Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rigs: Fewer Falling, Many Waiting to Return

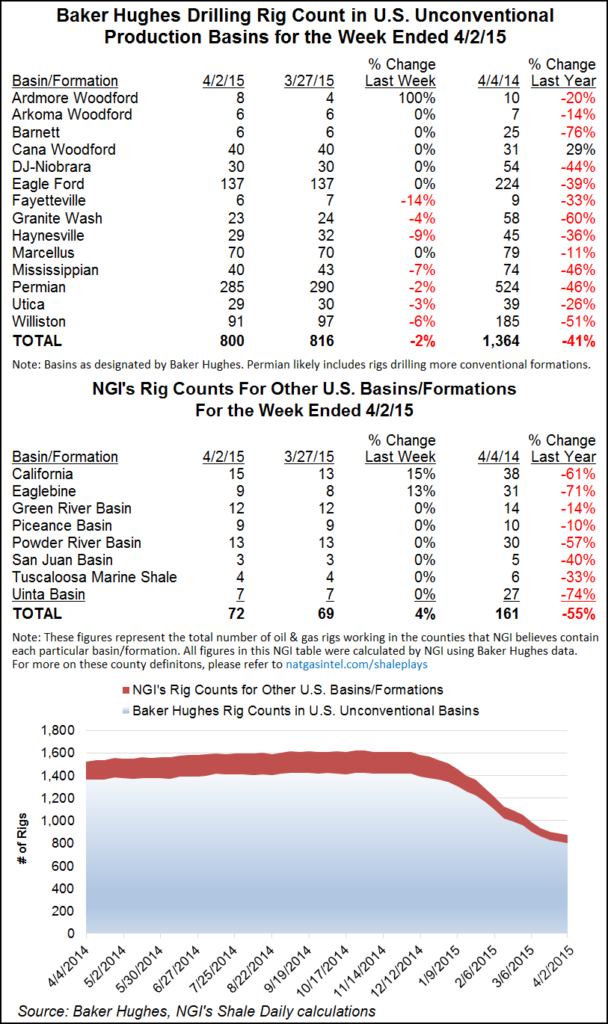

As with the overall rig count, declines occurring in U.S. unconventional basins appear to be leveling off, according to Baker Hughes Inc. data for the week ending Thursday April 2, and NGI analysis. However, the downturn has cut the rig census by roughly half, and there are plenty of high-efficiency rigs ready to get back in the game, analysts said.

A number of plays saw gains in the most recent operating rig tally, which was released on Thursday due to the Good Friday holiday. For instance, the Ardmore Woodford in Oklahoma charged a 100% week-to-week gain, adding four rigs for a total of eight running. California picked up two rigs, and the Eaglebine in East Texas added one. The biggest loser was the Williston Basin, which dropped six rigs to 91 in the latest count.

Much has been made of the rig count’s shortcomings as a predictor of future production due to the substantial technology and efficiency gains that have taken place in U.S. shale plays. In an April 1 note, analysts at Tudor, Pickering Holt & Co. (TPH) took a look at operating rig data to divine what classes of rigs are most prevalent in the oil/gas patch today following the halving of the rig count.

Higher-performance AC (alternating current) rigs have had more staying power, TPH said, dropping about 34%, compared with mid-tier SCR (silicon-controlled rectifier) rigs, down about 54%, and lower-tier mechanical rigs, down about 66%. This was to be expected, the analysts said, as operators drop their least-efficient rigs first.

“Consequently, AC rigs have continued to gain market share, moving from about 38% of the total U.S. land drilling market to about 50% today,” TPH said. “Why are these statistics important? Because when rig count does trough, we think AC and SCR rigs will be the first rigs to come back, so it could take time for pricing to recover meaningfully with 560 recently working rigs in those asset classes idled.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |