NGI Archives | NGI All News Access

PTEN Achieves Near 100% Utilization for High-Spec Rig Fleet

Patterson-UTI Energy Inc. (PTEN), whose only focus is land drilling in North America, has newbuild contracts for high-spec rigs for at least another year, with pressure pumping utilization and U.S. pricing exceeding expectations during the second quarter.

Chairman Mark Siegel and CEO Andy Hendricks shared a microphone last Thursday to discuss the quarterly results. It’s no longer about location, location, location. It’s demand, demand, demand, said Siegel.

“Demand for high-spec rigs remains strong. In addition to the growth of our rig fleet, we were able to achieve 99% utilization for our Apex rig fleet,” one of the leading alternating current, or AC, rigs on the market.

The Houston operator has more than 275 land-based drilling rigs in North America.

“We added rigs to our Apex newbuild program and at the same time, customer demand continued to accelerate,” Siegel said. “We are in the very positive situation of being almost sold out of our new Apex rigs over the next four quarters.”

Nabors Industries Ltd. reported similar gains in AC rig demand during 2Q2014 (see Shale Daily, July 24).

“The demand for high-spec rigs and the increase in horizontal drilling activity led to an increase in pressure pumping demand during the second quarter,” Siegel said. “A lag in pressure pumping demand relative to the rig count is normal, as wells have to be drilled before they can be completed. The increase in our customers’ activity levels during the second quarter exceeded our expectations.”

PTEN’s average rig count between April and June increased by seven rigs sequentially, to 201 from 194, said Hendricks.

“Our growth in the U.S. rig count more than offset the spring breakup in Canada, where our average rig count decreased to three rigs in the second quarter from 10 rigs in the first quarter.” The company’s rig count this month is expected to average 207 in the United States and nine in Canada, he added.

“This growth in the rig count is unlike the recent past, where the demand was uneven and the weakness in one market served as a source of incremental rig supply for the stronger markets, such as the Permian,” Hendricks said.

“I think we’re certainly upbeat about where we are in the market right now. The fact that we can get pricing improvements is a big shift from where we were. But we are seeing the higher cost in materials and transportation. And right now, these price increases are just offsetting those higher costs.”

On the improving market in the quarter, PTEN’s average U.S. revenue increased $490/day sequentially to $23,490, mostly on improving fleet mix of higher dayrate Apex rigs. Canada’s total average revenue per day increased $240 to $23,630.

“The strength in the U.S. rates led to a better-than-expected increase in the average U.S. rig margin per day of $370 sequentially to $9,900, and an increase in total rig margin per day of $270 to $9,870,” said Hendricks. “Of note, while our greatest dayrate increase has occurred for our higher-spec Apex and other electric rigs, average U.S. dayrates increased across all three of our rig classes during the second quarter.”

Things are looking optimistic for the second half of the year, said the CEO. During the third quarter, PTEN’s average rig count is forecast to increase by another eight rigs to 209, while in Canada, six more rigs are expected to be added for nine total.

The booming activity and tightness in the labor market led PTEN to implement a wage increase at the end of June, which was passed through to customers.

“Considering this wage increase, plus further improvement in both dayrates and fleet mix, we expect our average U.S. rig revenue per day during the third quarter to increase $350 and our average U.S. rig margin per day to increase $200,” Hendricks told analysts. “With the ramp-up in our higher-margin Canadian activity, we expect our total average rig revenue per day for the third quarter to increase $500 and our total average rig margin per day to increase $250.”

Six Apex rigs were completed in the second quarter, bringing the fleet to 133 rigs. Since the end of March, PTEN has gained 19 contracts for new rigs. Plans now are to build 25 Apex rigs through next June; 22 already are contracted, said Hendricks. Three additional Apex rigs are to be completed in the second half of 2015.

“Based on contracts currently in place, we expect to have an average of 149 rigs operating under term contracts during the third quarter and an average of 138 rigs operating under term contracts during the last half of 2014,” he said.

The Apex newbuilds will be incremental, Hendricks noted. “We’re still seeing strong demand in all regions and we don’t see that any of these newbuilds are going out there to replace any of the existing non-APEX electrics or mechanical rigs.”

Added Siegel, “It’s the old Mark Twain comment about ”reports of my demise are greatly exaggerated.’ We see those reports as well about the mechanical rigs, and I think one of the reasons we wanted to highlight that the pricing was across the board in all three categories was to make the point clearly that in effect, it’s across the board and it’s not just the high-spec rigs, although obviously, those are doing the best.”

PTEN also generated record quarterly output for pressure pumping revenues of $307 million, a $66 million jump from the first quarter. The fleet of 31,500 hp acquired in mid-June started a large job soon after the acquisition, said Hendricks. PTEN also benefited from an “unusually high level of utilization in sand volumes for this horsepower during this short period. Revenues from this equipment are expected to return to a more normal level going forward.”

The pressure pumping fleet at the end of June included more than 790,000 hp, with more than 709,999 designated for fracking.

“We recently ordered an incremental 115,000 frack horsepower,” said Hendricks. “Together with the previously announced 40,000 hp on order, we now have a total of 155,000 hp on order, enough equipment for three complete frack spreads plus spares.”

One spread is contracted to be activated late this year in Texas, while a second spread is set to begin operations in the state in early 2015. A third spread, for operations in the Northeast, should be ready by the middle of next year.

Following the conference call, analysts with Tudor, Pickering, Holt & Co. said if there were any doubt as to the strength of the U.S. land drilling market, “circle back and listen to a replay of the PTEN earnings call…Our ”CliffsNotes’ version, the fact that the company is seeing dayrate improvements across all rig types,” AC, silicon-controlled rectifiers and mechanical, “suggests PTEN likely continues inking long-term newbuild rig contracts in the second half of 2014-plus.”

Net income in 2Q2014 was $54.3 million (37 cents/share), versus year-ago profits of $40.8 million (28 cents). Revenues rose to $757 million from $659 million.

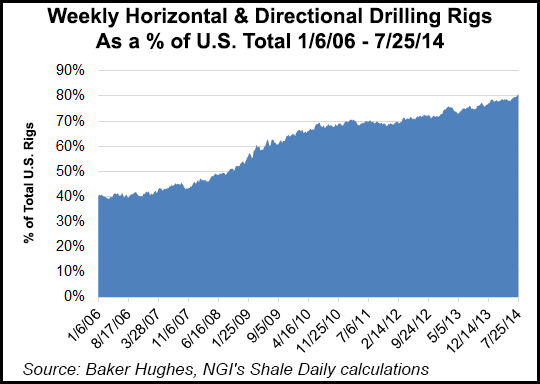

Horizontal and directional drilling rigs continue to gain prominence in the U.S., and they currently account for an all-time high of 80.8% of total domestic rigs at work.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |