Markets | NGI All News Access | NGI Data

Roaring Natural Gas Production Growth at Heart of September Bidweek Declines

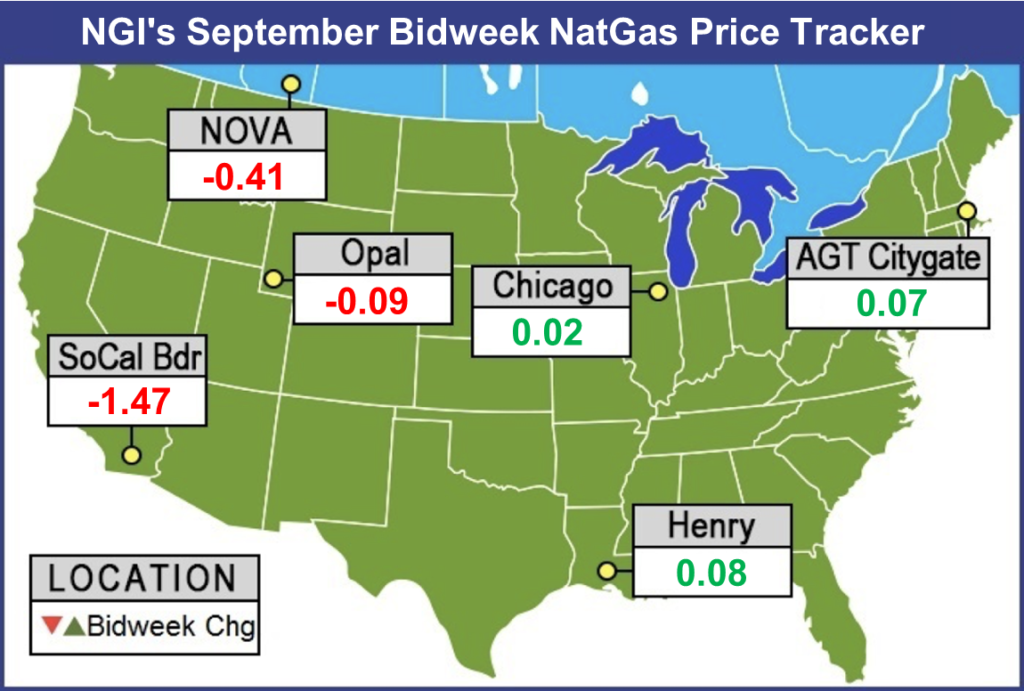

Late summer heat and hefty storage deficits took a back seat to record production as traders sent NGI’s National Bidweek Avg. down 12 cents from August to $2.64 for September, which is exactly on par to the penny with September 2017’s bidweek average.

Lower 48 production has been on a tear in recent weeks, hitting new highs almost weekly, with further growth expected as additional infrastructure is set to come online before year’s end. Monthly average volumes have climbed nearly 4.5 Bcf/d since February — an average of 700 MMcf/d per month — to just above 82 Bcf/d in August, according to RBN Energy.

The growth pace has accelerated in the past couple of months, with volumes increasing by more than 1 Bcf/d in July and August, and producers show no signs of slowing down. Case in point: The most recent record of 83.6 Bcf/d was set just last week (Aug. 27), RBN natural gas analyst Sheetal Nasta said.

And there’s more growth ahead as production is expected to climb as additional takeaway capacity goes into service before year end. Already, August saw an additional 7 Bcf of takeaway capacity versus August 2017, according to Genscape Inc. Meanwhile, Rover Pipeline on Friday asked FERC to place its last two remaining laterals — Sherwood and CGT — into service by Sept. 15, bringing the pipeline’s full 3.25 Bcf/d into service.

Rover’s Majorsville location — which received FERC approval last month to begin service — increased scheduled capacity from 85 MMcf/d on Aug. 31 to 354 MMcf/d through the Labor Day weekend and for Tuesday’s gas day, according to Genscape. Cumulative receipts onto Rover also increased and went from an average of 2.2 Bcf/d in August to 2.8 Bcf/d on Sept. 1, with other notable changes in nominations at the Berne, Clarington-Eureka and Sundance receipt points. Deliveries increased correspondingly to Vector Pipeline and Panhandle Eastern Pipeline, the firm said.

In addition, Transcontinental Gas Pipe Line Co. LLC (Transco) has asked the Federal Energy Regulatory Commission for authorization to begin full service on its 1.7 million Dth/d Atlantic Sunrise expansion by Sept. 10.

The new infrastructure is set to go online ahead of the winter season, when many regions see their highest natural gas usage of the year. This past week saw the first cold shot of the season, although the weather system was more of a relief for regions that have been dealt sweltering heat for much of the summer.

“The summer of 2018 has turned out to be one of the hottest ever — with June, July and August much hotter than normal and summer heat extending well into September. This has driven power sector demand to record levels for much of the summer, masking the extreme oversupply condition that is developing in the U.S. market,” EBW Analytics said.

Indeed, the hotter forecasts led the Nymex September gas futures contract to jump 4.3 cents in its final day in the prompt-month position, expiring at $2.895.

The latest weather outlooks show a swing back to stronger-than-normal demand for the first week of September as hot high pressure was forecast to return across the Ohio Valley and East, sending daytime temperatures into the upper 80s to 90s, according to NatGasWeather. It also was expected to remain “very warm” over the South and Southeast, although with areas of showers that will limit the coverage of 90-degree temperatures, therefore making conditions cooler versus last week. The showers in the South and Southeast were being aided by Tropical Storm Gordon, which was expected to make landfall Tuesday night as a hurricane.

The West was forecast to be mostly warm to hot with highs in the mid-80s to 100s, “although there will be showers and cooling over the Rockies and Plains as an early season cool front sweeps through,” NatGasWeather said.

High pressure was expected to return once again to the east-central United States Sept. 12-16, but weather models greatly diverged, with the European model consistently hotter than the rest of the datasets. Regardless, it’s likely the markets see some gains in cooling degree days after Sept. 15 as being partially offset by the loss of heating degree days across the northern United States in a mostly warmer-than-normal pattern, NatGasWeather said.

Despite the lingering heat, EBW said the natural gas market is poised to shift gears and head significantly lower later this month. “While the next two weeks are expected to be extremely hot by seasonal standards, this hot weather most likely is already priced into the market,” EBW CEO Andy Weissman said.

By mid-September, the odds of very hot weather will decline sharply, he said. “If current forecasts are directionally correct (as is likely), power sector demand for natural gas will drop sharply, possibly by as much as 10 Bcf/d,” Weissman said.

With demand plummeting and supply continuing to rapidly increase, the result is likely to be a string of 100 Bcf-plus storage injections starting with the week ended Sept. 20, he said. To be sure, the shoulder season is expected to see a significant uptick in storage injections, which have been lagging throughout the summer as intense heat has kept air conditioners running on full blast.

The EIA reported that storage inventories as of Aug. 24 grew by 70 Bcf to 2,505 Bcf, 646 Bcf below last year and 588 Bcf below the five-year average. Bespoke Weather Services said the EIA data showed a market that was slightly looser than what it had been forecasting, “but on a two-week rolling basis, when cutting through weekly EIA noise, we saw a market that was fitting quite well with our reading of balance.”

Further loosening was expected to become apparent this coming Thursday, when the market should see an even looser weather-adjusted print, even as the net injection size should be slightly lower. “Weather this past week was solidly supportive; heat was impressive across the South, where seasonally heat matters the most now. Heat across the Mid Atlantic and Northeast was impressive for the time of year as well, with strong raw power burns,” Bespoke chief meteorologist Jacob Meisel said.

On a weather-adjusted basis, however, power burns did not appear particularly impressive, and an increase in Canadian imports as well as other demand-side loosening seem likely to keep this week’s injection actually quite close to the prior week’s despite significant heat, he said.

“There are risks mixed in both directions; all summer heat across the South has had a more bullish impact than expected, so we could see another solid draw there, but we also saw very strong wind generation for the week that has us seeing the potential that some overestimate how strong power burns were,” Meisel said.

Broken down by region, stockpiles across the East remain outside the five-year range but began closing in on that range as of the EIA’s last report; builds were likely to increase from there as well with the market loosening, according to Bespoke.

“The Midwest is not looking quite as comfortable yet with stockpiles further outside the five-year range and not moving back closer yet, while the Mountain Region has held onto that five-year range. The Pacific Region has a considerable deficit to make up, but a build is expected this week,” the forecaster said.

On the whole, EBW said that with production continuing to soar, it expects the storage deficit versus the five-year average could be cut by as much as 200 Bcf by mid-November, “creating significant downward price pressure for natural gas.”

The expected slide in natural gas prices was already apparent in some regions that saw September bidweek prices fall by several dollars. In California, SoCal Citygate prices plunged $4.57 month/month (m/m) to reach $4.93. Malin was down a far more modest 12 cents to $2.37, while PG&E Citygate rose 11 cents to $3.19.

The steep sell-off in California comes despite ongoing heat in the region. AccuWeather shows highs this week in Los Angeles soaring to the mid-90s by Friday. Early indications point to daytime temperatures holding in the mid- to upper 80s for the majority of the month, save for the last week of September.

Bidweek prices in the Rockies also softened m/m, with the largest decrease seen at Northwest Sumas, which fell 21 cents to $2.04. Cheyenne Hub was down 7 cents to $2.27.

Northeast September bidweek prices were mixed given the multiple heat waves that were expected to move in and out of the region during the next couple of weeks. Algonquin Citygate prices climbed 7 cents to $2.96, while Iroquois Zone 2 edged up 3 cents to $2.93. Transco Zone 6 non-NY fell 12 cents to $2.68.

AccuWeather said high temperatures through Thursday were expected to average in the 90s along the Interstate 95 corridor, Ohio Valley and the Carolinas. Temperatures were forecast to climb well into the 80s to near 90 over the Appalachians and the lower Great Lakes region.

“Temperatures will fluctuate more across New England,” AccuWeather senior meteorologist Kristina Pydynowski said. “However, there will be more than one day of highs around 90 [Fahrenheit] in Boston.”

Cooler air was expected to reach much of the region by Friday, with temperatures in most areas being slashed by 10 to 15 degrees. However, humidity levels were likely to remain elevated through the weekend, she said.

Appalachia prices were up across the board as the impending in-service of key infrastructure projects provided some uplift to prices in the region. Tennessee Zone 4 200L jumped a dime to $2.69, Tennessee Zone 4 Marcellus shot up 23 cents to $2.39 and Transco-Leidy Line rose 24 cents to $2.47.

Louisiana prices were stronger as well given the localized heat in the Southeast, with gains of as much as a dime across the state. Similar increases were seen in much of Texas, while constrained capacity coming out the Permian Basin sent regional prices there lower. At Waha, September bidweek prices plunged 54 cents m/m to $1.29, while El Paso-Permian tumbled 40 cents to $1.45.

Pipeline companies are working to expand their facilities or build greenfield projects to boost gas takeaway capacity in the basin, with an eye toward the Gulf Coast, where demand continues to rise thanks to increasing exports to Mexico and overseas via liquefied natural gas.

Those projects, however, are at least a year from in-service, and with pipeline capacity still constrained, Waha cash prices languished at about 90 cents below Henry Hub during August, sinking down to a spot price of $1.27 on Aug. 29, which was $1.69 below Henry Hub. That’s well below the previous negative basis record of $1.42, which was set in April.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |