Markets | Natural Gas Prices | NGI All News Access

Range-Bound Natural Gas Futures Ease Lower Ahead of EIA Storage Report

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

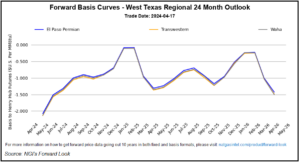

Lofty levels of natural gas in storage and a severe Permian Basin supply glut continued to cloud the outlook for prices. Natural gas forward prices fell in every region during the April 11-17 trading period, NGI’s Forward Look data show. Levels remained well below the $2.00/MMBtu level across the Lower 48, with exceptionally weak West…

April 18, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.