Presidio Fortifies Anadarko Basin Holdings with Apache Assets

Presidio Investment Holdings LLC, a portfolio company of Morgan Stanley Energy Partners, has acquired Apache Corp.’s oil and natural gas producing properties that were within the Anadarko Basin of Texas, Oklahoma, and Kansas.

The transaction is the first add-on acquisition for the Fort Worth, TX-based Presidio since the initial private equity investment formed the company in May 2018.

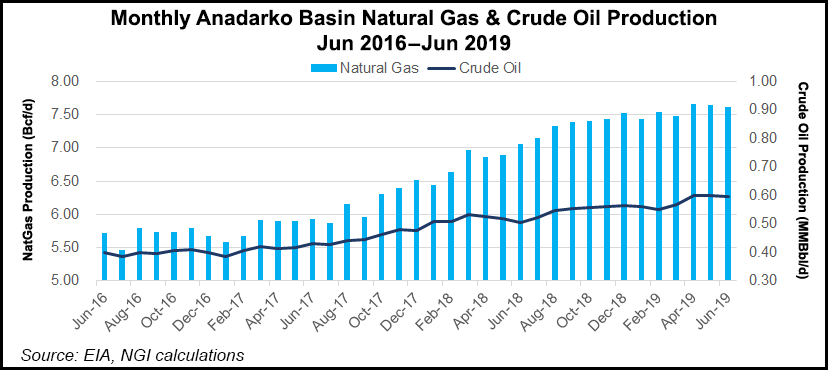

Average production from the assets was 33,000 boe/d in 1Q2019, 90% weighted to natural gas and liquids, according to Apache.

“We are thrilled to add Apache’s high quality western Anadarko Basin assets to our portfolio and are excited to welcome the outstanding team responsible for operating these assets at Apache to the Presidio family,” Presidio Co-CEO Chris Hammack said. “Apache has done a tremendous job assembling and developing these properties, and we are eager to leverage Presidio’s existing operations and expertise in the basin, strengthened by the addition of Apache’s field operations team, to further enhance the assets.”

Hammack previously was CEO of Trinity River Energy, formed in 2014 through a merger of assets held by Legend Production Holdings and KKR Natural Resources Funds.

Presidio Co-CEO Will Ulrich said the “industrial logic of combining Apache’s western Anadarko Basin properties with our existing operating footprint in the basin is tremendously compelling. We believe Presidio is very well positioned to integrate this transaction efficiently, instill industry-leading operating practices that underpin value creation, and expand on the asset optimization playbook we’ve successfully implemented across our existing business these past 12 months.”

Ulrich previously worked at Atlas Energy for seven years, where he was senior vice president of corporate development and strategic planning.

Apache, which has turned its Lower 48 focus to the Permian Basin, said the sale reflected its exit from the Anadarko and resulted in proceeds estimated at $612 million net. Apache is reporting quarterly results on Thursday (Aug. 1) and said it expects to report about 32,000 boe/d from the Midcontinent-Gulf Coast region assets for 2Q2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |