Markets | NGI All News Access | NGI The Weekly Gas Market Report

Second NatGas Market Revolution Underway As Export Market Explodes, Says IEA

A more flexible global natural gas market, linked by trade doubling in exports, will lead to a second “revolution” for the industry to 2040, the International Energy Agency said in its flagship annual publication.

The World Energy Outlook for 2016 (WEO-2016) is foreseeing a “truly global gas market is coming into view.” A 1.5% annual rate of growth in gas demand worldwide is expected to 2040, which is “healthy,” compared with other fossil fuels. However, markets, business models and pricing arrangements “are all in flux,” as the liquefied natural gas (LNG) trade expands the role for gas in the global mix.

The era of fossil fuels is “far from over,” but government policies and cost reductions across the energy sector should enable renewables to double while energy efficiencies grow. Natural gas use should continue to expand, while the shares of coal and oil fall back.

“We see clear winners for the next 25 years — natural gas but especially wind and solar — replacing the champion of the previous 25 years, coal,” said IEA Executive Director Fatih Birol. “But there is no single story about the future of global energy: in practice, government policies will determine where we go from here.”

The transformation of the global energy mix described in WEO-2016 means that risks to energy security also are evolving, as gas and renewables share of the market grows — a forecast for gas that is similar to IEA’s in 2015.

“Traditional concerns related to oil and gas supply remain — and are reinforced by record falls in investment levels. The report shows that another year of lower upstream oil investment in 2017 would create a significant risk of a shortfall in new conventional supply within a few years.”

According to WEO-2016, U.S. gas output reaches more than 950 bcm in 2040, 30%-plus higher than in 2014. The U.S. gas production forecast by 2040 is nearly 100 bcm higher than last year’s prediction, based on a higher estimated shale gas resource to 22 trillion cubic meters (tcm).

Domestic Shale Gas Output Tapering Off After 2030

“Shale gas production continues to increase rapidly over the coming years but then tapers off at some 660-670 bcm after 2030,” IEA forecasters said. “The long-term plateau in shale gas production is largely compensated by increasing production of tight gas, resulting in continued growth of the country’s unconventional gas production throughout the projection period.”

Conventional gas production in the United States should decline through the mid-2020s but then stabilize to 90-100 bcm to 2040, according to the forecast.

Strong growth in unconventional gas production is going to affect U.S. trade in two ways, according to IEA.

“First, it underpins a rapid ramp-up in U.S. exports of LNG over the medium term, the conditions for which (in terms of infrastructure investments) were established over the last few years. Second, the ample availability of relatively cheap U.S. natural gas dampens the prospects of investment into shale gas production in Canada and Mexico, with the result that production growth in the two countries picks up only in the latter half of the projection period.”

Low gas prices in the past few years have spurred cross-border pipeline development to Mexico, enabling growing pipeline exports over the medium term. And in Canada, the U.S. shale gas boom implies a “continued decline” in exports to the Lower 48.

“The combination of these factors leads to the much anticipated switch in the net trade position of the United States, within the medium term, from a net importer of gas to a net exporter, with major implications for international gas trade,” forecasters said.

IEA is predicting U.S. net LNG exports will reach 70 bcm in the mid-2020s and then increase further to 110 bcm in 2040. Increased LNG shipments will change how gas security is perceived, according to IEA. At the same time, the variable nature of renewables in power generation, particularly wind and solar, leads to a new focus on electricity security.

‘Footloose’ U.S. LNG Cargoes to Catalyze Global Market Shift

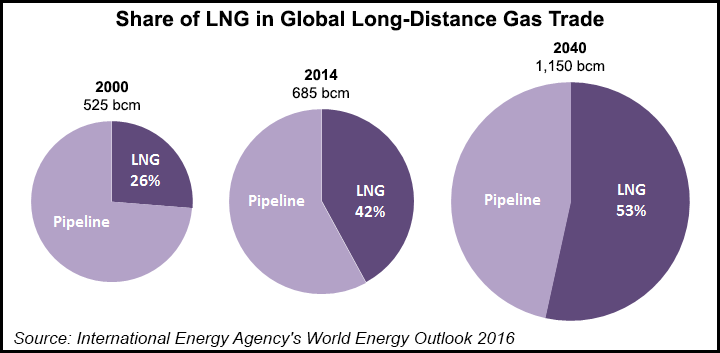

Implications for gas growth are enormous, with the share of LNG overtaking pipelines and growing to more than half of the global long-distance gas trade, up from a quarter in 2000. In its annual forecast issued earlier this year, BP plc also said LNG would dominate global trade by 2035.

“In an already well-supplied market, new LNG from Australia, the United States and elsewhere triggers a shift to more competitive markets and changes in contractual terms and pricing,” WEO-2016 said. “Gas consumption increases everywhere” through the forecast period, except in Japan as it falls back on nuclear energy. China, where gas consumption is set to grow by more than 400 billion cubic meters (bcm), and the Middle East are seen as the largest sources of gas growth.

“But questions abound about how quickly a market currently awash with gas can rebalance,” particularly with another 130 bcm (4.59 Tcf) of liquefaction capacity under construction, primarily in the United States and Australia.

“New projects in North America, Australia, Africa, the Middle East and Russia help to boost the share of LNG in inter-regional gas trade from 42% today to 53% in 2040,” overtaking the pipeline trade. “The gradual removal of contractual restrictions, such as destination clauses, also eases the emergence of a globalized gas market in which prices are increasingly determined by the interplay of gas supply and demand.”

IEA is assuming a “marked change from the previous system of strong, fixed-term relationships between suppliers and a defined group of customers, in favor of more competitive and flexible arrangements, including greater reliance on prices set by gas-to-gas competition. This shift is catalyzed by the increasing availability of footloose U.S. LNG cargoes and the arrival in the 2020s of other new exporters, notably in East Africa, as well as the diversity brought to global supply by the continued, if uneven, spread of the unconventional gas revolution.”

Floating storage and regasification units should help to unlock new and smaller markets for LNG, whose overall share in long-distance gas trade is seen growing from 42% in 2014 to 53% in 2040 — surpassing the pipeline trade.

However, uncertainty over the direction of the commercial transition could delay decisions on new upstream and transportation projects, “posing the risk of a hard landing for markets once the current oversupply is absorbed,” the WEO-2016 said.

“Export-oriented producers have to work hard to control costs in the face of strong competition from other fuels, especially in the power sector. In the mid-2020s, in gas-importing countries in Asia, new gas plants may be a cheaper option than new coal plants for baseload generation, but only if coal prices were $150/metric ton, which is double the anticipated 2025 price.

The space for gas-fired generation also is expected to be squeezed by the rising deployment and falling costs of renewables.

Henry Hub to Become Global Reference Point

As of September, Henry Hub prices were around $3.00/MMBtu.

“Our view is that this price will need to rise, in all scenarios, in order the balance the market — although the extent of this increase is highly contingent on the trajectory for composite demand (local and for export) and also on the size of U.S. shale gas resources,” IEA researchers said.

The U.S. gas price trajectory in WEO-2016’s new policies scenario remains relatively low over the medium-term as a result of an anticipated rebound in the global oil price.

“By increasing the value of the liquids produced along with the gas and by encouraging tight oil production and its associated gas volumes, gas output remains buoyant at prices around $4.00/MMBtu until well into the 2020s. However, looking further ahead, the need for the United States and Canada to produce more than 1 tcm of gas each year starts to tell. The twin cost pressures of relying more on dry gas production and depleting the most productive areas of the various shale gas plays has the effect of pushing the price gradually higher and by 2040 it is closing in on $7.00/MMBtu.”

In the WEO’s new policies scenario, the global LNG market does not rebalance until the mid-2020s, a consideration that curbs profitable export opportunities in the meantime. However, increased competition, combined with United States becoming a major LNG exporter, “creates a propitious backdrop for movement toward more flexible pricing and trading arrangements,” researchers said.

“Large U.S. resources and production flexibility, combined with an LNG export industry actively seeking arbitrage opportunities, means that Henry Hub is projected to become not only a regional but also a global reference point, shaping investment and marketing strategies in other exporting countries and regions.”

