Infrastructure | E&P | NGI All News Access

SCOOP Rigs Fall as U.S. Sees Pullback in Oil Drilling, Says BHGE

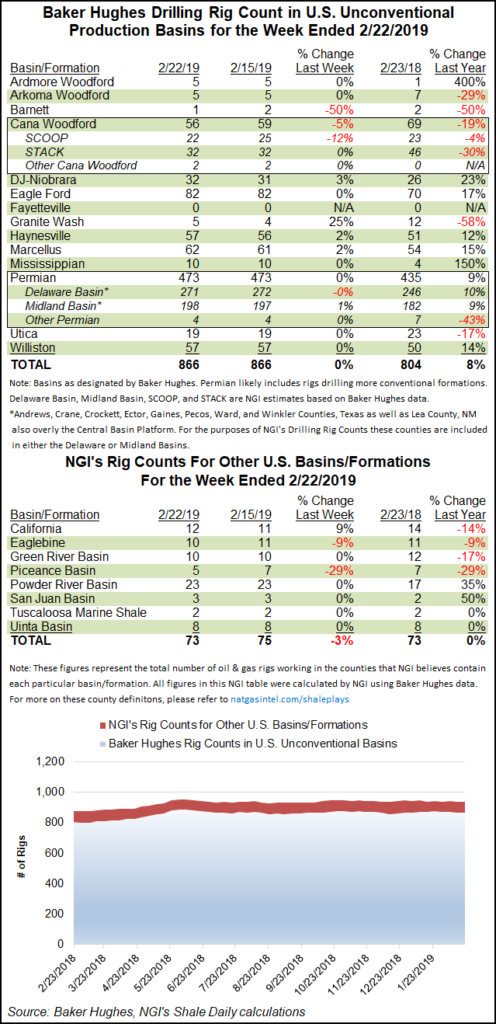

Declines in oil drilling sent the U.S. rig count lower for the week ended Friday (Feb. 22), with four rigs dropped to reach 1,047, according to data from Baker Hughes, a GE Company (BHGE).

The total number of domestic natural gas-directed rigs finished flat on the week at 194, while total oil-directed rigs ended at 853 after four units packed up shop, according to BHGE. The combined U.S. count finished 69 units ahead of its year-ago tally of 978.

Two land units exited the patch, while two departed offshore to drop the Gulf of Mexico tally to 19, versus 17 a year ago. One horizontal unit returned to action, offset by the loss of two directional units and three vertical units, according to BHGE.

Canada saw 12 units exit on the week, eight oil-directed and four gas-directed, dropping its overall count to 212, well behind the 306 units active in the year-ago period. The combined North American count fell to 1,259 for the week, down from 1,284 a year ago.

Among the major basins, the Cana Woodford posted the largest week/week loss, falling three rigs to 56, versus 69 in the year-ago period. A more detailed breakdown of BHGE data by NGI’s Shale Daily shows this week’s Cana Woodford decline impacting the SCOOP, aka the South Central Oklahoma Oil Province, which fell to 22 rigs.

The Barnett Shale saw one of its two active rigs exit for the week, while the Denver Julesburg-Niobrara, Granite Wash, Haynesville Shale and Marcellus Shale each added one rig.

Among states, Louisiana and Oklahoma each experienced a net decline of two rigs for the week, according to BHGE. Alaska, California and West Virginia added one rig each to their respective totals, while Colorado, New Mexico and Texas each dropped one.

U.S. energy professionals are a bit more confident about oil prices today than they were a few months ago, when prices surprisingly and rapidly slumped, but they have no confidence that natural gas prices will gain much momentum in the longer term, based on a recent survey by Raymond James & Associates Inc.

In conjunction with the recent North American Prospects Expo (aka NAPE), the team at Raymond James hosted its 17th annual dinner to gauge the mood of about 150 guests, mostly exploration and production (E&P) executives, and analysts again relied on anonymous voting to grill the group on a variety of topics.

“The mood throughout the room appeared cautiously upbeat,” considering the difference in industry profitability at today’s mid-$50/bbl oil price versus the mid-$40s price in late 2018, said analyst J. Marshall Adkins and his colleagues. “In sum, the industry seems to be more bullish on oil than the futures markets, although not nearly as bullish as we are over the next year.

“On the other hand, the respondents (like us and the futures market) do not expect to see U.S. natural gas prices greater than $3.00/MMBtu any time soon.”

This comes as Oklahoma City-based independent Devon Energy Corp. has revealed its plans to cast off the Barnett Shale and its Canadian portfolio to complete its transformation into a pure-play U.S. oil producer.

“With our world-class U.S. oil resource plays rapidly building momentum and achieving operating scale, the final step in our multi-year transformation is an aggressive, transformational move that will accelerate value creation for our shareholders by further simplifying our resource-rich asset portfolio,” said CEO Dave Hager as the company rolled out its 4Q2018 results earlier in the week.

“New Devon will emerge with a highly focused U.S. oil portfolio and has the ability to substantially increase returns and profitability as we aggressively align our cost structure to expand margins with this top-tier oil business. The new Devon will be able to grow oil volumes at a mid-teens rate while generating free cash flow at pricing above $46/bbl.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |