Markets | Natural Gas Prices | NGI All News Access | Shale Daily

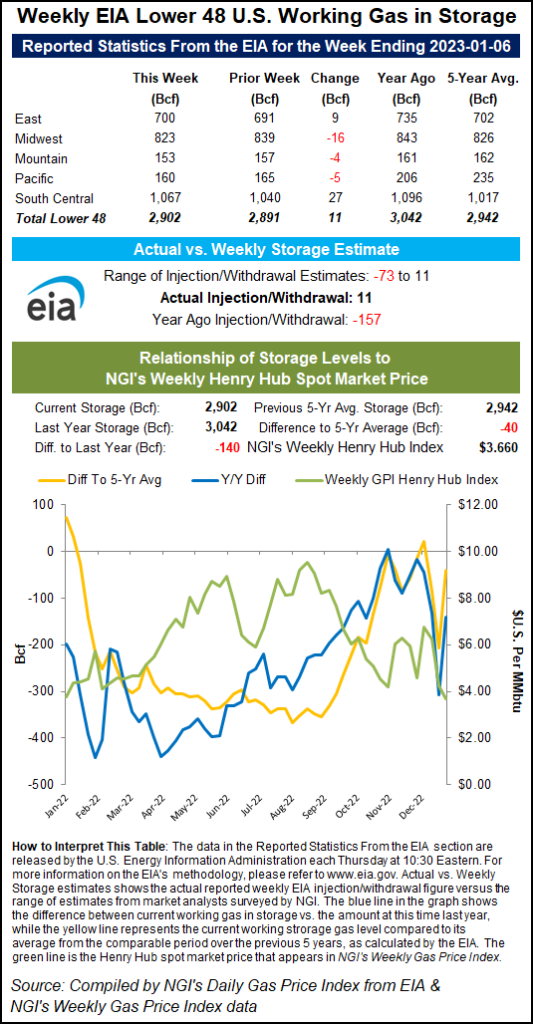

Rare Winter Storage Injection Fails to Fluster February Natural Gas Futures

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |