Oil | LNG | LNG Insight | NGI All News Access

Prices Rally as European Union Weighs Oil Ban Proposal

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

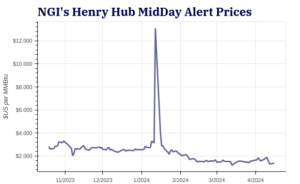

Natural gas futures were headed for another daily decline through midday trading Tuesday before a sudden burst higher around 2 p.m. ET threatened to give market onlookers whiplash. Cash prices for the most part were advancing modestly off recent lows. Here’s the latest: May Nymex futures at $1.722/MMBtu as of 2:14 p.m. ET, up 3.1…

April 16, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.