E&P | NGI All News Access | NGI The Weekly Gas Market Report

Ring Doubles Permian Production, Proved Reserves in $300M Deal

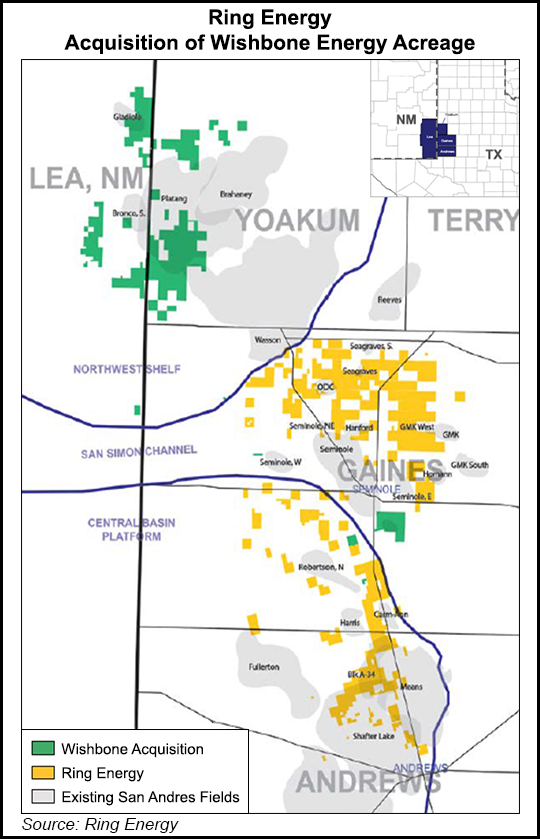

Ring Energy Inc. has agreed to pay $300 million to Wishbone Energy Partners LLC to acquire a substantial leasehold in the Permian Basin’s third major formation, the Central Basin Platform (CBP), which would double its proved reserves and its production.

The 37,206 net acres being acquired span the Permian and primarily are in Yoakum County, TX, and Lea County, NM, adjacent to the prolific Wasson and Brahaney fields. The acquisition, with would double proved reserves, which when completed would be nearly 71 million boe, a 94% increase.

Once combined, Ring’s oil and gas output would increase by an estimated 98% to 12,200 boe/d.

“This acquisition doubles our daily production, adds another 37,000 prime acres to our horizontal footprint and nearly doubles our proved reserves,” CEO Kelly Hoffman said. “We now have over 20 years of San Andres horizontal drilling inventory using a two-rig development program.

“We believe this acquisition is a major step toward achieving our stated goals to continue to generate strong annualized production growth and to become cash flow neutral/positive by the second half of 2019.”

Houston-based Wishbone, formed in 2013 by private equity Quantum Energy Partners, is receiving $270 million cash and $30 million worth of Ring stock.

A base of 127 gross wells now produce about 6,000 boe/d net, according to Ring, and the assets are 96% operated by current production volume. In addition, infrastructure already in place includes 1,385 acres of owned surface rights, 21 saltwater disposal wells, 15 source water wells, five fracture ponds and three caliche pits for road material and new locations.

The Midland, TX-based independent would operate the leasehold with a 77% working interest and a 58% net revenue stake.

SunTrust Robinson Humphrey, which acted as financial adviser to Ring, provided a financing commitment letter for an increased $1 billion senior credit facility with a borrowing base of $425 million. Baker Hostetler acted as Ring’s legal counsel.

The transaction is expected to close early in the second quarter, with an effective date of November 1, 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |