NGI The Weekly Gas Market Report | E&P | NGI All News Access

Qatar Petroleum Said Considering $20B in U.S. Oil, Natural Gas Ventures

The No. 1 natural gas exporter in the world, Qatar Petroleum (QP), is said to be exploring investments of up to $20 billion in the United States, in both onshore and offshore projects.

The state-owned operator earlier this month announced it would exit the Organization of the Petroleum Exporting Countries, i.e. OPEC, to concentrate on building its already substantial gas business, and in particular, liquefied natural gas (LNG). Combined oil and natural gas, which it supplies via pipeline and through LNG exports, currently is around 4.8 million boe/d, Energy Minister Saad Sherida al-Kaabi said at the time.

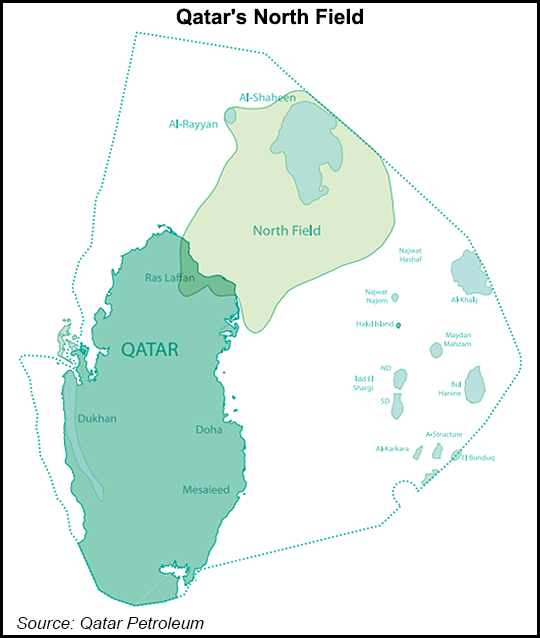

Qatar owns most of the North Field, considered the largest gas field in the world, which it shares with Iran.

QP in September said its long-range plans were to increase gas production, including developing more reserves in the North Field, with an eye to boost liquefaction capacity by 43%. QP has designs to add a fourth liquefaction train for the field, which would raise capacity to 110 million metric tons/year (mmty) from 77 mmty. The fourth train would add an estimated 32 mmty of LNG, 4,000 metric tons/day of ethane, 260,000 b/d of condensate, 11,000 tons/day of liquefied petroleum gas and 20 tons/day of pure helium.

In an interview with Reuters on Sunday, al-Kaabi said QP would announce foreign partners for the new LNG trains by mid-2019. QP also could go it alone, he reportedly said. He also signaled the operator could invest more than $20 billion into U.S. natural gas and oil, conventional and unconventional.

“We are looking for a lot of things” with current partners, “including asset swaps, things that will help me in my international expansion,” al-Kaabi told Reuters. “If I don’t get good deals, nobody will come.”

QP is 70% owner of the proposed Golden Pass LNG terminal in Sabine Pass near Port Arthur on the upper Texas coast. ExxonMobil Corp. owns a 17.6% stake; ConocoPhillips holds a 12.4% interest in the project.

A final investment decision on the estimated $10 billion project has not been made, but al-Kaabi had said in October the project could be sanctioned by early January. The associated 69-mile Golden Pass Pipeline would originate at the terminal with nine interconnects to intrastate and interstate pipelines.

Golden Pass, initially launched in 2003 to import gas to a thirsty U.S. market — before the onshore unconventional gas boom — was authorized for exports in late 2016 by the Federal Energy Regulatory Commission [CP14-518]. Last year, it was authorized by the Department of Energy to export up to 2.21 Bcf/d worldwide for 20 years [12-156-LNG]. The project in Jefferson County is also preserving its ability to import gas.

QP has been an active participant with many of the world’s largest oil and gas companies. Royal Dutch Shell plc partners with QP on, among other things, the biggest gas-to-liquids (GTL) project in the world, Pearl GTL. Five years ago, Shell and QP partnered on a natural gas-based jet fuel that supplied Qatar Airways’ first commercial flight from Doha International to London Heathrow.

QP has also begun to spread its wings to international development. Earlier this year, QP snapped up its first significant international stakes in unconventional resources in an agreement with ExxonMobil to become an equity holder in the Vaca Muerta formation in Argentina’s Neuquén Basin. And on Sunday it said it would take a 35% stake in three of Eni SpA’s Mexico oilfields, which are set to begin producing by mid-2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |