Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

SCOOP Activity, Utica Land Grab Drive Up Gulfport’s Costs

An active year in which it set out to delineate the South Central Oklahoma Oil Province (SCOOP), along with a push to acquire and trade for leasehold in core areas, has led Gulfport Energy Corp. to increase 2017 capital spending by 10.5% this year to $1.16 billion.

The company is still guiding for 1.065-1.1 Bcfe/d of annual production. Led by the Utica Shale in Ohio, Gulfport during 3Q2017 beat Wall Street consensus for the third quarter in a row, reporting output of 1.2 Bcfe/d, significantly higher from 734.1 MMcfe/d in the year-ago period and 1.038 Bcfe/d in 2Q2017.

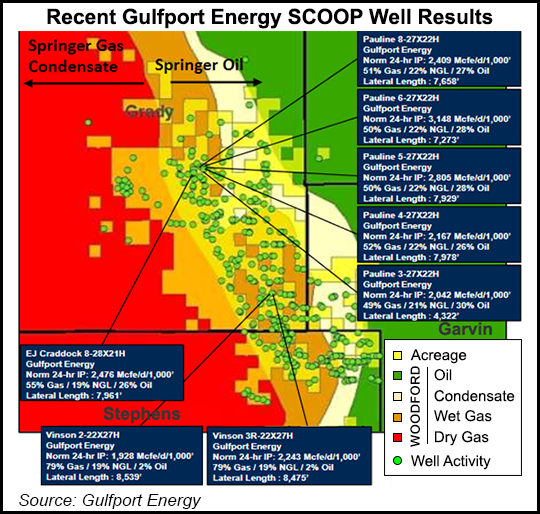

CEO Michael Moore said the company has been “intensely focused” on zone targeting, bit selection, casing placement, seismic processes and other exploration activities in the SCOOP. Year-to-date Gulfport has added 10,700 acres in the Utica and 4,100 net acres in the SCOOP. It elected to increase SCOOP spending by $35 million for delineation and $75 million to cover the cost of spudding more wells.

The Utica accounted for 987.2 MMcfe/d of production during the third quarter. Gulfport kicked-off the year running six rigs in the play, but as the completion schedule is effectively finished, it has dropped to four rigs there.

“Overall, we had a solid year on the drilling front and our efficiencies realized in 2017 set us up well as we enter 2018, allowing us to plan to do more with the drill bit with less overall rigs running,” Moore said. The company is targeting a cash flow-neutral program next year and has begun to drop rigs in the play as contracts expire.

In the SCOOP, Gulfport produced 194.4 MMcfe/d after entering the Midcontinent earlier this year. The company has so far drilled 15 gross wells, where it’s still running four rigs, mostly focusing on the Woodford Shale.

Management also elected to include Springer Shale and Sycamore formation tests this year. The company recently completed drilling a Sycamore well and is moving the rig out. It plans to complete the well and have an update by year’s end. A Springer well was also recently drilled and completed and is in the early stages of flowback, with an update expected in the coming weeks.

In the Northeast, Gulfport is girding for more than 3.5 Bcf/d of takeaway capacity that’s expected to come online through early next year, including TransCanada Corp.’s Leach and Rayne Xpress projects, as well as Texas Eastern Transmission LP’s Adair Southwest project and part of Energy Transfer Partners LP’s Rover Pipeline.

“Once in service, we expect to see Appalachian pricing shift as our incremental growth volumes in 2018 will be priced into a basis tightening-local market, which we see reflected in the pricing today,” Moore said. While Gulfport has yet to announce its plans for 2018, Moore’s comments are representative of other Appalachian operators that see an inflection point in 2018 with all the pipeline projects coming online.

Gulfport’s legacy assets on the Gulf Coast rounded out third quarter production, coming in at 17.1 MMcfe/d.

While natural gas prices were up year/year before hedges in the third quarter, Gulfport realized an average blended price of $2.41/Mcfe, a decrease from $2.87/Mcfe in 3Q2016. Revenue inched upward on higher volumes, going from $193.7 million in the year-ago period to $265.5 million.

Gulfport reported net income of $18.2 million (10 cents/share) for the third quarter, versus a year-ago net loss of $157.3 million (minus $1.25).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |