NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Saudi Aramco Gaining Hold in U.S. LNG with Deal to Buy Stake, Supplies from Sempra Port Arthur Project

State-owned Saudi Arabia Oil Co., aka Aramco, on Wednesday said it has signed a heads of agreement (HOA) to negotiate buying a 25% stake in Phase 1 of Sempra Energy’s natural gas export project in Port Arthur, near Houston.

The parties also are finalizing a 20-year sale and purchase agreement (SPA) for 5 million metric tons/year (mmty) of offtake from the initial phase of the liquefied natural gas (LNG) export project under development.

The HOA was secured between subsidiaries Sempra LNG and Aramco Services Co. No financial details were disclosed.

“The agreement with Sempra LNG is a major step forward in Saudi Aramco’s long-term strategy to become a leading global LNG player,” Aramco CEO Amin Nasser said. “With global demand for LNG expected to grow by around 4% per year, and likely to exceed 500 mmty by 2035, we see significant opportunities in this market and we will continue to pursue strategic partnerships which enable us to meet rising global demand for LNG.“

For months, rumors have swirled that Aramco was prowling to take stakes in various Lower 48 oil and gas projects after the national oil company bought a 70% stake in Saudi Basic Industries Corp., aka Sabic, the kingdom’s petrochemicals firm, in a $69.1 billion deal. The investment paved the way to make investments into global deals beyond the Middle East.

The majority stake in Sabic by Aramco merges the kingdom’s two largest companies and provides Aramco with about the same amount of money it had been expected to recoup in an initial public offering.

Sabic already has a foothold in the United States. It has a Houston office and employs around 34,000 in 50 countries, with around 5,000 in the Americas. Last year, Sabic and ExxonMobil Corp. created a joint venture to advance the Gulf Coast Growth Ventures project, a 1.8 mmty ethane cracker planned for San Patricio County near Corpus Christi.

Sabic is also involved in preliminary plans to build a 2 mmty methanol production plant on the Mississippi River in St. James Parish, LA, which would be the largest of its kind in North America. South Louisiana Methanol and Sabic clinched a six-month agreement early this year to review the project; the agreement may be extended.

In the United States, Aramco affiliates own, among other things, Motiva Enterprises in Port Arthur near Houston, considered North America’s largest refinery with crude capacity of 630,000 b/d. Motiva also operates the largest U.S. lubricant plant, which is on the Gulf Coast.

Sempra CEO Jeffrey W. Martin said the California-based operator was “developing one of the largest LNG export infrastructure portfolios in North America, with an eye toward connecting millions of consumers to cleaner, more reliable energy sources.”

Sempra’s partnership with affiliates of Aramco, “the largest oil and gas company in the world,” would help “to advance the development of Sempra LNG’s natural gas liquefaction facility in Texas and enable the export of American natural gas to global markets,” Martin said.

Phase 1 of Port Arthur is expected to include two liquefaction trains, up to three LNG storage tanks and associated facilities that would enable exporting 11 mmty of LNG on a long-term basis.

Port Arthur LNG, one of five gas export development projects being considered by Sempra LNG, could be one of the largest export projects in North America, with potential expansion capabilities of up to eight liquefaction trains.

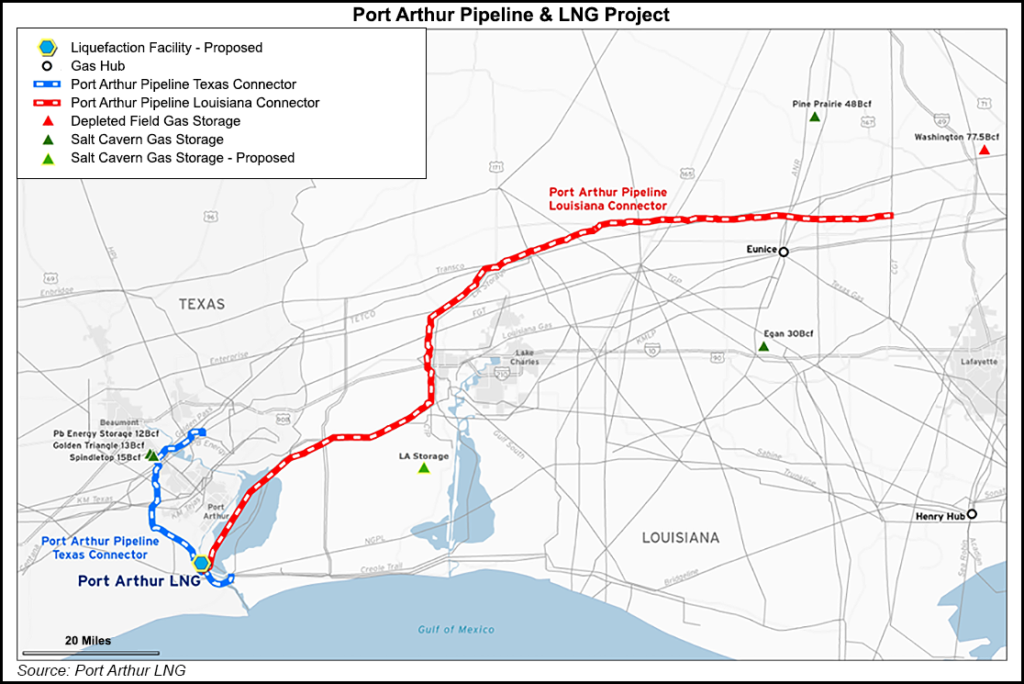

Earlier this month, the U.S. Department of Energy authorized Port Arthur to export gas worldwide. In April, Port Arthur LNG and its affiliates were authorized by the Federal Energy Regulatory Commission to site, construct and operate the facility and related natural gas pipelines.

Developing Sempra Energy’s LNG export projects, management said, still is contingent upon obtaining additional customer commitments, completing required commercial agreements, securing all necessary permits, obtaining financing, incentives and other factors, and reaching a final investment decision (FID).

“The ultimate participation by Aramco Services Co. and its affiliates in the Port Arthur LNG project remains subject to finalization of definitive agreements, among other factors.”

The Port Arthur project, sited east of Houston, would complement Sempra’s Cameron LNG export facility in Louisiana, a 15 mmty facility scheduled for start up this year. In addition, Energia Costa Azul is on the drawing board for Baja California, with an FID expected next year.

If the Port Arthur HOA is converted to a SPA, “this will be one of the largest LNG deals ever signed and the largest deal signed since 2013,” said Wood Mackenzie research director Giles Farrer. “This is a signal of Aramco’s intent to become a global gas player and develop a broad LNG portfolio.”

As the “energy transition” intensifies globally, Wood Mackenzie expects national oil companies to follow the lead of “major international oil companies by diversifying their exposure away from oil and into gas and LNG.”

Additional moves into other “major” LNG provinces b Aramco “are likely,” Farrer said. Aramco is rumored to be interested in acquiring LNG-focused projects in, among other places, Arctic Russia and Australia.

“It’s unclear what the final destination of Saudi Aramco’s LNG will be,” Farrer said. “There continues to be a long-term expectation that, in time, Saudi Arabia will import LNG to be used for power generation. However, we expect that Saudi Aramco will use this volume to establish a global portfolio as it seeks to become a global gas player.”

Wood Mackenzie expects Aramco to establish an LNG marketing operation by building on its expertise in crude and products marketing, “while also leveraging Saudi Arabia’s diplomatic ties.”

Aramco recently began trading LNG and sold its first cargo to India in April, he noted.

If the Port Arthur deal is finalized, the project likely will achieve a positive FID by early 2020, according to Farrer.

Port Arthur has a 2 mmty deal in place to supply Poland’s state-owned Polskie Gornictwo Naftowe i Gazownictwo SA, aka PGNIG. “This deal will take total contract volumes from the 11 mmty facility to 7 mmt, a level that should be sufficient to secure debt finance. As such, we expect debt raising to now be accelerated to facilitate FID. With the facility now looking more likely to go ahead, other buyers may now choose to sign up to buy LNG from the project too.”

Bechtel already is lined up to provide engineering, procurement and contracting (EPC) for Port Arthur.

“We expect Saudi Aramco will have been attracted to sign up with Port Arthur ahead of rival U.S. LNG export projects due to the fact that Sempra is an established energy player with a long history of infrastructure ownership and development,” Farrer said. “The EPC wrap provided by Bechtel, and its strong project delivery reputation, provides further credibility too.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |