E&P | NGI All News Access | Permian Basin

Ring Limits Drilling, Scoping Out M&A Opportunities in Permian

Fresh from closing an acquisition that significantly increased its size, Ring Energy Inc. said it plans to limit drilling for now but is actively looking for more merger and acquisition (M&A) opportunities to become a premier exploration and production (E&P) company focused on the Permian Basin.

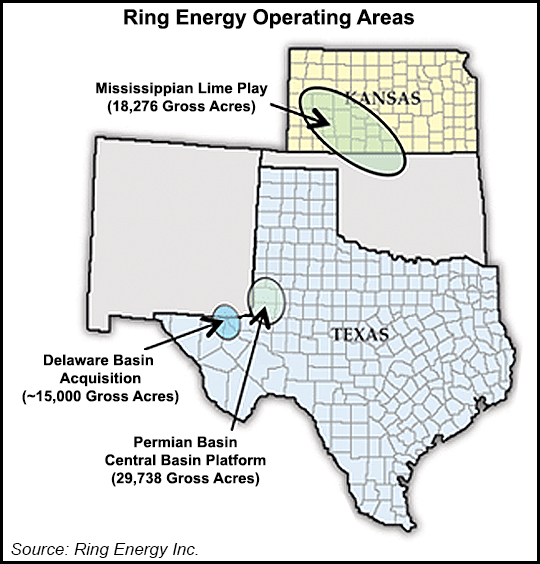

Ring, an independent E&P company based in Midland, TX, finalized an acquisition at the end of June that gave it 14,700 net acres in the Permian’s Delaware sub-basin from an undisclosed seller for $75 million (see Shale Daily, May 26). The company holds a 98% working interest (WI) and an average net revenue interest of 78% on the acquired acreage, which is in the West Texas counties of Culberson and Reeves.

On Monday, Ring said internal estimates of net proved, probable and possible (3P) reserves, including the acquisition, totaled 43.4 million boe. Present value of estimated future revenues, net of estimated direct expenses, discounted at 10%/year, or PV-10, is $436.2 million.

During a conference call Tuesday to discuss 2Q2015, CEO Kelly Hoffman said that after the acquisition closed, Ring immediately began clean up operations there.

“Currently, we are putting wells back on and executing our capital improvement plans, which will allow us to take advantage of some low-hanging fruit,” Hoffman said. “We’ll be limiting our drilling with more of a focus on remedial work, as well as continuing to push for meaningful acquisitions.”

Executive Vice President Daniel Wilson added that Ring had “identified higher fluid levels in nearly every single well out there. We’ve already got in most of the capital expenditures [capex] program where we’re going to increase the efficiency of the water handling facilities out there, which will allow us to ramp up our fluid handling capacity.

“While we’re putting that in place, we’re upgrading pumping equipment on wells. We can just start cranking those up. We also are going through the property methodically and hanging wells back on that had been let go. That’s just a small example of some of the ‘low-hanging fruit’ we’ve got in front us. [It will] keep us busy probably for several months.”

Ring’s 2Q2015 presentation said the 2015 capex budget was yet to be determined.

Hoffman said the E&P intends to exit 2015 “with a very active growth rate,” but added that it was still negotiating with vendors to lower drilling costs and has yet to kick off a drilling program, due to persistently low oil and gas prices.

Despite low commodity prices, natural gas sales volumes surged from 7.1 MMcf in 2Q2014 to 94.5 MMcf in 2Q2015. Oil sales volume also increased year/year by 39.8% from 118,533 bbl to 165,759 bbl.

Ring President David Fowler said the company’s acquisition team was actively making offers for bolt-ons to its platform core assets, and was preparing to make offers with operators on its newly acquired acres in Culberson and Reeves counties. He said Ring was also seeing an increase in M&A opportunities, some of which were being brought by various investor banking groups, investors and others.

“We believe our M&A opportunities will continue to increase throughout the end of the year,” Fowler said. “With our strong balance sheet, we remain ready and able to move quickly to consummate a transaction — as we did on our recent acquisition — should such an opportunity arise.”

Ring quit drilling last year in mid-November. Fowler told NGI’s Shale Daily on Wednesday that the company considered restarting when oil hovered around $60/bbl. West Texas Intermediate was trading just above $43/bbl on Wednesday.

“We’re glad now that we didn’t,” Fowler said. “We’re going to pull back and get a little better feel for what’s going to take place in this market. We want to hit on all cylinders, whether it be internal rate of return, return on investment or PV-10 numbers. We’re holding off and hoping that we see a little bit of an uptick in oil prices.”

Ring reported net income of $534,167 (2 cents/ share) for 2Q2015 versus $2.8 million (11 cents) for 2Q2014. Revenues fell nearly 20% from a year ago to $9.0 million from $11.2 million. Net production rose 52% — from 1,316 boe/d in 2Q2014 to 1,995 boe/d in 2Q2015. Average realized sales price/boe collapsed from $93.58 to $49.46.

Wunderlich Securities analyst Jason Wangler said Ring had a strong quarter, with earnings per share ahead of estimates from his firm and Wall Street.

“Ring has been an interesting name in 2015, given that it completely shelved drilling at the beginning of the downturn and has held that line nicely,” Wangler said in a note Wednesday. “Meanwhile, production has shown solid trends and, with the recent acquisition, is expected to hold up nicely as Ring improves the processes and facilities in the Delaware Basin.

“While Ring has made the conscious, and we believe correct, decision to stop drilling in 2015, it has done so to preserve its inventory and capital for better times while also watching the merger and acquisition market for opportunities that could grow the company.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |