Markets | Infrastructure | LNG | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report

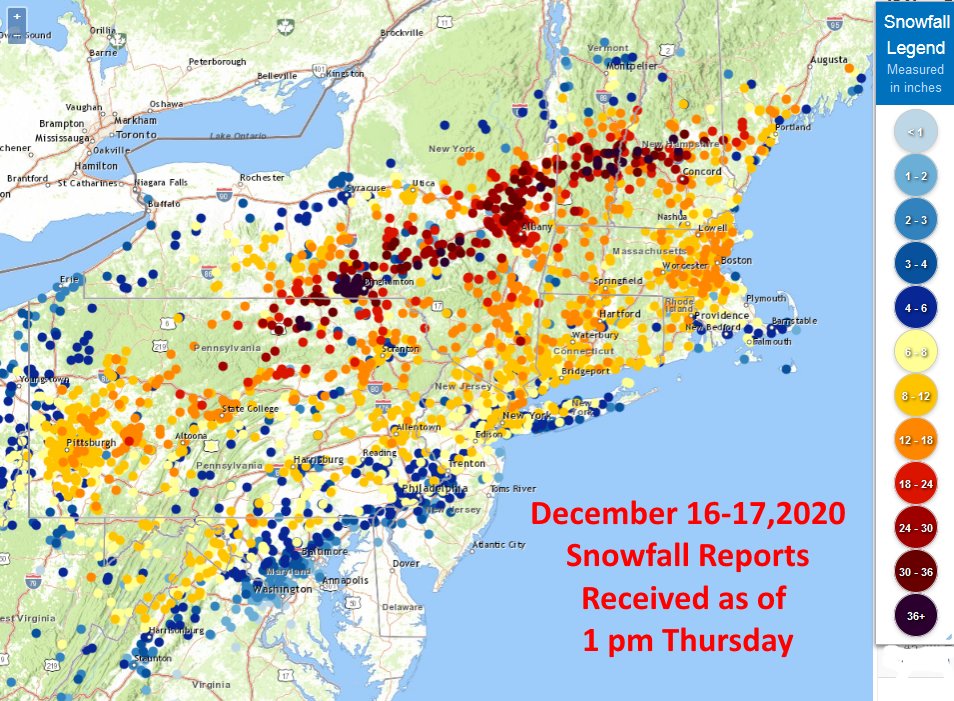

Record Snowstorm Snaps Natural Gas Forward Losing Streak; Rampant LNG Demand Fuels Price Gains in 2021

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |