Bankruptcies filed by producers in the North American oil and gas space slowed to two in November, according to the latest monthly Oil Patch Bankruptcy Monitor report published by Haynes and Boone LLP.

The trend shows a gradual reduction in bankruptcies this autumn compared to earlier in the year; there were three producer bankruptcies in October, according to Haynes and Boone.

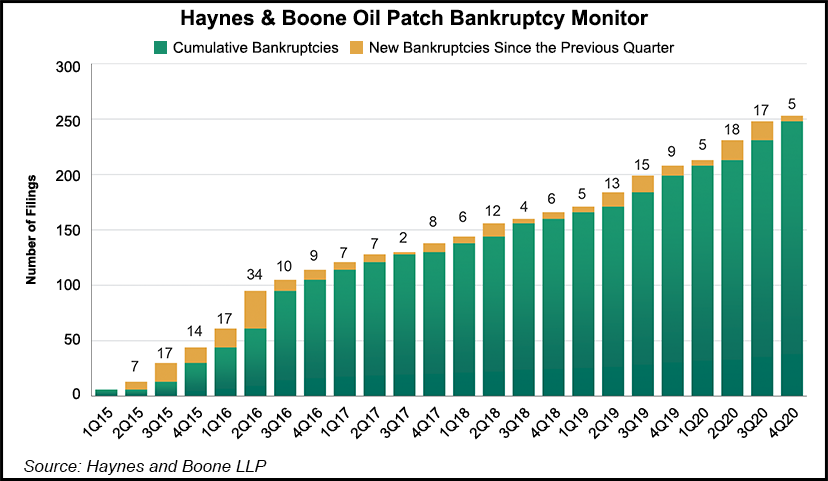

In the third quarter of this year, 17 producers filed for bankruptcy, slightly below the 18 North American producer bankruptcies in the second quarter when the coronavirus stunned oil and gas markets.

The second quarter figure is second only to the 34 bankruptcies recorded in 2Q2016. Haynes and Boone began keeping records in 2015.

Combined with bankruptcy filings of oilfield services (OFS)...