Markets | NGI All News Access | NGI Data

Season’s First Below-Average Injection Not Scaring Natural Gas Futures Bears

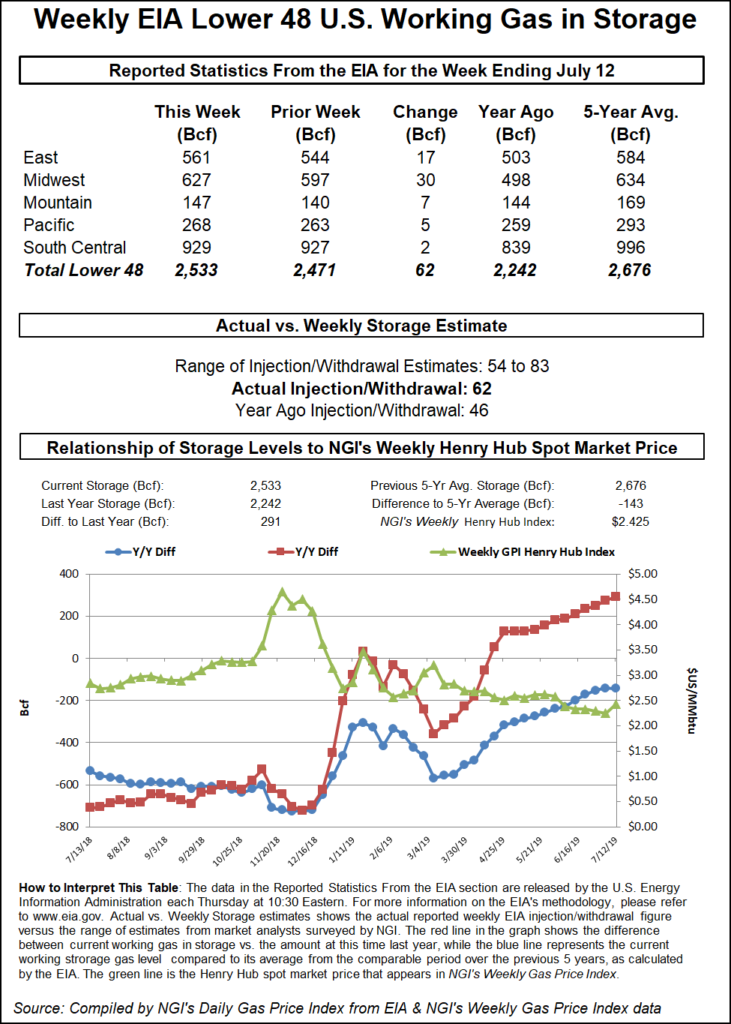

The Energy Information Administration (EIA) reported a slightly below-average 62 Bcf build into U.S. natural gas stocks Thursday, on the low side of expectations, but it wasn’t enough to frighten the bears prowling the futures market.

The 62 Bcf injection, recorded for the week ended July 12, comes in higher than the 46 Bcf build for the year-ago period but slightly below the five-year average of 63 Bcf. This week’s report marks the first below-average build since injections began in March, EIA historical data show.

In the lead-up to Thursday’s EIA report, the August Nymex futures contract was trading slightly higher at around $2.325-$2.340. As the 62 Bcf figure crossed trading screens at 10:30 a.m. ET, the front month went as high as $2.355 before quickly changing direction, dropping below $2.300 just minutes later.

By 11 a.m. ET, August was trading around $2.312, up less than a penny from the prior day’s settle but down a couple cents from the pre-report trade.

Prior to Thursday’s report, estimates had been pointing to a near-average injection close to the actual figure. A Bloomberg survey showed a median 69 Bcf, while a Reuters survey called for a 65 Bcf build. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 61 Bcf, while NGI’s model predicted a 65 Bcf injection.

The injection indicated a week/week tightening of balances, according to Bespoke Weather Services.

“Market reaction has been bearish early on, however, perhaps viewing the lower build as simply the result of some production turning off late last week due to Barry,” Bespoke said. “The lower production will be an issue in next week’s number as well, though burns, weather-adjusted, have definitely been weaker this week. All in all, this report is viewed as very neutral in our opinion.”

Total Lower 48 working gas in underground storage stood at 2,533 Bcf as of July 12, 291 Bcf (13.0%) above year-ago levels but 143 Bcf (minus 5.3%) below the five-year average, according to EIA.

By region, the Midwest recorded the largest build of the week at 30 Bcf, followed by the East at 17 Bcf. The Mountain region refilled 7 Bcf, while the Pacific injected 5 Bcf. In the South Central region, a 14 Bcf injection into nonsalt stocks was partially offset by an 11 Bcf withdrawal from salt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |