Earnings | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger CEO Calls on Oil, Gas Industry to ‘Engineer and Innovate’ from Downturn

The oil and natural gas industry may be going through one of its most challenging periods in modern history from diminished global demand and an uncertain future, but Schlumberger Ltd. CEO Olivier Le Peuch said Friday it’s more than up to the task.

During a Friday conference call to share second quarter results, the chief of the world’s largest oilfield services company said the energy industry has a solid history of being able to “go into a crisis and rebound. So, there’s no doubt that this industry will engineer and innovate its way out of the current crisis.”

Le Peuch expects the industry to be different “on the other side of this cycle from what we have known in the last 10 to 15 years…I think capital efficiency, capital discipline, cost of service delivery will be the prime elements of differentiation.”

Adopting new digital technologies is key, he told financial analysts.

“I think the game has changed. This is not about finding new supply,” but rather finding “lower costs” and “shorter-cycle extraction.” Operators have to use every advantage through improved technology, “which always makes a difference, but it would be focused on performance impact efficiency. This will change the game.”

More quarterly earnings coverage by NGI may be found here.

Revamping and partnering with suppliers also are boosting efficiencies, Le Peuch said.

“Because we need to transform as an industry, we need to find a way to extract this capital efficiency by changing the way we operate, by transforming the way we digitally align with our operators and the cost service industry…This is what I think will be the winning factor in the future.”

At What Cost?

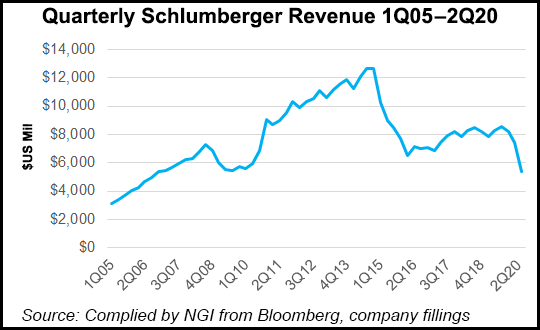

The game changing that Le Peuch envisions is not coming without a devastating toll. The Houston-based industry bellwether, which posted its weakest revenues in 14 years, announced it is laying off 21,000 people — one-fifth of the global workforce. At the end of 2019, Schlumberger employed around 105,000.

To put this in financial perspective, the job losses are so huge that Schlumberger is spending an estimated $1 billion in severance costs to decimate the job ranks to an 11-year low. Those costs, combined with other one-time restructuring and impairments led to a $3.7 billion writedown in 2Q2020.

Expect to see the budget squeezed even more by year’s end, the CEO warned. Although 40% of the estimated $1.5 billion in reduced costs are completed, another $900 million is still to be slashed. In addition, the potential for Covid-19 to continue to wreak havoc is weighing on the outlook.

“This has probably been the most challenging quarter in past decades,” Le Peuch said. “Subsequent waves of potential Covid-19 resurgence pose a negative risk to this outlook.”

While the company hunkered down and made necessary adjustments between April and June, there were few bright spots in the financial results overall.

Building Remotely

Remote operations, which allow exploration customers to reduce onsite staff, expanded by more than 25%, a highlight also acknowledged by Baker Hughes Co. in its 2Q2020 results.

Schlumberger’s remote operations capabilities were supported by more than 250 remote operations engineers, Le Peuch said. “In addition, we are now performing over 1,000 digital inspections that will apply to maintenance, manufacturing or integration applications across more than 40 countries, leveraging our digital backbone infrastructure…”

The digital operations are lowering the cost of service delivery and the size of the crews, while improving efficiencies across the board. The exploration and production customers also are continuing to spend on technologies.

In U.S. land, there recently has been an uptick in well completion activity, and “the rebound is expected to last…commodity pricing remains stable,” Le Peuch said. “The conditions are set in the third quarter for a modest fracture completion activity increase in North America, though from a very low base.

“Internationally, markets may continue to be disrupted by the pandemic and will continue to adjust to budget levels set during the second quarter, but this would be mostly offset by the seasonal return of activity in the Northern Hemisphere and the rebound of Latin America from its second quarter weakness.”

Still, the pandemic is causing some concern, said the CEO, “given the uncertainties regarding the pace of economic and oil demand recovery. The range of activity outcomes for the second half of the year is still wide. However, with what we know and see today, we expect…the activity decline to recede into a soft landing in the coming months, absent further negative impact from Covid-19 on economic recovery or escalating rig activity disruption.”

Home Sweet Home

Le Peuch took time to acknowledge the “remarkable resilience” of the workforce during the quarter. He said up to 55,000 people were working remotely to maintain the business continuity.

“They have embraced digital remote operations, adjusted work practices to mitigate contamination risks and delivered benchmark safety and service quality performance for our customers,” he said. “I would like to extend my heartfelt appreciation for their dedication and sacrifices while working in a difficult operating environment, and for their leadership in helping the communities where we live and work. As the pandemic lingers, we will remain cautious in our global operations. The safety of our people remains paramount.”

Net losses totaled $3.4 billion (minus $2.47/share), compared with year-ago profits of $492 million (35 cents). Revenue fell to $5.4 billion, off $3 billion year/year.

North America revenue slumped by nearly half from 1Q2020, off 48% at $1.18 billion, with international revenue down 19% at $4.12 billion.

North America land revenue fell 60% sequentially as customers reduced spending. In the international business, the decline was pinned on Latin America and Africa, which experienced the largest declines because of Covid-19 restrictions and the drop in deepwater activity. In addition, revenue fell following a production interruption in a project in Ecuador caused by a major landslide that led to the rupture of the main pipeline.

Revenue for global operations in the third quarter is forecast to remain essentially flat sequentially, with a “slight positive uptick internationally offset by flat-to-low single-digit decline in North America,” Le Peuch said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |