Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Range Sells Core Royalty Interest, Other Properties for $634M

Range Resources Corp. said Friday that it has agreed to sell a 2% overriding royalty interest in 350,000 net surface acres in its core area of southwest Pennsylvania to undisclosed parties for $600 million.

The two separate transactions, Range said, are expected to close this month and be effective as of March 1. The deals apply to existing and future Marcellus, Utica and Upper Devonian shale development, but exclude shallower and deeper horizons. The properties produced 1.9 Bcfe/d in 1Q2019, while annual cash flow associated with the sales is expected to be $48 million based on first quarter pricing.

Range said it also completed the sale of non-producing acreage in western Pennsylvania’s Armstrong County for another $34 million in a deal with an undisclosed buyer that closed last month. That transaction included 20,000 acres.

The transactions come less than a year after Range sold a 1% overriding royalty interest in its leases in southwest Pennsylvania for $300 million. The company continues to focus on generating free cash flow (FCF) and reducing debt, saying again on Friday that sales processes are ongoing for other noncore assets.

“Following the expected closing of these transactions, Range will have executed a $1 billion reduction in absolute debt over the past 12 months as the Company strengthens the business through organic free cash flow generation and asset sales,” said CEO Jeff Ventura.

The $634 million would go toward repaying the company’s revolving credit facility, helping reduce total debt by 17%. The company added that annual interest expense is expected to decline by $30 million and “offset a significant amount of the cash flow reduction associated with the royalty sales.”

Over the last year, Range has generated asset sale proceeds that equal 75% of its current market capitalization in divestments that have impacted annual cash flow by less than 4%.

The company is marketing several asset packages and has not ruled out the sale of its large position in North Louisiana, where the Cotton Valley Sands Terryville Complex continues to underperform. Other noncore assets, like those in northeast Pennsylvania, are also on the table.

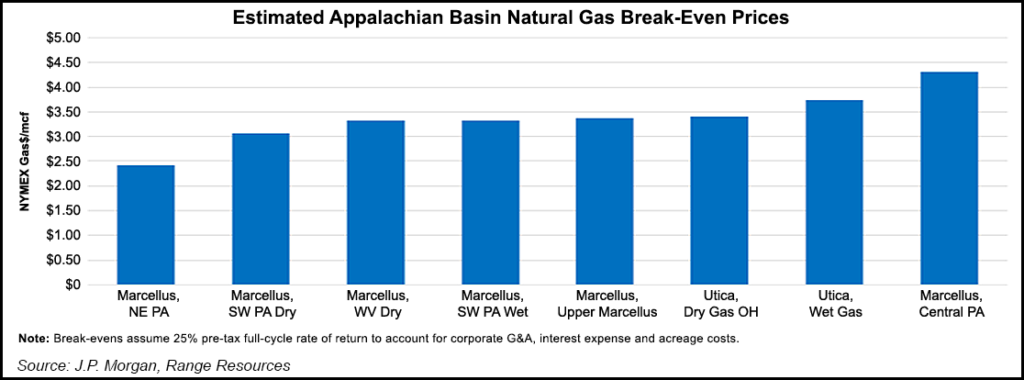

As equity markets have soured on Appalachian producers over stagnant natural gas prices, many of the basin’s leading operators have seen their values slide precipitously in recent years. Positive FCF has been hard to come by for the gassier operators as investors search for better returns, which has partly impacted their market capitalization.

Range generated FCF for the first time in years in 2018, and it’s forecast to generate $108 million in FCF by the end of this year and another $144 million by the end of 2020, according to historical and analyst estimates gathered by BTU Analytics LLC before Friday’s announcement.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |