aug. 30, October futures climbed by 2.8 cents to $3.581.

With the exception of a few lightly traded Northeast points and Dawn in the Midwest, PG&E bidweek at $3.88 registered September’s highest price.

A Calgary-based analyst said the PG&E gain resulted from a combination of factors. “It’s a confluence of events with what is going on in Alberta.” The Foothills pipeline, which brings gas from Alberta to Malin, has been undergoing work because of recent flooding. “It has caused TransCanada to conduct investigative work,” which “reduced its capability and has reduced the amount of gas that can flow to PG&E.

“That coupled with the [lean] hydro situation this year has caused the gas plants in the Pacific Northwest to burn maximum levels of gas to balance the power grid. They can’t get any more gas through Northwest to hit Malin, so it’s put everything in a semi tight situation,” he said.

Basis levels at major market centers unraveled as less costly Marcellus gas found its way to eastern markets. The Henry Hub came in at $3.57, up 12 cents but the gain implies “negative” transportation to traditional market points such as Transco Zone 6 New York, $3.50, down 13 cents, and Tetco M-3, $3.38, up 5 cents. More difficult to reach Chicago Citygates were seen up a cent at $3.63.

Great Lakes marketers reported concern about supply availability and they anticipated stronger pricing on September nominations. “We are going in a little heavier on September baseload volumes. There are some things currently happening [on Panhandle] and you just don’t know if it can get worse,” a Michigan buyer said Tuesday.

“Even if we put in an order, it doesn’t necessarily mean it is going to happen. We had to buy gas today since the weather is hot through the end of the month. On Consumers, we paid more than we did last Friday, $3.83, $3.87 and $3.77 on Michcon.”

Midwest buyers facing the challenge of whether to increase baseload September volumes elected to go with what they knew rather than extrapolate recent weather-driven loads into September. A utility buyer reported a sharp increase in gas usage that was driven by the recent heat wave baking the Upper Midwest. “Our power customers have been taking almost as much as the City of Omaha and they have been taking about 25,000 Dth/d. Total we are at about 55,000 Dth,” the buyer said.

“The heat looks like it will hold through Saturday. We’ve had quite the heat wave. It came in and looks like it will [remain] for about 10 days.” The buyer said the utility doesn’t think increased power generation volumes would impact its September baseload volumes because management “gave us an amount they said they would use and we get our baseload in line including them. It’s only hot for the first couple of weeks in September and then it starts moving into fall weather.”

At the end of the week the main price driver, weather, had become somewhat benign, with analysts looking for signs of a tropical system that might inject come bullish fervor into the market.

“The temperature factor looks neutral/slightly bearish from our perspective with generally cool temps covering the northeast region of the nation within the eight-14 day forecast window,” said Ritterbusch and Associates’ Jim Ritterbusch. Last Thursday’s “price action reinforced our expectations for some more near-term price chop as the market appears poised to price in some occasional storm activity that will likely be gaining traction with the arrival of September. Consequently, we are maintaining a neutral view for now as we continue to look for a spot and a time to establish a short position in anticipation of a price decline of as much as 30-35 cents from [Thursday’s] close.”

Analysts at Tudor, Pickering, Holt & Co. urged clients to keep everything in perspective. “Assuming normal injections through October, storage should start winter [at] 3.8 Tcf. However, if the more bullish supply and demand balance persists (1 Bcf/d undersupplied), storage could start winter closer to 3.7 Tcf,” they said in a note Friday.

“Moreover, with the recent improvement in the supply and demand balance with gas at/below $3.50/Mcf, gas provides more confidence in our $3.50-4.50/Mcf gas price band over the near/medium term; $3.50/Mcf gas ain’t great, but it is better than 2012 pricing.”

The to-date uneventful 2013 Atlantic hurricane season continues to sputter. While the number of systems has been increasing over the last few weeks, the probability has remained low for strengthening so far. In a report on Monday, the National Hurricane Center (NHC) said it was tracking three systems: one over the Western Yucatan Peninsula, one near the Dominican Republic and one near the West Coast of Africa. The NHC gave the first two systems a 20% chance of strengthening into a tropical cyclone, while the third system only had a 10% chance of reaching that level.

On the storage front, the Energy Information Administration (EIA) reported last Thursday that 67 Bcf was injected into storage for the week ending Aug. 23, which was above trader forecasts. Inventories currently stand at 3,130 Bcf, and injections for the nine weeks remaining to the traditional Oct. 31 end of the season need to average 72 Bcf weekly to attain the five-year average ending inventory of 3,776 Bcf, and 89 Bcf weekly to reach the 2012 record ending inventory of 3,930 Bcf. A recent EIA report projected that working gas levels in storage would finish October at 3,800 Bcf, which would mark the lowest end-of-October total since 2010.

Looking ahead at prices, Robust production out of the Marcellus Shale is weighing on prices, causing Bank of America (BofA) analysts to doubt the staying power of their fourth quarter and 2014 price forecasts and prompting Bernstein Research to cut its 2013 forecast by 25 cents. Fitch Ratings also is calling for range-bound gas prices for the “next few years.”

“The Marcellus is a monster and production keeps growing,” BofA said in a note last week. “North America simply remains awash with dry natural gas…Low Henry Hub gas prices have reignited coal-to-gas switching. But given strong storage injections, mild demand and, most importantly, continued growth in U.S. dry natgas production, we see downside risk to our 4Q and 2014 price forecasts of $4.30/MMBtu and $4.20/MMBtu.”

Bernstein analysts took note of Henry Hub prices averaging about $3.70/Mcf year to date and their expectation that prices would not average $4.40/Mcf-plus for the rest of the year. They cut their Henry 2013 forecast to $3.75/Mcf from $4.00/Mcf.

“We maintain our forecasts for $4.00/Mcf gas price in 2014 and 2015, but continued strong results in the Marcellus (downspacing for Range Resources Corp., well performance by Cabot Oil & Gas Corp.) suggests to us that resource estimates out of the Marcellus may continue increasing…” Bernstein said.

Bernstein analysts added that expected environmental regulations affecting dirty power plants and exports of liquefied natural gas will “provide some price tailwinds” in 2015 and beyond.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 |