Over the longer term, the European import price settles at around $4-5.00/MMBtu above the U.S. price — in all WEO-2016 scenarios — a differential that reflects the cost of delivering gas to exporting terminals, its liquefaction, shipping and then regasification in the importing country.

Asian import prices are seen rising more quickly because of the continued importance of oil-linked pricing in this region, but as this link weakens, the “Asian premium” disappears and the differentials from the U.S. price fall to around $5.00-6.00/MMBtu. The additional sum, compared with Europe, reflects the extra shipping distance to Asian markets.

Gas production growth is seen dominated to 2020 by Australia and the United States, but thereafter the increase in supply comes from a larger range of countries. East Africa should emerge as a new gas province because of large offshore developments in Mozambique and Tanzania, while Egypt is seen making a comeback as does Argentina with the development of promising shale gas resource in the Vaca Muerta region.

“After remaining relatively flat into the early 2020s, Russia’s output rises again as a new pipeline route opens up to bring gas to China, but a larger share of the increase in international trade is taken by LNG,” WEO-2016 said.

“As the natural gas market globalizes, so the various regional prices start to move in tandem, with the U.S. market — where the price rises above $6.00/MMBtu by the late 2030s — increasingly serving as a global reference point.”

According to WEO-2016, gas demand in the United States increases from just under 760 bcm in 2014 to 840 bcm in 2040, an annual average growth rate of 0.4% that is ” markedly lower” than the global average. Currently one-third of the gas is consumed in the power sector, with one-third in buildings and more than 20% in industry.

Domestic gas consumption rose in 2015, primarily from strong growth from the power sector, but “gas-fired power generation faces headwinds over the medium term…” The increase in gas prices to around $4.00/MMBtu in 2020 slightly weakens the competitive position of gas versus coal and the recent tax credit extensions for wind and solar are stimulating additional deployment of those technologies — effectively limiting the growth potential for gas over the medium term.

In the long term, gas use in the U.S. power sector is seen growing to nearly 290 bcm from 250 bcm in 2014, while output from gas power plants rises 27% from 2014 levels.

CPP May Improve Gas-Fired Generation Outlook

Price is clearly not the only determining factor in gas-to-coal competition, WEO-2016 said. The U.S. Clean Power Plan faces more hurdles from the incoming Trump administration and GOP-led Congress, but it would improve the outlook for domestic gas-fired power generation, according to WEO-2016.

“However, uncertainties remain: assuming that overall emission reductions targets remain unchanged, faster deployment of renewables increases the CO2 budget available for power generation from fossil fuels and thus reduces the need to displace coal in achieving targets. Although there is significant potential for fuel switching on a short-term basis, a persistent price-driven shift away from coal in power generation would require gas prices to remain below $3.00/MMBtu for a sustained period of time.”

However, the WEO-2016 analysis also suggests that those price levels would be incompatible with continued shale gas production in the United States.

The IEA’s coal and gas price trajectories under the new policies scenario “make the United States one of the few regions where coal-to-gas switching is underpinned by economics. However, the rate at which gas grows in power generation remains sensitive to policy developments, both to back out coal and to support renewables.”

Lower gas prices in the United States should lead to a change in the global landscape for gas-based chemicals production. And the United States also should see “one of the strongest increases in natural gas use in transport, with an additional 30 bcm consumed in road transport (mainly heavy-duty vehicles) over the outlook period.”

“We are entering a period of greater oil price volatility,” said Birol. “If oil prices rise in the short term, then shale producers can react quite quickly to put more oil on the market, producing a see-saw movement. And if we continue to see subdued investments in new conventional oil projects, this could have profound consequences in the longer term.”

According to the forecast, global oil demand continues to grow until 2040, mostly because of the lack of easy alternatives to oil in road freight, aviation and petrochemicals. However, oil demand from passenger cars declines even as the number of vehicles doubles in the next quarter century, mostly because of improvements in efficiency, but also biofuels and rising ownership of electric cars.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |