NGI The Weekly Gas Market Report | E&P | Markets | NGI All News Access

Robust Natural Gas Production to Keep Lid on Prices This Summer, Says NGSA

Demand for natural gas could set records this summer, but production increases are likely to keep pressure on gas prices neutral compared with the same period last year, according to a report issued Thursday by the Natural Gas Supply Association (NGSA).

The 2019 April-October summer injection season began with a 1.13 Tcf end-of-March inventory level, 505 Bcf below the five-year average, and injections have been “extremely strong,” about 5.8 Bcf/d above the five-year average, according to the NGSA’s 2019 Summer Outlook for Natural Gas.

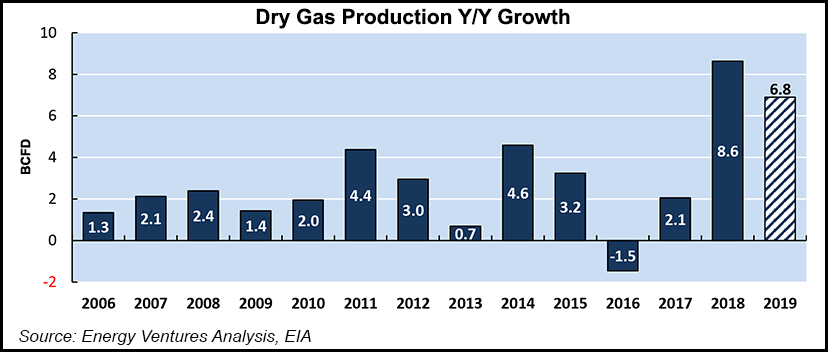

“The high injections thus far in the season are a result of robust production levels, which are 9.7 Bcf/d higher year-on-year as of April 2019. Production is forecast to grow further in the summer, given spare pipeline takeaway capacity in the Northeast as well as new pipelines coming online in the Permian and SCOOP and STACK. In fact, higher production this year will result in the second highest injection season on record, injecting 2.6 Tcf to reach 3.75 Tcf by the end of October.”

Domestic production growth is crowding out imports from Canada, which are expected to decline by 0.8 Bcf/d this summer compared with the same time last year, NGSA said.

“The picture that has emerged for the upcoming summer is one of remarkable growth in demand that is matched by record-setting production,” said NGSA Senior Vice President Jenny Fordham. “With more than enough supply to meet demand, we anticipate flat pressure on prices compared to last summer.”

The report, prepared by Energy Ventures Analysis, projects record-high U.S. natural gas demand of 82.1 Bcf/d this summer, based largely on expected growth in liquefied natural gas (LNG) exports and a 3% increase in demand from the domestic industrial sector compared with summer 2018. The residential and commercial sectors are expected to show slightly decreased demand compared to last summer, based on forecasts for relatively cooler temperatures. In addition, pipeline exports to Mexico are expected to reach 5.5 Bcf/d this summer.

Domestic LNG export capacity will nearly double in 2019, increasing from 3.6 Bcf/d at the beginning of the year to about 7 Bcf/d by the end of the year, according to FERC’s Summer 2019 Reliability and Energy Market Assessment. Additional LNG export capacity is expected to come from facilities including Sempra Energy’s Cameron LNG in Louisiana, Kinder Morgan’s Elba Island liquefaction in Georgia, and Cheniere Energy Inc.’s Corpus Christi LNG export facility in Texas.

Higher-than-average temperatures are expected across much of the United States this summer, but reserve margins, boosted by a flood of domestic natural gas production, are likely to be adequate in all regions except the Electric Reliability Council of Texas (ERCOT), according to the Federal Energy Regulatory Commission.

Despite the relatively higher temperatures, the net demand for electricity is forecast to decrease by 0.3% this summer compared to summer 2018, due to reductions associated with greater energy efficiency and behind-the-meter systems, FERC said.

Electric grid operators in the Northeast will have no problem meeting summer demand even in the most extreme weather conditions as new supplies, including natural gas-oil generation plants, and demand-response resources enter service, according to a recent summer forecast by the Independent System Operator-New England.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |