Markets | Infrastructure | NGI All News Access

Propane Markets Worked Through January Crisis, Analyst Says

The recent propane crisis, which involved shortages of the heating fuel in the Midwest and Northeast prompted by unusually frigid winter weather, could actually result in a stronger propane industry, according to RBN Energy’s Callie Mitchell.

The crisis, which at its peak inflated the price for propane to a record high of almost $5.00/gallon in Conway, KS, wasn’t just the result of the recurring polar vortex, Mitchell said in an RBN blog post. Contributing to the shortage were also a late, wet, bumper crop of corn that required large volumes of propane for grain drying, and already low inventories due to a growing number of barrels earmarked for export.

And there were other factors: Kinder Morgan Inc.’s Cochin Pipeline was out of service for most of December (see Daily GPI,Jan. 22), Hess’s Tioga, ND, gas processing plant was offline for expansion work, rail lines were crowded and there was a shortage of transport truck drivers.

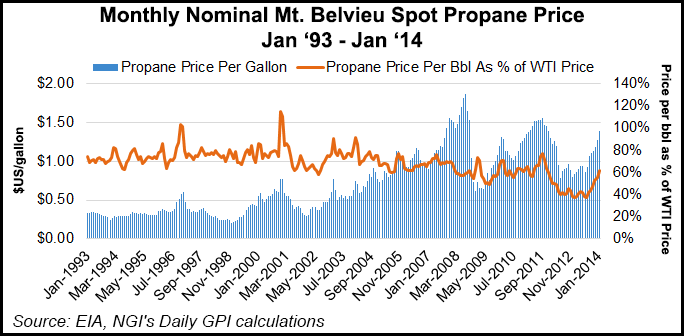

“Essentially the crisis began in mid-December 2013, peaked on Jan. 24, 2014, and quickly subsided over the next few days,” Mitchell said. “Since early February, the price of Conway propane has returned to pre-crisis levels.” Prices at Mont Belvieu, TX — which didn’t reach the same highs as Conway, but did spike higher during the crisis — have also moved back down.

“Since prices have now declined, we can say that the market worked — over time. However, in the throes of the crisis just a few weeks back, clearly there were things that were not working as they should have,” Mitchell said.

Mont Belvieu spot propane prices, which had started 2013 at just 83.8 cents per gallon, were on the upswing most of the year, reaching $1.28 per gallon by December, according to Energy Information Administration data. The January price at Mont Belvieu was $1.40 per gallon, but spiked to $1.75/gallon at one point.

Smaller retailers, who couldn’t afford to pre-buy propane, were hit especially hard by the crisis. The high propane prices were a big hardship for customers, some of whom couldn’t get propane at all and were forced to take extraordinary measures to keep warm during one of the coldest winters on record.

On Feb. 7, the Federal Energy Regulatory Commission invoked its emergency authority under the Interstate Commerce Act to help alleviate “dangerously low” propane supplies in the Midwest and Northeast (see Daily GPI, Feb. 10). The order directed Enterprise TE Products Pipeline Co. LLC to temporarily provide priority treatment to propane shipments from Mont Belvieu to those areas, which were suffering from severe cold weather (see Daily GPI,Feb.6).That and other actions by companies to reroute supplies and by state governments allowing truckers to work longer hours to move critical supplies, helped during the crisis.

The natural gas liquids industry “is a tight knit community” that “has learned from experience that there are some things that are a given with events like this — lots of money is made in certain corners, and just as much money is lost in others,” Mitchell said. “Relationships end, others get reconfirmed and become stronger than ever. In the aftermath of the 2014 propane crisis (which hopefully is now behind us), we can expect ramifications for months and years to come. Some players will get bigger, others will disappear, others will be gobbled up, and new regulations and scrutiny will certainly set in.”

Mitchell commended the National Propane Gas Association (NPGA) and state organizations for coordinating industry and government actions to bolster inventories in critical areas. NPGA has established a Supply and Infrastructure Task Force to do a comprehensive post winter season analysis to identify causes and contributing factors to the supply, demand, and distribution problems.

According to the Propane Education and Research Council, the United States produced about 18 billion gallons of propane in 2013 — including 12.2 billion gallons from gas processing plants and 4.2 billion gallons from refinery production — and imported about 1.2 billion gallons, mostly from Canada. About 8.2 billion gallons were consumed by the retail market, while 5.4 billion gallons went to petrochemical feedstocks and 4.5 billion gallons were exported.

Mitchell, the author of the RBN commentary, had a 30-year career in the energy industry focused primarily on marketing, trading, distribution, business development, acquisitions and divestitures, and corporate restructuring of business around natural gas and natural gas liquids.She retired from Williams as Vice President of Enterprise Services and Real Estate and President of The Williams Foundation in 2008.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |