NGI Archives | NGI All News Access

QEP Beefs Up Bakken/Three Forks Acreage in Deals Totaling $1.38B

Continuing its strategy of increasing its acreage in the liquids-rich Bakken Shale and Three Forks Formation, a QEP Resources Inc. subsidiary has entered into two deals with multiple sellers to acquire “significant crude oil development properties” in the Williston Basin for an aggregate purchase price of close to $1.38 billion.

The 27,600 net acres in Williams and McKenzie counties in North Dakota are about 12 miles west of QEP Energy’s existing core acreage in the Williston Basin. QEP said the aggregate current net production of the assets is around 10,500 boe/d, with estimated aggregate net proved and probable reserves of 125 million boe, comprised of 81% crude oil, 9% natural gas liquids and 10% natural gas. QEP will operate almost 90% of the acreage.

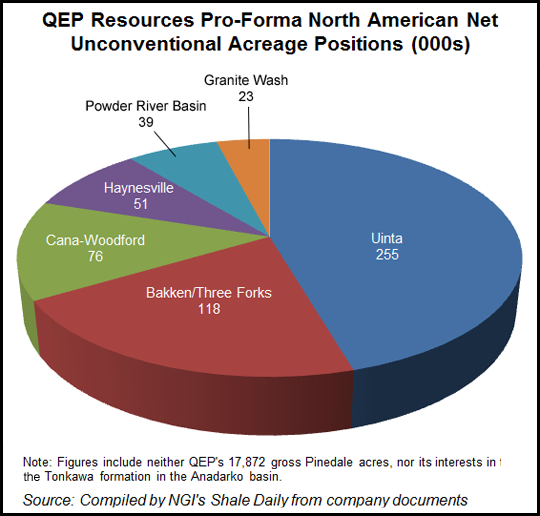

The Denver, based independent said the Bakken and Three Forks are both prospective across all of the acreage and will be developed by separate horizontal wells targeting each formation. The acquisitions, which are expected to close by Sept. 27, are expected to increase QEP’s net acreage in the Williston Basin to 118,000 acres.

“The acquisition will add a new contiguous block of QEP-operated acreage in a localized ‘sweet spot’ for both the Bakken and Three Forks formations, as evidenced by above average well performance and EURs [estimated ultimate recoveries] from wells drilled to-date in both reservoirs,” said QEP CEO Chuck Stanley. “To drive operational efficiency, we have historically targeted the best rock in contiguous operated acreage blocks in the basins in which we operate.”

In anticipation of the acquisition, QEP adjusted its full-year 2012 guidance, which it had given in 2Q2012. The company expects production to increase from 305-310 Bcfe to 310-315 Bcfe, while adjusted earnings before interest, taxes, depreciation and amortization are expected to increase from $1.35-1.40 billion to $1.40-1.45 billion.

While QEP was keeping the names of the sellers private, Rapid City, SD-based Black Hills Corp. acknowledged Thursday that its oil/gas subsidiary had signed a definitive agreement to sell 85% of its Bakken and Three Forks shale assets in the Williston in North Dakota to QEP for $243 million.

Included are all of the interests of Black Hills Exploration & Production Inc. in the Williston owned jointly with Helis Oil & Gas and others, including 73 gross wells and 28,000 net lease acres. At the end of the second quarter, net year-to-date production from these properties totaled 149,000 bbl of oil and 171 MMcf/d of natural gas, Black Hills said. Total proved reserves at of the end of 2011 were 2.2 million bbl of oil and 3.4 Bcf of gas. The properties being sold represent about 15% of Black Hills’ production for the first six months this year, and 13% of year-end 2011 reserves.

Noting that the company announced at the end of last year its intent to optimize “upside value” in existing oil/gas properties following a 2011 strategic review, Black Hills CEO David Emery said “the divestiture of these assets has effectively and immediately captured the future potential value that we projected for this portion of our oil/gas portfolio.” Emery predicted that the sale would strengthen Black Hills’ balance sheet with net proceeds in the range of $230 million to $240 million and would help the company self-fund upcoming projects, such as its $237 million Cheyenne Prairie Generating Station.

“This sale demonstrates the substantial value of our oil/gas business, and the ability of our oil/gas team to identify and develop quality assets,” said Emery, adding that the energy holding company remains focused on realizing “significant upside opportunity” in its remaining oil/gas assets in the Mancos Shale and San Juan and Piceance basins.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |