View more information about the North American Pipeline Map

Background Information about the San Juan Basin

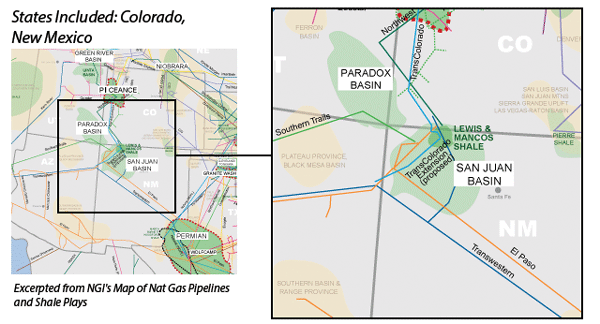

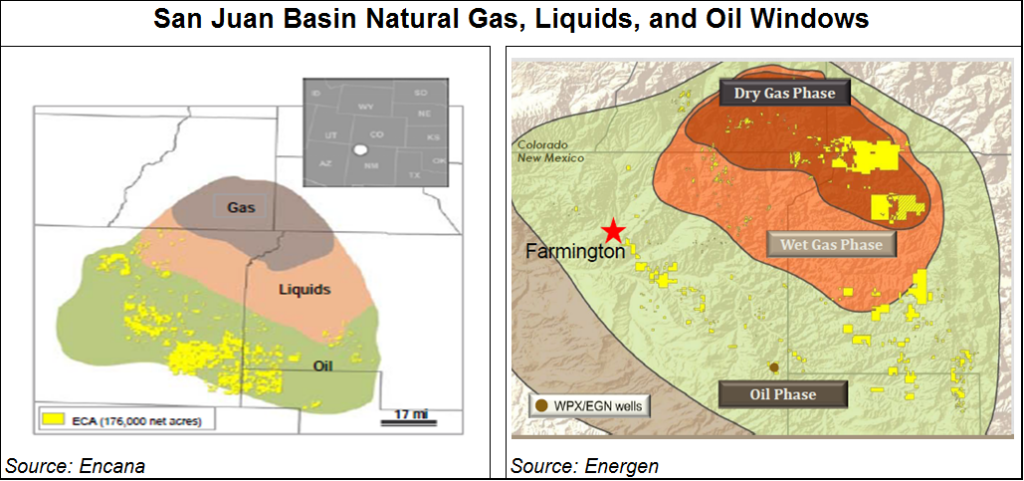

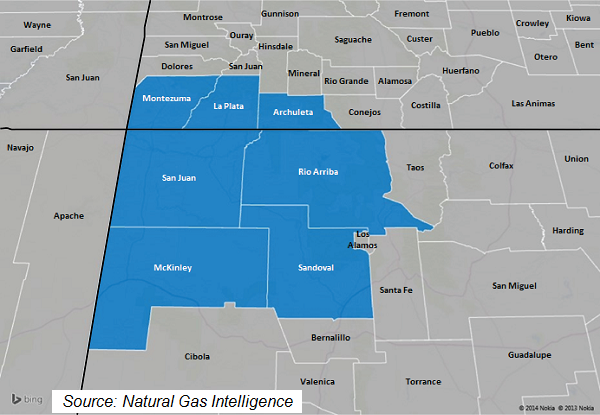

The San Juan Basin, which is located predominantly in Northwest New Mexico and extends into Southwest Colorado, is primarily a natural gas production area from both conventional and unconventional tight sands, coal bed methane (CBM), and shale formations, although crude oil production in the region has been gaining momentum. The San Juan is one of the oldest producing areas in the United States, with the first conventional natural gas discovered in 1921, and the first CBM well spud in 1948. However, CBM production in the San Juan Basin didn’t really flourish until the 1990s, thanks in large part to Federal tax credits. Overall, there are currently more than 20,000 oil and gas wells in the San Juan Basin.

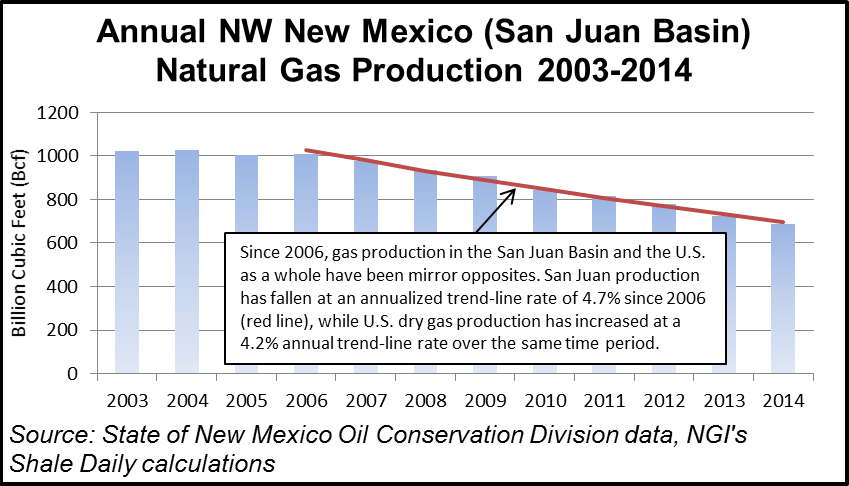

In 2010, the U.S. Energy Information Administration (EIA) tabbed the combined San Juan Basin Gas Area in Colorado and New Mexico as the 2nd largest natural gas field in the United States in terms of proved reserves, with production of 1.3 trillion cubic feet in 2009. However, since 2006, total natural gas production in the San Juan Basin and the U.S. as a whole have been mirror opposites of each other. As seen in the chart below, New Mexico San Juan natural gas production (most of the San Juan Basin lies in New Mexico) has fallen at an annualized trend-line rate of 4.7% since 2006, while U.S dry gas production has increased at a 4.2% annual-trend line rate over the same period. Moreover, CBM continues to account for a smaller percentage of production on the New Mexico side of the play, falling from 49.5% in 2006 to 41.0% in 2014.

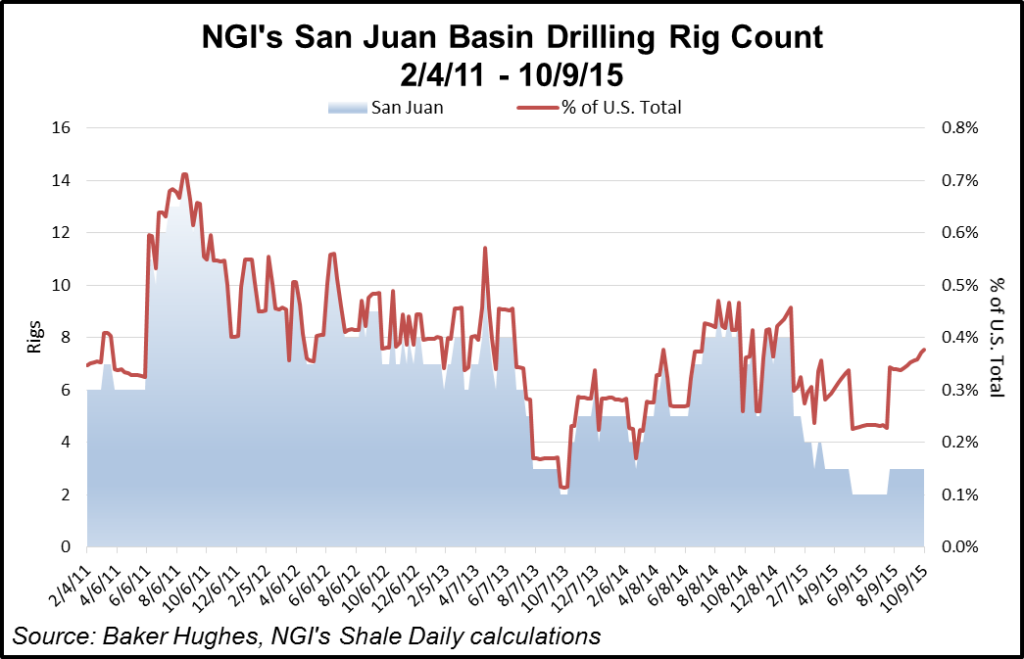

After peaking at 14 in August 2011, the drilling rig count in the San Juan Basin stood at just 3 in early October 2015. 2 of those rigs were in Rio Arriba County, NM, with the third in San Juan County, NM.

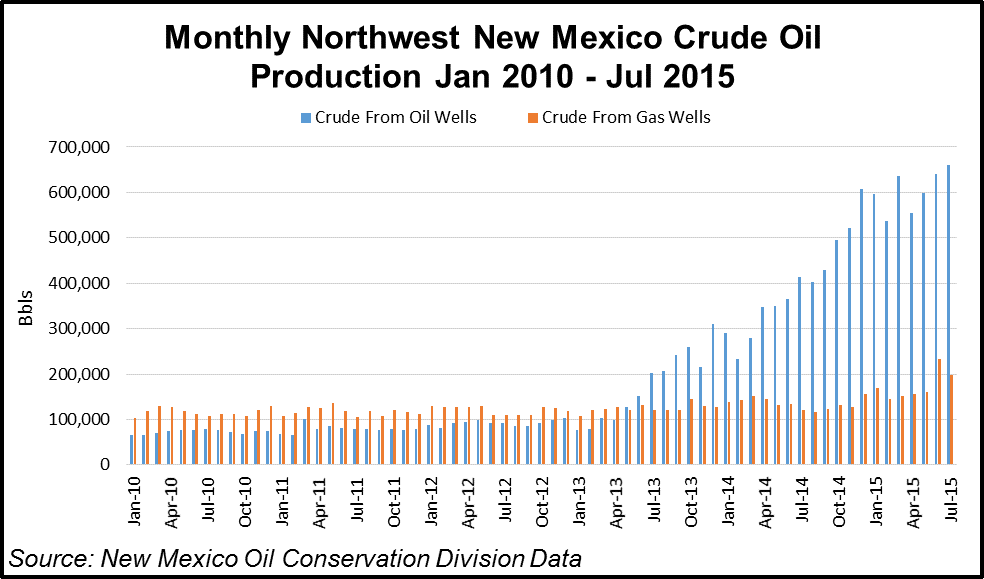

The flood of Marcellus gas supplies to market over the past few years, which dropped the commodity’s price well below the crude oil value slump, led producers in the San Juan Basin away from the gassier part of the play and towards the oil-rich Mancos Shale portion located in the southern end of the basin. In addition to the Mancos, the San Juan Basin is also home to the gassier Lewis Shale formation. However, attempts by the industry to develop this resource largely have proven to be unsuccessful thus far.

Development of the Mancos still remains very much in the early stages, but initial mixed drilling results are starting to become more favorable. During its 2Q14 conference call, Encana reported it was in the process of advancing commercial development of the San Juan, while continuing to delineate its acreage. The company had drilled 14 wells in the San Juan as of June 2014, and noted the performance of those wells had been consistently at or above its expectations, with initial production rates between 400-500 b/d.

While the steep decline in oil prices over the last year has dampened development even in the Mancos, some producers are renewing their interest. In 2015, BP returned to its legacy holdings in the San Juan Basin, a gassy asset that was spurned for international opportunities years ago (see Shale Daily, Oct. 27, 2015).

“In the San Juan, we are seeing significant reduction in development costs compared to the last time we drilled in the basin back in 2009,” BP CEO Bob Dudley said during a 3Q2015 earnings call. Gas wells in San Juan now “are being developed at a cost of 45 cents/Mcf.” The company’s first dual-lateral well in the San Juan also is showing “encouraging early performance.”

WPX Energy Inc., which has been active in the San Juan Basin’s oily Gallup formation, which lies within the Mancos Shale, added 14,300 net acres in the Gallup in June as part of its plan to step away from its natural gas-heavy portfolio for onshore oil prospects (see Shale Daily, June 22, 2015).

The $26 million transaction with an undisclosed seller includes around 100 drilling locations, which would boost the Tulsa independent’s Mancos Gallup Sandstone locations to around 500. WPX owns or controls around 100,000 acres in the core of the Gallup oil window, where it has spud 100-plus wells since a discovery in 2013 (see Shale Daily, Aug. 7, 2013). Management was confident enough in the Gallup discovery in 2014 to swap coalbed methane properties in the Powder River Basin for a bigger slice of San Juan leasehold (see Shale Daily, Aug. 20, 2014).

Energen Corp. in February 2015 agreed to sell the majority of its San Juan natural gas assets to a private company for $395 million. The assets included about 985 net operated wells on some 205,000 net acres. On the liquids side, Energen deployed one horizontal rig for its Mancos Shale appraisal program in the San Juan Basin for the second half of 2015. Irene O. Haas, analyst for Wunderlich Securities Inc. said in August 2015 that all eyes were on the company’s 2H2015. “This fall, we look forward to seeing Energen drilling its eight-well program in the San Juan Basin, which could offer positive catalysts,” she said (see Shale Daily, Aug. 11, 2015).

Energen’s management noted on its 3Q2015 earnings conference call that it is still too early to know whether the company will dedicate more capital to the Mancos in 2016-17, and that decision would be determined in no small part by how well economics in the area compete with the company’s acreage in the Midland Basin in the Permian. But even if their Mancos wells do prove to be competitive, EGN indicated permitting issues in the San Juan may restrict their ability to develop that resources at an accelerated pace.

The commodity downturn has proven to be too much for some producers. Tulsa-based Samson Resources Corp., which operates in the San Juan along with a number of other basins, filed for Chapter 11 bankruptcy in September 2015 and said it expects its restructuring to provide “a significant deleveraging” as well as $450 million of new capital (see Shale Daily, Sept. 17, 2015). The move had been expected; the company announced restructuring plans in August (see Shale Daily, Aug. 17, 2015). “The steps we are taking will allow our company to maximize future opportunities and compete more effectively with significantly less debt on our balance sheet,” said CEO Randy Limbacher. “We fully expect to operate our business as usual throughout this process and to emerge as a financially stronger company.”

EV Energy Partners LP announced in September 2015 that it would acquire oil and natural gas properties in four basins across the country in a $259 million drop-down from institutional funds managed by affiliate EnerVest Ltd. (see Shale Daily, Sept. 3, 2015). The properties, located in the Appalachian Basin, New Mexico’s San Juan Basin, Michigan and Texas’ Austin Chalk hold proved reserves of 302 Bcfe, EVEP said. In all, the deal adds more than 9,400 wells in mostly legacy fields to the company’s inventory. EVEP said it expects daily production to increase 33% in the dropdown. “These assets we are acquiring have much lower initial operating risks since EnerVest has been acting as operator of these properties for the past five to ten years,” said EVEP CEO Michael Mercer.

Counties

New Mexico: McKinley, Rio Arriba, San Juan, Sandoval

Colorado: Archuleta, LaPlata, Montezuma

Local Major Pipelines

Natural Gas: El Paso, Northwest Pipeline, Southern Trails, TransColorado, Transwestern Crude

Oil: Western Refining

NGLs: Rocky Mountains (Enterprise)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | Power River | Paradox

Shale Daily

Shale Daily